🎁🎄 $BNB >> 506% ZEC + 200% BIFI.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

🎁 Unwrapping Christmas 2025… and it’s all red. From Christmas 2024 until now: only $BNB ( ▼ 0.68% ) (+19.6%) and $ZEC ( ▼ 0.62% ) (+506.2%) managed to go up. Everything else is down bad.

Even if you held $BTC, buying at the wrong price still means you’re stuck at the top. Long-term holders sometimes are just as rekt as short-term traders.

So… what do we call 2025? For me, it’s definitely the “Rekt Year” 🤣

Here’s what we got for you today:

-

👀 What will the future of crypto be like?

-

⭐ BTC/USD1 crashed to $24K on Binance

-

⭐ $6M vanished from Trust Wallet users

-

🔥 Burning hot takes for the road

We’ve spent a lot of time watching the crypto market promise us a “trustless” utopia, only to see it look more like the “Wild West” every day.

We were told the code would protect us, but we’re still losing millions to shiny websites and “guaranteed” returns. So can we actually have a system that doesn’t rely on trust?

If you’re curious about which projects will actually survive, you’ll want to give this a read 👇

6️⃣ BEGINNERS ROAD TO PRO TRADERS

DAY 6: Risk Management & Scams. How to Not Get Reckt

Crypto is powerful, but it’s also a playground for scammers. You don’t lose money because you “invested wrong”, but because you chased a 100x gain and ran straight into a trap.

It is 100x easier to scam with a new token than with a base coin (BTC/ETH). So today, we’ll explore a process that forces you to slow down when everyone else is rushing.

If you can master these safety checks, you stop being a target for scammers and start moving with the confidence of a veteran who knows exactly where the landmines are hidden.

🎄 BTC/USD1 CRASHED TO $24K? HOLD ON FOR A SEC…

Before you freak out: no, it wasn’t the entire market. It was a flash crash on a new trading pair: BTC/USD1, and it gave us a look of how risky low-liquidity pairs can be.

So here’s what actually happened (a little messy):

First, the crash only happened on BTC/USD1, a pair using USD1, a new stablecoin backed by Trump’s family via World Liberty Financial.

BTC price briefly dropped to $24K, then bounced back to $87K+ in seconds. No other BTC pair (like BTC/USDT) was affected at all, they stayed solid.

Source: TradingView

Now why did this happen?

-

Holiday trading volume was super low (it’s Christmas, after all)

-

Binance just launched a 20% APY promo for staking USD1 (up to $50K per user), which led to a flood of USD1 minting, over 45.6M tokens in just a few hours.

→ Total supply shot up to $2.79B+ -

That surge made $USD1 ( 0.0% ) price move slightly (+0.2%), opening up arbitrage chances

-

Some people borrowed USD1 and sold it through BTC/USD1, but… the pair had almost no liquidity

→ So the price tanked that hard just for a moment. Binance’s chart even showed a classic flash-crash candle: one giant wick straight to the floor.

After that, it recovered quickly, and no big liquidations happened, but it was a clear warning sign.

We found a few folks called it a “liquidity test.” Others just said, “meh, bear market things.” Also, many asked me: Could this happen to BTC/USDT?

My answer was like “ah, not likely.” BTC/USDT has insanely deep liquidity. In fact, Binance’s 1% market depth crossed $600M back in October, higher than pre-FTX levels.

Bitcoin Market Depth on Binance

Even during the recent BTC dip (from $110K → $86K), the pair handled it smoothly with $19.8B/day average spot volume, totaling over $613B in 100 days.

In short, BTC/USDT is way too thick for this kind of crash.

If you’re a retail trader like me and most of us, just be extra careful with new trading pairs, especially ones launched during holidays or paired with new stablecoins.

I don’t think Binance expected this to go unnoticed either. They probably wanted to see how USD1 holds up under pressure.

So, please stick to the big boys, BTC/USDT, ETH/USDT, if you’re not actively managing your trades. Don’t touch new pairs when volume is low (weekends, holidays, etc.).

And when you see a promo that feels too good to be true… assume it might come with low liquidity risk attached. We’re probably gonna see more of these weird pair launches in 2026.

The best time to forecast? Now.

Q4 is the perfect window to turn this year’s numbers into a clear, actionable forecast aligned with your goals. Set your business up for a stronger 2026 with BELAY’s new guide.

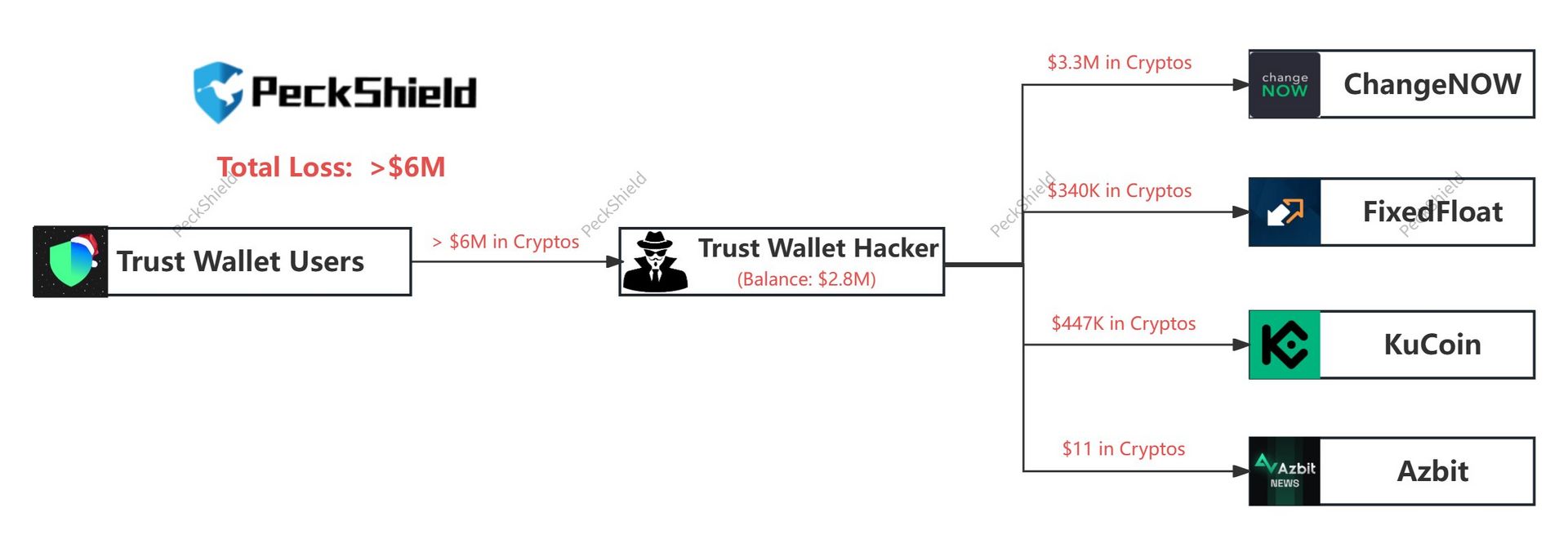

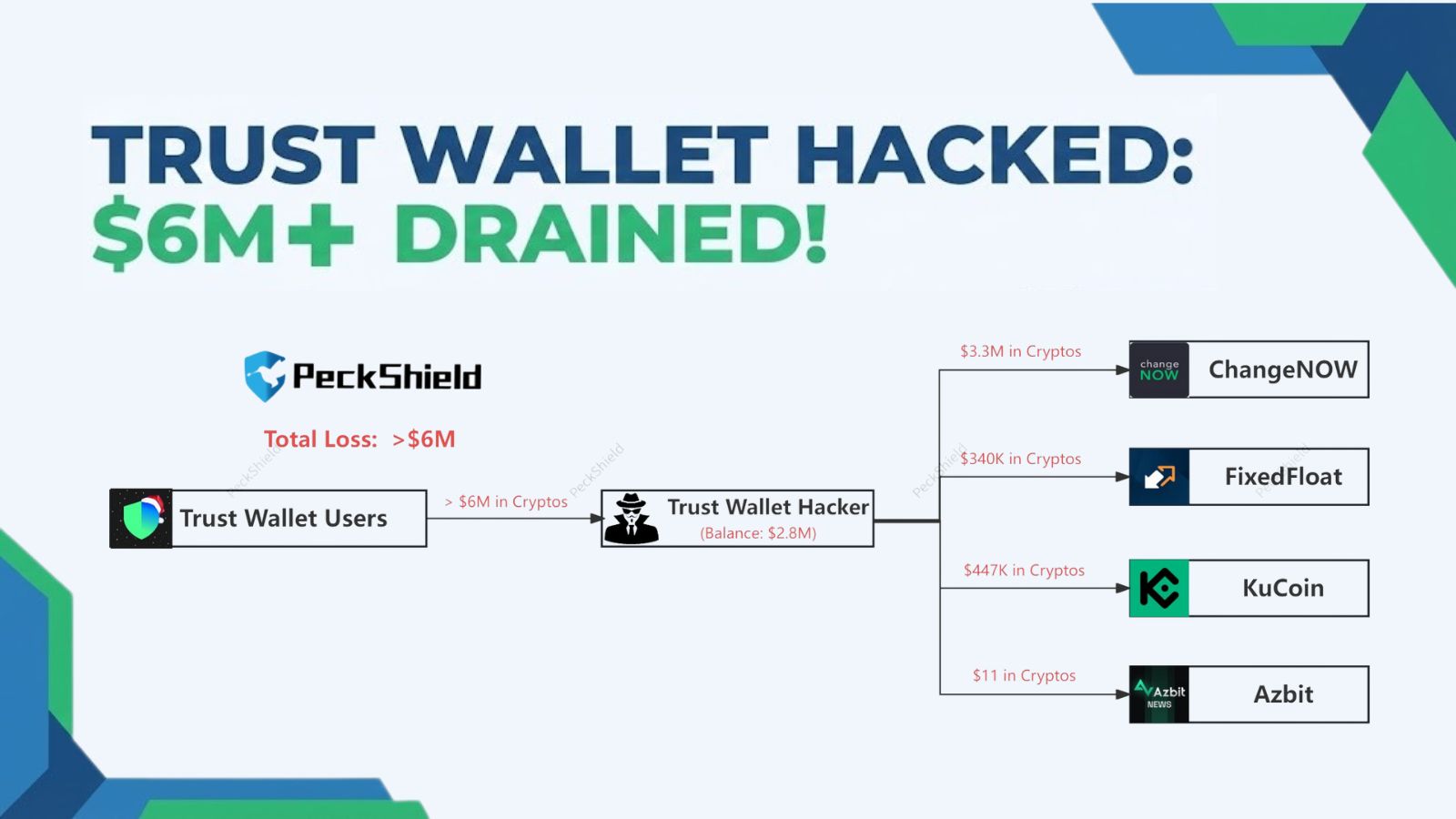

🚨 $6M JUST VANISHED FROM TRUST WALLET USERS

This one is a wake-up call for every crypto user relying on browser wallets.

On-chain sleuth ZachXBT just issued a red alert on Telegram: Hundreds of Trust Wallet users lost their entire balances in minutes, across multiple blockchains, and most didn’t even do anything.

Here’s what’s happened:

-

The attack hit Trust Wallet’s Chrome Extension (version 2.68)

-

Victims reported zero signs of phishing or malicious approvals

-

Over $6M was drained from wallets on Bitcoin, EVM chains, and Solana

-

The funds were swept within seconds to minutes, looking like a coordinated operation

On-chain patterns suggest this wasn’t your typical scam, it looked like someone got access to seed phrases.

That’s terrifying. You know what? The timing is suspicious, Trust Wallet had just released a new browser extension update before the hacks started.

Now everyone’s looking at one scary possibility:

“This might have been a supply chain attack where malicious code slips into official updates. If true, this is way beyond a simple bug. It means even the official update process can be hijacked”

So, Trust Wallet responded publicly:

-

The affected version is only the Chrome Extension v2.68

-

They urge everyone to immediately update to v2.69 or disable the extension

-

Mobile apps and other platforms are not affected (for now)

Meanwhile, PeckShield confirmed the stolen funds were being moved across different exchanges (likely with fake KYC info)

CZ (who owns Trust Wallet since 2018) confirmed the loss is over $7M, and Trust Wallet will fully compensate users. Still, the actual method of the attack remains unknown.

→ The Trust Wallet token $TWT ( ▼ 0.79% ) dipped nearly 4% today. This kind of thing shakes your trust. I mean, how do you stay safe when even the update you’re supposed to trust could be compromised?

Maybe keep your main bag off your everyday laptop, the one you use to browse X, click memes, open random links…

Make your paychecks work for you

When you set up direct deposit with Cash App, you can get paid up to 2 days early. That means less planning around payday, more living on your own schedule. And that’s just the start:

-

Put a percentage of every paycheck toward savings, stocks, or bitcoin

-

Keep all of your money with no monthly or hidden fees.

-

Make your money go further with 3.5% interest on savings and up to $200 in free overdraft coverage.

-

Know your money protected by 24/7 fraud monitoring and built-in security features

🔥 BURNING HOT TAKES FOR THE ROAD

A trader on 4chan, the same one who accurately predicted Bitcoin’s cycle top on Oct 2025, is calling $250K BTC in 2026. Read more

$BIFI ( ▼ 8.01% ) , the governance token of Beefy Finance, surged over 200% on Christmas Day before cooling off; while the rest slept? Read more

CZ shared a Christmas chart from 7 years ago, and it looks scary as hell 😅 Crypto never sleeps, not even on holidays. See the post

Trump Media just moved 2,000 $BTC ( ▲ 1.08% ) (≈ $174M), with $12M sent to Coinbase Prime Custody. Note: sending ≠ selling. Read more

🤡 SPICY MEME

Why they like this 😥😥

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply