BOJ-ZILLA Wakes = 30YR High $BTC Rekt.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

Over $500M got liquidated in the past 24 hours 😵💫 So what’s going on?

-

CPI “sell the news” effect, we’ll analyze this below

-

BOJ rate decision coming up, macro traders pulling risk

-

Wintermute dumped & moved $500M+ BTC to exchanges

$BTC ( ▲ 2.04% ) dipped below $87K early this morning. $ETH ( ▲ 5.03% ) cracked $2.9K too.

Here’s what we got for you today:

-

👀 What we do with the market after the sell-off?

-

⭐ Inflation’s down, why did Bitcoin dump?

-

⭐ Fasttoken up 200% while others bleed!!

-

🔥 Burning hot takes for the road

Eugene just reviewed the latest market breakdown & also looked at macro trends like the $750B liquidity drain, fiscal tightening, and rate decisions.

He broke all of this down with clear charts, what the indicators say (without hype), and how he’s personally adjusting his strategy moving into Q1 2026.

If you want to stop guessing and start understanding where we really are in the cycle, this post is worth the read 👇

1️⃣ BEGINNERS ROAD TO PRO TRADERS

DAY 1: What the Hell Is Crypto (And Blockchain)?

If you still think that crypto = coins = gambling, you need to change that mindset. Crypto is digital value running on public records that anyone can verify. That’s it.

For this day 1, we’ll break down:

-

What crypto and blockchain actually are

-

The difference between coins vs tokens (it’s like cities vs businesses)

-

How to use AI tools to explain terms, quiz yourself, and build your own crypto glossary

If you ever felt like “I don’t get this crypto thing”, start this series with us, you won’t be lost after then.

📉 U.S. INFLATION DROPS. SO WHY DID BTC STILL FALL?

You’d think that falling inflation would send everything flying. U.S. inflation came in way better than expected, just 2.7% CPI vs 3.1% forecast.

But even after that, BTC and S&P 500 both pumped fast, then within 30 minutes… they both dumped hard.

People don’t hate the CPI report. That number was actually one of the most bullish inflation updates we’ve had all year. BUT:

-

Huge waves of “taker sell” orders came in, aka aggressive sell-offs, not gentle profit-taking

-

Most of it happened during U.S. trading hours

-

It looked more like forced selling or algorithmic risk controls, not retail panic

CryptoQuant showed that massive dumps hitting right after CPI, then again later in the week – rinse and repeat, always during peak liquidity hours.

It was just like leverage reacting to price.

1/ So why did “good news” lead to a drop?

Because that good CPI print improved liquidity, so it’s easier for big players to act. BTC pumped, probably hit a cluster of:

-

Short-term leverage longs

-

Stop-loss zones

-

High-volume resistance

Then the robots kicked in, and boom, liquidations, forced selling, price dives. The momentum flipped like a light switch.

Same thing in stocks: that “up → down → chaos” move was likely driven by hedging flows, options gamma, and algorithm rebalancing, not emotions.

2/ Is this market manipulation?

Not necessarily. Charts don’t prove foul play. But yeah, it feels rigged because:

-

Prices move super cleanly into stop zones

-

Sell-offs get fast and violent once the first domino falls

-

It always happens when the market’s most liquid (aka easiest to exit size)

This kind of volatility is normal in high-leverage markets like crypto, especially when market makers and algos dominate. They’re not trying to trick anyone.

3/ What does this all mean?

This sell-off doesn’t mean inflation data was bad. It’s just that good news + high leverage = trap zone if you’re not careful.

In the short term, what matters is:

-

Can BTC stay above $85K?

-

Is forced selling cooling down?

-

Do buyers step back in once the flush is over?

Like usual, if you follow The Crypto Fire daily newsletter and analysis from our trader, Eugene Le, you won’t overreact to this drop.

Earn Bitcoin Without Buying It

Learn how hundreds of Bitcoiners are mining straight from the network and stacking sats at a discount – no middlemen, no pressure, just answers.

-

Featured in Bitcoin Magazine

-

$280M+ equipment under management

-

95% annual rig performance guarantee

We manage over 3,500 rigs for hundreds of people worldwide – all powered by 100% renewable energy.

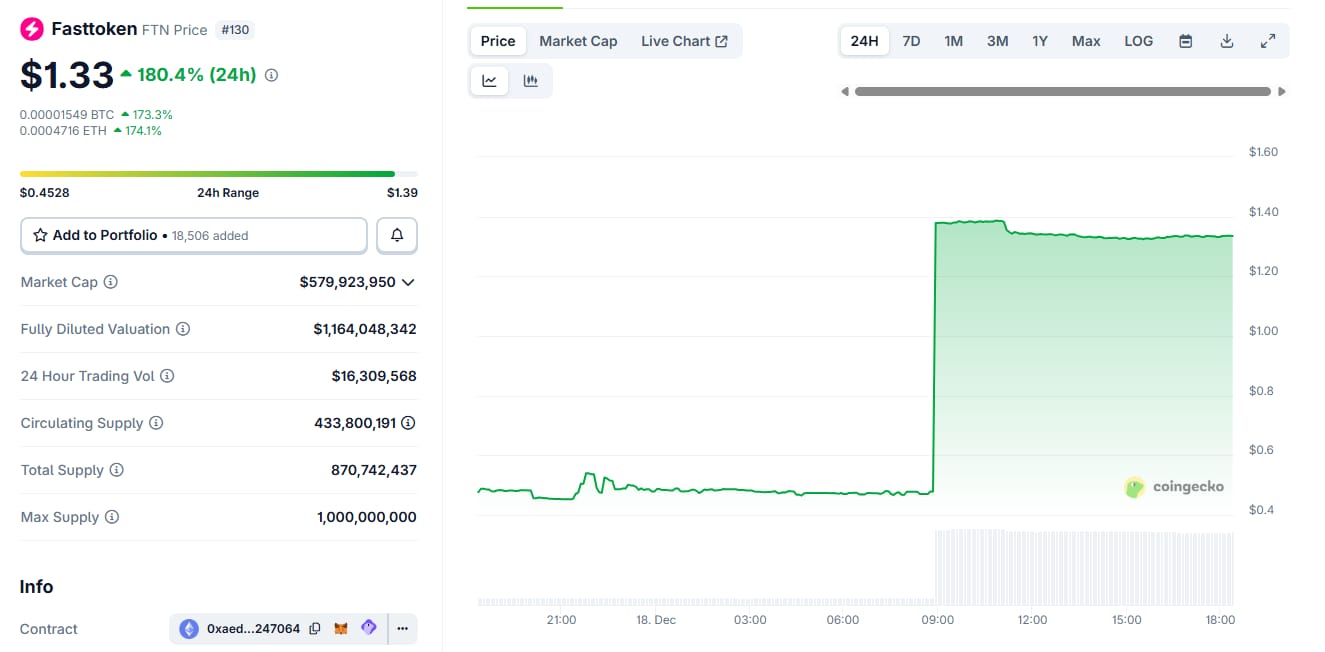

🧨 FASTTOKEN (FTN) UP ~200% WHILE OTHERS BLEED?

No joke, while most of crypto was red on Dec 18, Fasttoken ($FTN ( ▲ 4.23% ) ) decided to moon out of nowhere!?

It shocked everyone by surging almost 200% in a single day, jumping from around $0.37 to over $1.30, outperforming the broader crypto market, which was mostly in decline.

FTN Price on Coingecko

There was no major announcement, no partnership, no upgrade, nothing officially changed. So why did FTN pump this hard?

👉 Short answer: It’s a perfect combo of technicals + timing + psychology:

-

FTN had just crashed more than 90% from its early-2025 highs (~$2.00)

-

It hit historic lows under $0.25, triggering “oversold” signals

-

Traders started buying, betting on a quick rebound wave

-

Liquidity is low, so even modest buys caused massive price swings

Earlier this month, MEXC flagged FTN as “high risk”… but they didn’t delist it → people chilled out. That little bit of relief was enough to light the match.

If you’re new to this & asking what even is Fasttoken, FTN is the token for the Fastex ecosystem, built by SoftConstruct, a company doing stuff in payments, gaming, and IT.

FTN runs on its own Layer-1 blockchain called Bahamut (EVM-compatible, using PoSA), and it’s used for:

-

Transaction fees on Bahamut

-

Staking and ecosystem payments via Fastex Pay

-

Usage across NFTs, gaming, Web3 apps, and Fastex’s own DEX

So yeah, there’s a whole setup behind it, not just a random meme coin.

Actually, 2025 has been rough for FTN. Earlier this year, FTN traded over $2.00 then just… tanked. Also:

-

Big token unlocks hit the market

-

Overall altcoin fear kicked in

-

Exchanges like MEXC slapped on a “Special Treatment” tag

-

By mid-December, price had collapsed below $0.25, record lows

Most people stopped paying attention until now. So for this week’s rally, it got so oversold, some traders couldn’t resist a bounce play. People started revisiting the project’s old vision.

Fun fact: FTN’s X (Twitter) account hasn’t posted since September so this rally wasn’t driven by social hype.

There’s no denying this price action is wild. But experts caution that without a clear catalyst or sustained usage, this kind of rally can reverse just as fast.

It’s one of the most volatile coins right now in a very cautious market. Whether this pump is sustainable is still a big question mark.

Free in-network ATM withdrawals: Withdraw cash from 40,000+ ATMs with no fees.

Cash App reimburses ATM fees for all in-network withdrawals when you deposit at least $300 monthly of Qualifying Deposits into Cash App, or spend $500 or more in Qualifying Purchases using your Cash App Card or Cash App Pay in a calendar month. Service fees may apply. See terms for more details.

🔥 BURNING HOT TAKES FOR THE ROAD

World Liberty Financial ($WLFI ( ▲ 7.62% ) ) proposed using 5% of its WLFI treasury to boost stablecoin $USD1 ( 0.0% ) . Read more

Japan’s 10-year yield hit 1.98%, the highest since the 1990s. As the BOJ tightens, BTC is under selling pressure. See detailed analysis

Trump is eyeing a crypto-friendly Fed Chair. He’s preparing to interview a current Fed Governor for this role. Read more

North Korea-linked hacker groups stole at least $2B worth of crypto in 2025, including $1.4B Bybit hack in March. Read more

🤡 SPICY MEME

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply