CEXs $BNB: 15-Month Dying… 😥.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

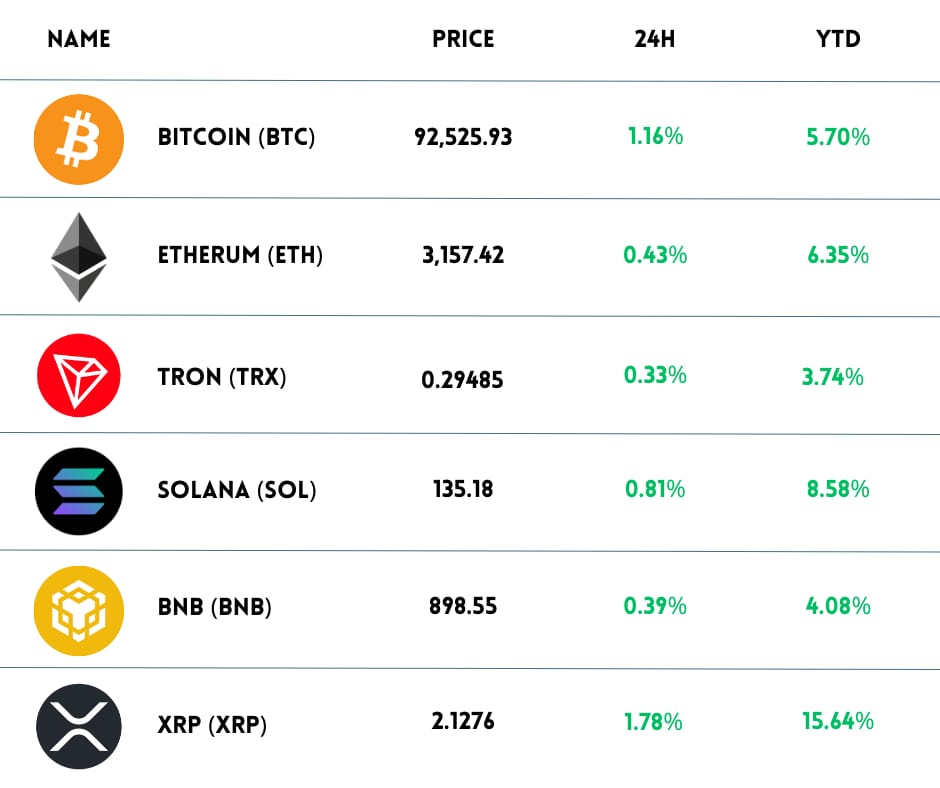

🌱 Crypto kicks off 2026 in the green. Since 2015, we’ve seen a pattern: 3 green years, then 1 red. But 2025… kinda broke the cycle.

What’s your prediction for 2026? $BTC ( ▲ 5.0% ) ? $ETH ( ▲ 5.71% ) ? AI coins? RWAs? Stablecoins? Or maybe just flee to stocks and gold? 😁

Here’s what we got for you today:

-

👀 Latest news: Bitcoin, BCH, XVG, ZEC

-

⭐ BTC is surging right now in 2026

-

⭐ Are memecoins making a comeback?

-

🔥 Burning hot takes for the road

2025 was definitely a wild ride, and watching BTC slide about 30% certainly tested our collective nerves. As we kick off 2026, we’re starting to see those “quiet” signals.

Remember when we predicted that dip to $80K while everyone else was screaming for $100K? Here’s exactly what we’re watching for BTC, BCH, XVG, and ZEC 👇

🔥 BTC IS SURGING RIGHT OUT OF THE GATE IN 2026

After a tense weekend of U.S. military action and the arrest of Venezuelan President Nicolás Maduro, global markets haven’t fully reacted yet but crypto already has.

And the response is just one word: bullish!!!

-

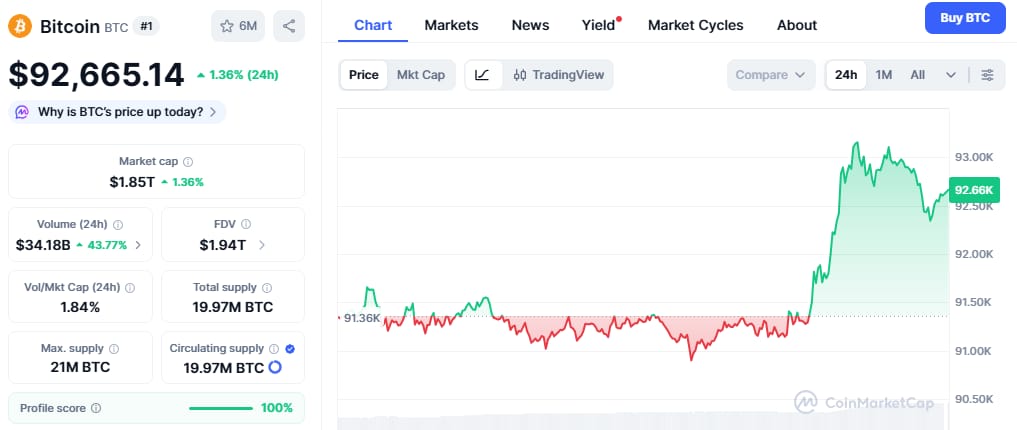

BTC broke past $93,000 for the first time since early December (now around $92K)

-

Memecoins exploded, with multiple double-digit gainers (read more below)

-

Total crypto market cap added over $200B since Jan 1

-

And in just the last 24h, $260M in leveraged positions got wiped, mostly from shorts (80%!)

And there’s more behind the pump than just global headlines. People are clearly turning more bullish, and we’ve got some strong on-chain signals backing that up.

Here are 3 big signals worth watching:

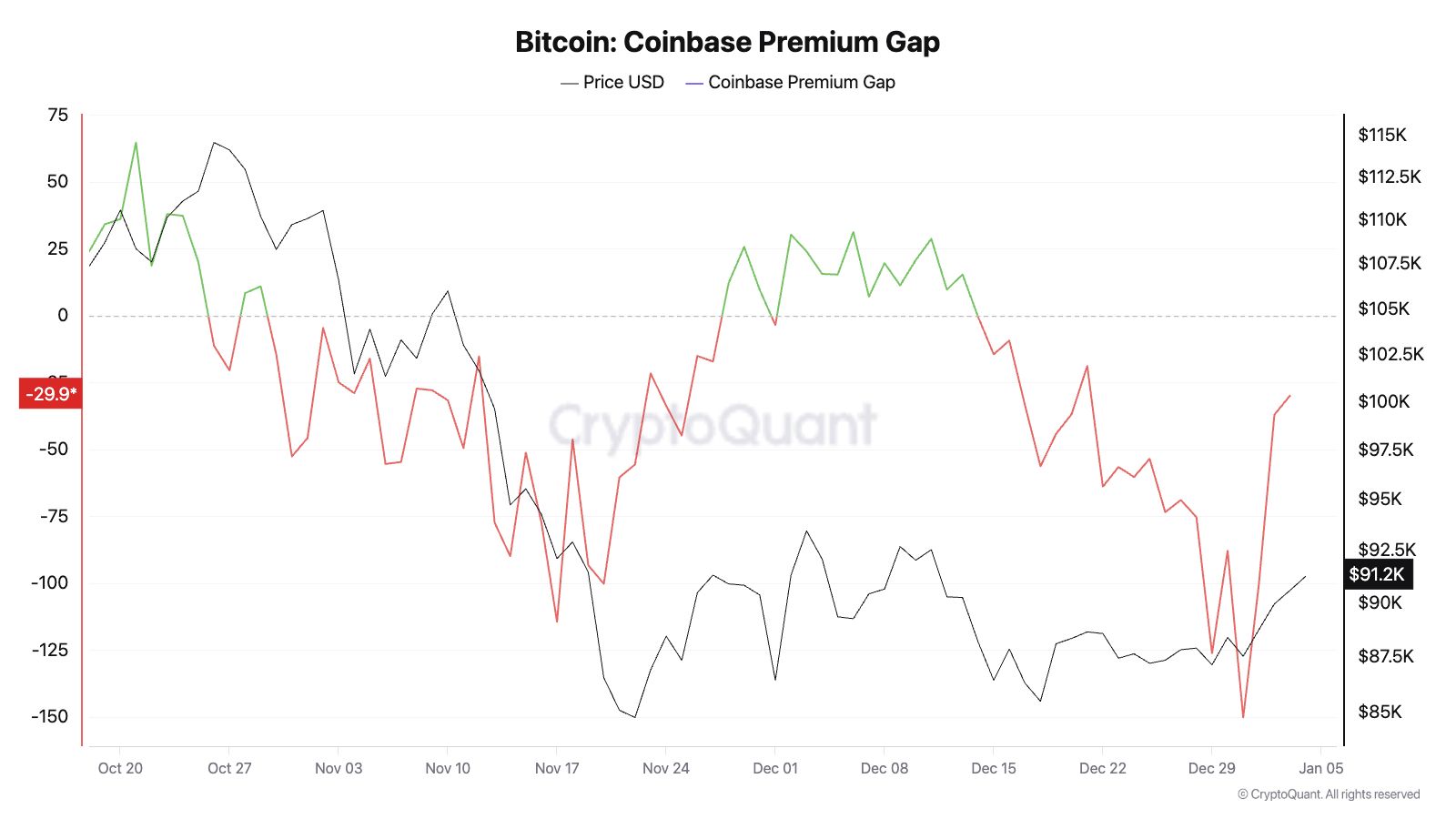

1/ Institutional money is sneaking back in

The Coinbase Premium Gap (a metric showing the price difference between Coinbase and Binance) is recovering fast.

It had dropped all the way to -150 at the end of December, usually a sign of U.S. investors stepping back.

Source: CryptoQuant

But now, it’s climbing back toward zero, which means one thing: U.S. institutions are buying again.

It’s a strong signal that real USD is flowing back into the market, and in the past, this kind of move has often kicked off big BTC runs.

2/ Market sentiment is recovering (slowly but surely)

The Crypto Fear & Greed Index just moved up from 29 to 42. That might not sound huge, but it’s a solid step out of the “Extreme Fear” zone.

Different trackers are showing slightly different numbers, Coinglass says 26, Binance reports 42, but either way, the direction is up. And that’s what matters.

3/ Traders are still betting on the upside

Even with all the recent liquidations, the BTC Long/Short ratio is still above 1.0, more traders are opening long positions than shorts. There’s still a bias toward expecting price to go up.

Plus, the fact that we’re not seeing a sharp dump or panic exit tells us the market’s structure is getting healthier.

But yeah, let’s not get carried away just yet, a few things still need watching:

-

Even though sentiment is improving, we’re still technically in “Fear”, so people are cautious

-

The Fed is still a wildcard. No one knows exactly when they’ll start cutting rates, and their December meeting minutes didn’t help, tone was still pretty hawkish

-

Some of that late-December BTC dip might’ve been tax-loss selling, so this bounce could just be technical. It doesn’t automatically mean everyone’s super bullish again

That’s why many analysts are saying: until Coinbase Premium flips and stays positive, we don’t really have a full confirmation that the trend has changed for good.

If Venezuela’s reserve rumors are true (600K+ BTC potentially locked), and U.S. steps in, we might watch a global supply squeeze take shape.

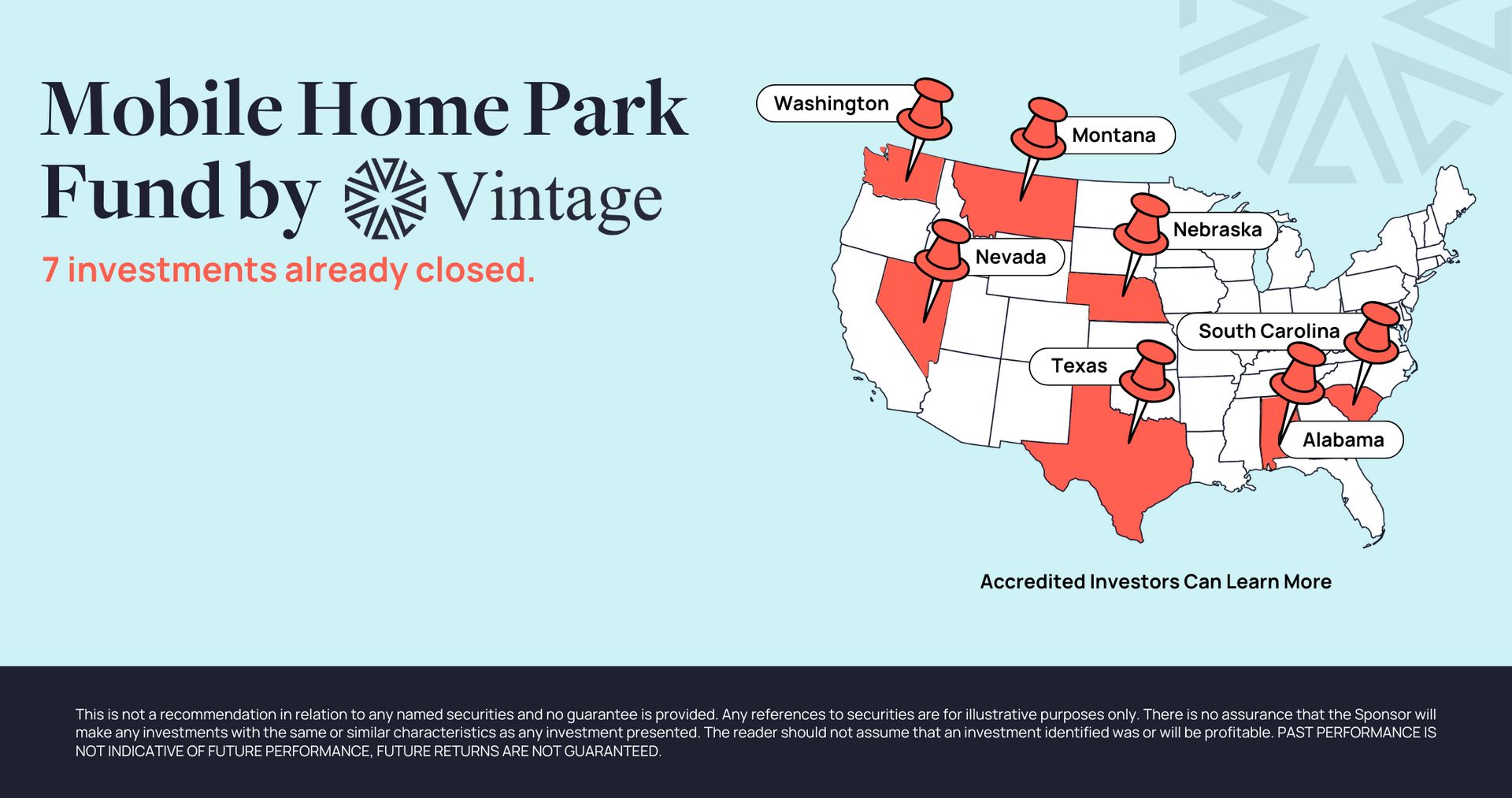

Invest in recession-resilient Mobile Home Parks with Vintage Capital

Invest in recession-resilient Mobile Home Parks with Vintage Capital. Invest direct or in a fund of 20+ underlying assets. 1031s are also available. Access stable, income-generating properties with consistent demand and low tenant turnover.

Now is the time to act: Current market conditions are creating opportunities to acquire properties at attractive valuations.

Our fund targets a 15%-17% IRR and makes monthly distributions, which provides a steady income stream alongside strong upside potential and tax-efficient benefits.

Why Mobile Home Parks?

-

Recession-Resilient: Affordable housing demand drives stable returns in any economy

-

High Tenant Retention: The average MHP tenant stays 10-12 years (compared to 2-3 in Multifamily)

-

Proven Expertise: $100MM+ track record in mobile home park investments.

-

Tax-Smart Investing: Bonus depreciation offers tax advantages.

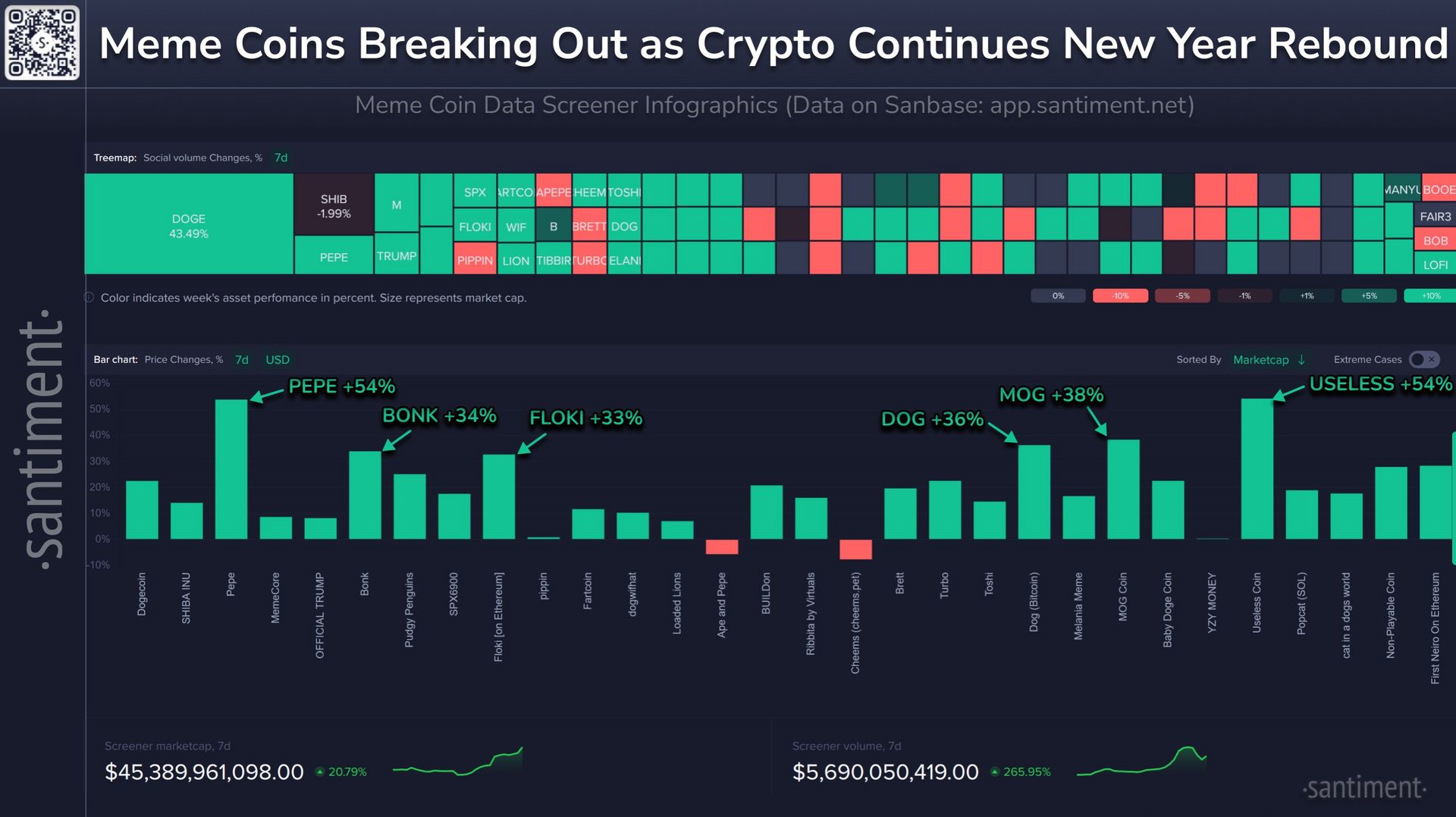

🚨 ARE MEME COINS MAKING A REAL COMEBACK?

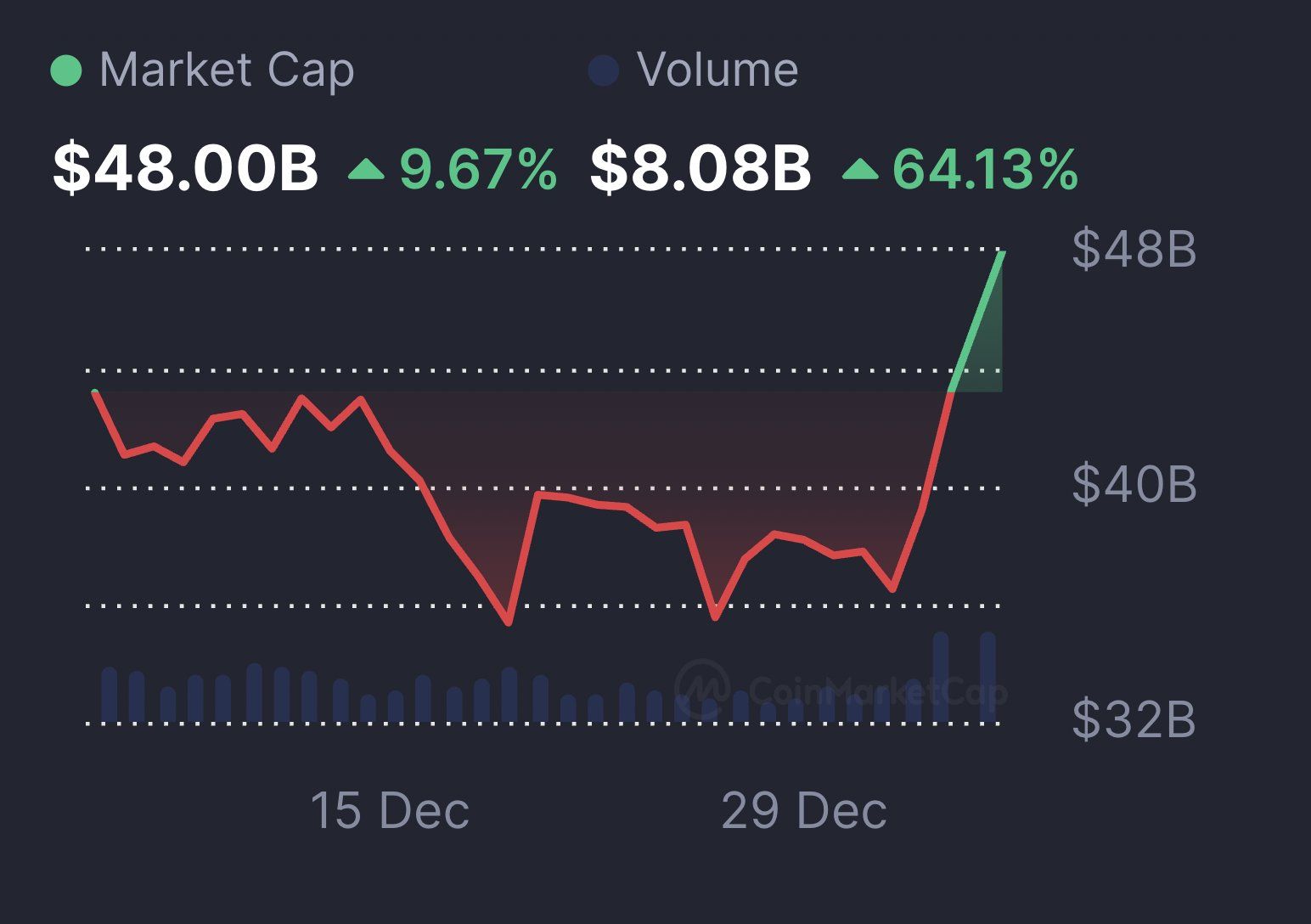

After a rough 2025, meme coins are kicking off 2026 with some serious heat. The total market cap for the whole meme sector just jumped 30%, crossing $48B.

What’s wild is how fast retail is rushing back in. You can see it in both trading volume and search trends, people are turning their heads back into the market really fast.

Memecoins are pumping again

Just look at this:

-

Meme coin market cap up 30% just this week

-

$9.2 billion in daily trading volume

-

+7% in just 24 hours as of Jan 5

-

For comparison, TOTAL3 (altcoin index without BTC & ETH) only moved up 7.5% since Jan 1

👉 So meme coins are outperforming most of the market, is it big time? One analyst even said this could be the start of something crazy.

Over the past week, top meme coins have seen standout gains:

-

$DOGE ( ▲ 19.22% ) jumped +20%

-

$SHIB ( ▲ 2.75% ) climbed +18.9%

-

$PEPE ( ▲ 46.06% ) exploded with +65.6%

And many smaller meme tokens are showing double-digit gains and climbing the top gainers list on CoinGecko.

Source: @santimentfeed on X

So… why are meme coins pumping now? It’s not just hype. A few things are lining up.

First off, this run looks even more dramatic when you zoom out and remember how terrible 2025 was for meme coins.

Most of them got wrecked. So this sharp bounce could be retail finally stepping back in after months of sitting on the sidelines:

-

Santiment reports the meme recovery started right after retail fear spiked late December. Basically: panic, then boom, re-entry

-

Google Trends shows searches for “meme coin” have been steadily rising since Jan 1, people are curious again. And in crypto, curiosity usually means FOMO is brewing

But there’s also a hidden factor: tax mechanics.

In traditional stocks, if you sell at a loss in December to reduce your tax bill, the IRS “wash sale” rule forces you to wait 30 days before buying the same asset again.

But crypto, it’s classified as property, not a security, so there’s no wash sale restriction.

That means a lot of traders likely sold off in late December, harvested their losses, and then jumped straight back into meme coins in early Jan, giving this rally a big push.

And now that meme coins are back in the spotlight, analyst Darkfost says this might just be the early signal of a full-on comeback. But, fair warning, it’s too early to say for sure.

So the next few weeks will tell us whether this is the real start of something, or just a quick New Year bounce.

The best time to forecast? Now.

Q4 is the perfect window to turn this year’s numbers into a clear, actionable forecast aligned with your goals. Set your business up for a stronger 2026 with BELAY’s new guide.

🔥 BURNING HOT TAKES FOR THE ROAD

After the U.S.-led arrest of President, Venezuela’s secret Bitcoin stash, worth over $60B, could change the global BTC market. Read more

Trump Media is launching a new reward token for shareholders, but distribution won’t begin until sometime in 2026. Read more

Aave Labs offered to share protocol revenue and IP rights to cool down a governance crisis. Read more

Crypto trading volume on CEXs just hit a 15-month low in December 2025. Binance still leads with $367.35B. Read more

🤡 SPICY MEME

Are you ready?

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply