Is This Supercycle or SuperCZcle?.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

BTC just broke past $92K and gold hit a new ATH, right after the Fed Chair is under criminal investigation.

Trump splits his attention in two: one part for Venezuela, Greenland, and the other… straight at the Fed 😡 And money always reacts before the answers arrive!

Here’s what we got for you today:

-

👀 Our Q1 2026 macro snapshot for crypto

-

⭐ Fed Chair is under criminal investigation

-

⭐ A Satoshi-era whale moved 2,000 BTC

-

🔥 Burning hot takes for the road

🌍 Q1 2026: Why Crypto is “Lagging,” Not “Failing”

Eugene (our trader, if you forget him) finished analyzing the Q1 2026 Macro Snapshot, and if you are wondering why the S&P 500 is ripping while your altcoins are chopping sideways, this report is the answer key.

The narrative now is shifting. Don’t let price action fool you. The macro engine is officially running hot again.

Here is his analysis of the 3 Core Signals in this report, and why he believes crypto is simply in a “catch-up” phase 👇

🔥 FIRST TIME IN FED HISTORY, ITS CHAIR UNDER CRIMINAL INVESTIGATION

For the first time in the Fed’s 110-year history, its sitting Chair faces the risk of criminal prosecution.

Jerome Powell, head of the most powerful central bank in the world, is now at the center of a rare DOJ investigation.

Here’s what’s going on:

-

It’s all centered around a $2.5 billion Fed building renovation project

-

The DOJ wants to know if Powell misled Congress about the project during a hearing last June

-

On Jan 9, the Fed got slapped with a grand jury subpoena asking for all related documents

Powell didn’t stay quiet. He confirmed everything in a video on X and made it very clear: This isn’t about office renovations.

It’s about whether the Fed can still make decisions independently, or whether politics is now steering monetary policy.

-

He’s served under 4 different presidents from both parties

-

The Fed’s independence is a non-negotiable principle

-

He’s still standing by the institution he’s run for over a decade

-

His job is to ensure price stability and maximize employment, not follow political agendas

He emphasized that the Fed has already shared detailed information with Congress on the renovation project through hearings and transparent documents.

This is all happening while Trump is back in office and has been publicly pushing Powell to slash rates harder and faster.

Meanwhile, Trump’s not exactly sitting back.

He’s now back in office, and publicly attacked Powell for months, mostly for not cutting interest rates fast enough.

His allies have been criticizing Powell for months, and now, this legal move takes it up a notch.

Now, tensions between the White House and the Fed are no longer subtle. They’re front and center and it’s sending shockwaves across global markets.

Market reactions were immediate:

-

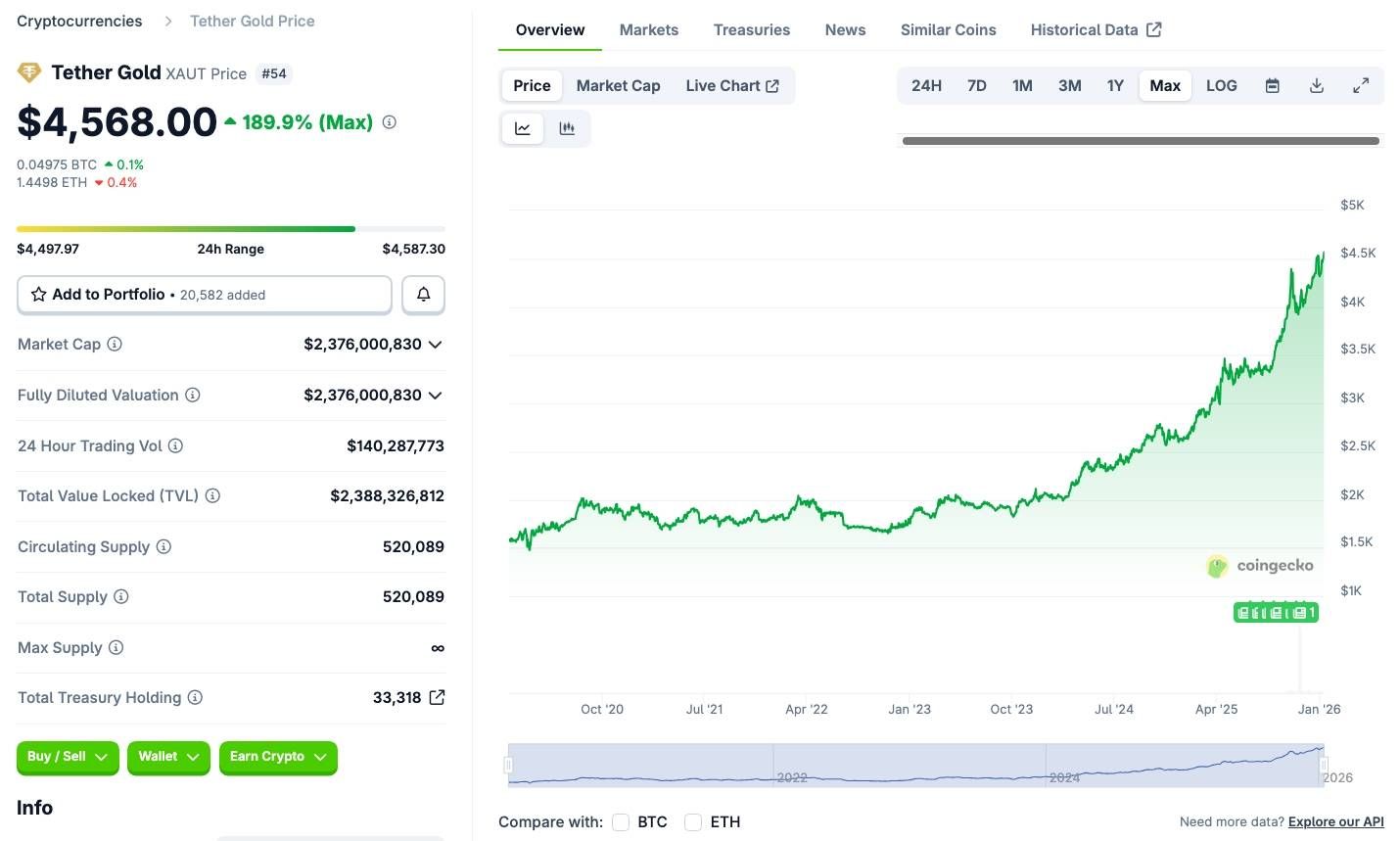

Gold prices surged to an all-time high, breaking above $4,600/oz on Jan 12

-

Stock futures dipped (Dow, Nasdaq, S&P all down ~0.5%)

-

Crypto actually jumped, likely from capital rotating into alternative assets during uncertainty

This came right as the Fed is already walking a tightrope, he’s trying to cool inflation without crushing growth.

When Powell repeatedly refused to follow Trump’s wishes on interest rates and when this is the end of his term as Fed Chair, it’s hard to believe this is “just a coincidence.”

Hiring in 8 countries shouldn’t require 8 different processes

This guide from Deel breaks down how to build one global hiring system. You’ll learn about assessment frameworks that scale, how to do headcount planning across regions, and even intake processes that work everywhere. As HR pros know, hiring in one country is hard enough. So let this free global hiring guide give you the tools you need to avoid global hiring headaches.

🟠 A SATOSHI-ERA WHALE MOVED 2,000 BTC AFTER 15 YEARS

A legendary Bitcoin wallet has suddenly become active again. These coins were mined when the block reward was 50 BTC over 15 years ago.

According to on-chain data, an early miner from 2010 quietly moved 2,000 BTC (~$181 million) straight to Coinbase. They had been sitting untouched across 40+ legacy wallets.

Julio Moreno from CryptoQuant confirmed: this is the largest whale transaction from the Satoshi era since the end of 2024.

Satoshi-Era Bitcoin Miners. Source: CryptoQuant

Analysts are watching closely, because this kind of on-chain move tends to happen at sensitive moments in the market.

-

The entire stash was mined in 2010

-

Around 2,000 BTC moved at once (≈ $181M)

-

Sent to Coinbase, signaling likely intent to sell

-

Market absorbed the supply without structural damage, showing strong liquidity

-

Still no identity revealed

And it’s not just this one wallet. In the past year, more and more 2009–2011 wallets are waking up.

Some are likely taking profits. Others may just be updating storage after a decade-plus of radio silence.

But the pattern is clear, OGs are on the move. You might remember that in July 2025, Galaxy Digital helped another Satoshi-era holder sell over $9 billion in BTC, one of the largest single crypto sales in history.

Still, Bitcoin didn’t crash. That’s the impressive part:

-

The market is now liquid enough to absorb old supply

-

Even “OG whales” exiting doesn’t break the system

-

Long-term strength is holding up, even under pressure

Institutional outlooks remain strong, too.

VanEck just released a long-term projection, stating that in a positive adoption scenario, BTC could reach $2.9 million per coin by 2050. And in their most bullish “hyper-growth” case: even higher.

If you’re wondering why someone would wait 15 years and then suddenly sell, this might be a strategic exit by someone watching macro signs closely: ETF inflows, U.S. policy shifts, and long-term cycles.

And here’s what we’re watching:

-

They sold to Coinbase, not peer-to-peer, not OTC. Why? They want liquidity now

-

They moved silently, then let the chain speak

-

They trusted the market to absorb it, and it did. That says a lot

If you’re holding Bitcoin or just getting in, this reminds you that early whales may sell, but that doesn’t mean the story is over. It means the torch is being passed.

So don’t panic about these old-wallet moves. Because the next 15 years might belong to us. Let’s keep paying attention.

🔥 BURNING HOT TAKES FOR THE ROAD

Arbitrum-based project FutureSwapX got exploited, $395K in $USDC ( ▲ 0.13% ) lost. The team has not responded publicly yet. Read more

BNB Chain Foundation just bought 4 Chinese meme tokens at once using $200,000 $USDT ( ▼ 0.02% ) . Here’s the list of 4 tokens

CZ says a “supercycle” might be starting thanks to historic shifts in U.S. regulation. But don’t get too excited just yet. Read more

VanEck, a global asset manager, said $BTC ( ▲ 1.02% ) could hit $53.4M per coin by 2050. But it’s just one of 3 long-term scenarios. Read more

🤡 SPICY MEME

Too cool for school

💌 SHOUTOUT FROM OUR FIRESTARTER

Dictate prompts and tag files automatically

Stop typing reproductions and start vibing code. Wispr Flow captures your spoken debugging flow and turns it into structured bug reports, acceptance tests, and PR descriptions. Say a file name or variable out loud and Flow preserves it exactly, tags the correct file, and keeps inline code readable. Use voice to create Cursor and Warp prompts, call out a variable like user_id, and get copy you can paste straight into an issue or PR. The result is faster triage and fewer context gaps between engineers and QA. Learn how developers use voice-first workflows in our Vibe Coding article at wisprflow.ai. Try Wispr Flow for engineers.

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply