🚢 Moon Chasing vs. Grave Digging.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

😱 $BTC.X ( ▼ 2.55% ) just wicked under $89k and the panic is loud. But dry your eyes and zoom out: this looks like a floor, not a crash. The 3D MACD hit a record low & RSI is oversold — the same rare buy signals that marked the 2018 & 2022 bottoms.

While the crowd screams $60k, smart money sees a recharge. Don’t flip your bias over a 2% discount; the energy is loading. 🔋

Here’s what we got for you today:

-

👀 The Safe Havens the 1% don’t want you to know

-

⭐ How to pick winners (and dodge dead coins)

-

⭐ The debate that broke the internet

-

🔥 Burning hot takes for the road

We all know the classic advice: “Buy gold in chaos, buy land in peace.” But what happens when inflation spikes, wars break out, and everything correlates to the downside?

The super-rich play a different game. We broke down the Top 5 Safe Haven Assets billionaires are accumulating right now.

And yes, BTC is on the list… but not for the reason you think.

🚢 WHICH COINS TO ENTER, WHICH TO EXIT — WHAT SIGNALS MATTER?

The most common question I get in the DMs right now is: “What should I buy? Everything is moving, and I don’t want to get trapped.”

Most people try to guess the bottom of the coins that dumped the hardest. That is a mistake. In this market, you don’t want to buy the cheap coins; you want to buy the strong ones.

Here are the 3 specific signals I use to spot the next runner (and avoid the dead coins).

1. Chase the “Runners” (Yes, Buy High)

This feels counter-intuitive. You see a coin that is already up 20% while the market is flat, and you think, “I missed it. I’ll wait for it to crash.”

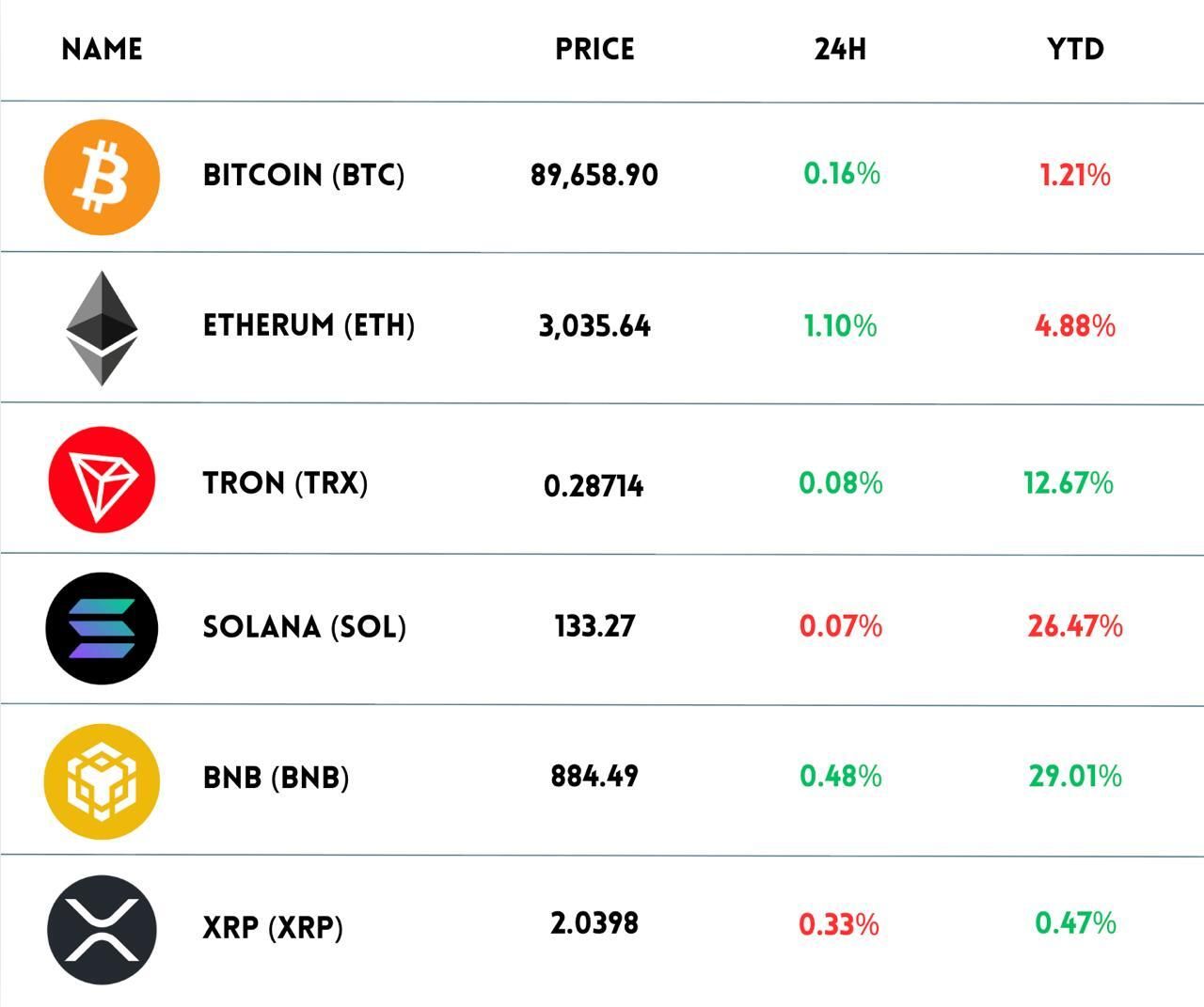

Don’t! In crypto, strength begets strength. The coins outperforming $BTC.X ( ▼ 2.55% ) and $ETH.X ( ▼ 1.23% ) right now are the ones with real demand. Buying the winner is usually safer than trying to bottom-fish a loser.

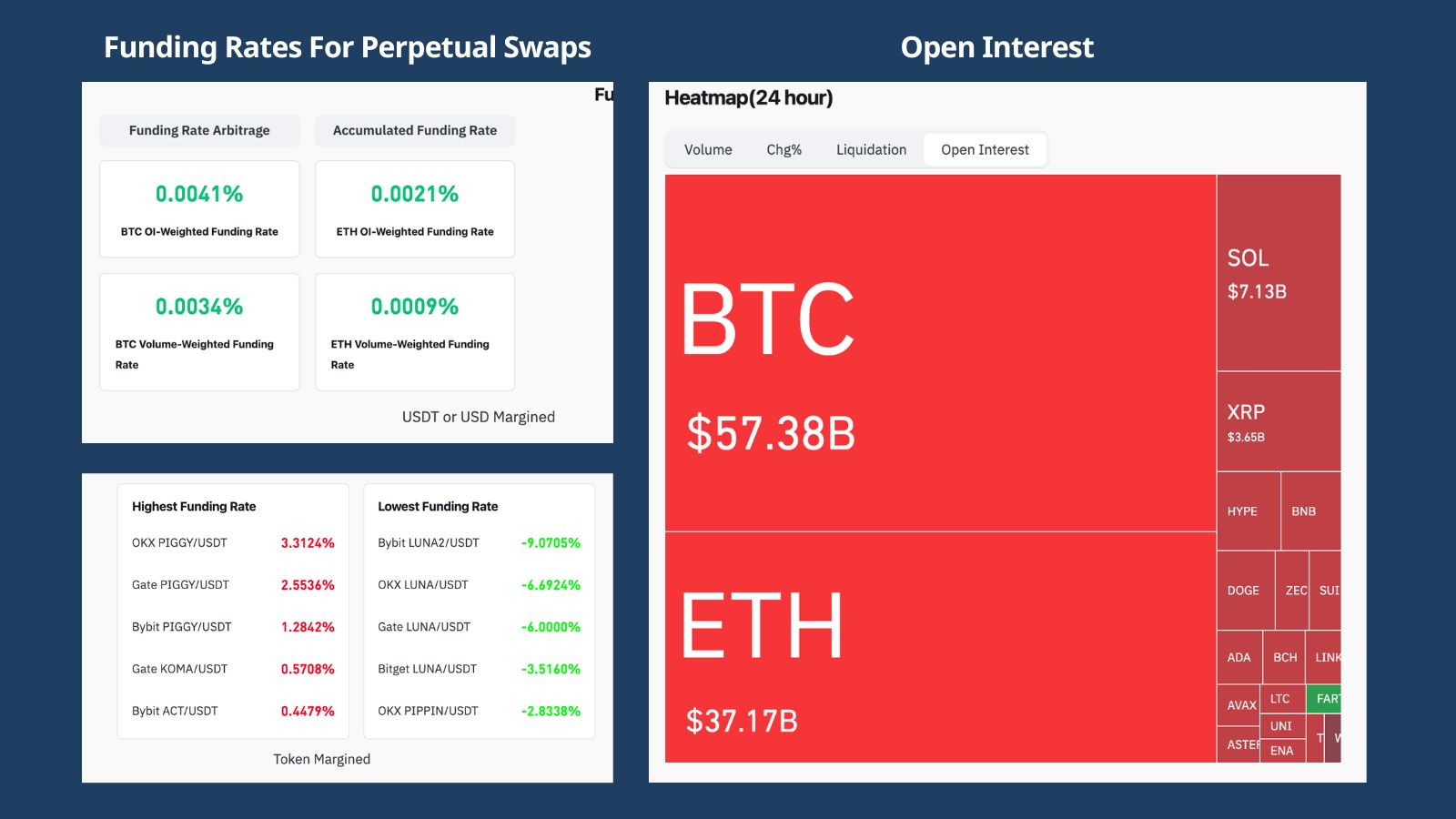

Look at Funding Rates and Open Interest. If the price is flying but funding isn’t insanely negative, there is likely still fuel left in the tank.

Don’t wait for a perfect entry. Size in small, then DCA if it dips.

2. The “V-Shape” Monsters

Watch what happens immediately after a market flush. Look for coins that experienced a sharp dump but instantly recovered, effectively swallowing the red candle within hours.

This is a massive signal that active buyers are protecting price levels. We see this often in high-volatility sectors like Memecoins. If a coin V-shapes while everything else bleeds slowly, put it on your watchlist immediately.

3. The Stalwarts (Relative Strength)

When Bitcoin drops 5%, look at your watchlist. Which coins only dropped 1% (or stayed green)? These are the Stalwarts. They are showing “Relative Strength.”

Caution: Sometimes a coin that refuses to drop also refuses to pump (it’s just low liquidity). You want to see a Stalwart that holds the line during a crash, then explodes the second BTC stabilizes.

My Personal Take: Momentum is the Only Truth

Too many traders lose money trying to find the reason why a coin is pumping. “Why is this garbage up 40%? It makes no sense!”

Stop asking why. The market doesn’t care about your logic. Sometimes, the only reason is “people want to buy it.” 😁

Focus on Momentum and Market Structure. If real buy pressure is visible on the chart, the narrative will follow the price. Stop reading the news; start reading the behavior.

Invest right from your couch

Have you always been kind of interested in investing but found it too intimidating (or just plain boring)? Yeah, we get it. Luckily, today’s brokers are a little less Wall Street and much more accessible. Online stockbrokers provide a much more user-friendly experience to buy and sell stocks—right from your couch. Money.com put together a list of the Best Online Stock Brokers to help you open your first account. Check it out!

🔥 GOLD BUG VS. CRYPTO KING: THE DEBATE THAT BROKE THE INTERNET

If you wanted fireworks, you should have been at Binance Blockchain Week in Dubai yesterday 🍿.

In a rare face-off, Peter Schiff (the world’s loudest Bitcoin hater) and Changpeng Zhao (CZ) (founder of Binance) shared a stage to debate the ultimate question: Is BTC real money, or just a zero-sum game?

It was tense, hilarious, and surprisingly revealing

1. Schiff’s Attack: “BTC is Fake Wealth”

Peter Schiff argued that Bitcoin is purely a “transfer of value,” not a creator of it. If you buy BTC at $90k, you haven’t created anything. You just hope to sell it to someone else for more. He called it a “zero-sum game” where the world isn’t better off because 20 million BTC exist.

He pointed out that BTC buys 40% less gold today than it did 4 years ago, claiming it has failed as a store of value.

2. CZ’s Counter: The Gold Bar Moment

CZ literally pulled out a 1kg gold bar on stage (lol) and handed it to Schiff.

With gold, you need a lab to verify it. With BTC, you just need a node. CZ argued that Schiff’s own “tokenized gold” platform relies on a central custodian (a promise).

Bitcoin relies on math. If the custodian goes bankrupt, your digital gold is gone. If an exchange fails, your self-custodied Bitcoin is still yours.

What I think from this

Schiff’s argument that “digital assets aren’t real” is getting old. By his logic, Google, OpenAI, and Visa are also fake wealth because they don’t produce physical goods.

BTC isn’t just a token; it’s a monetary network. It allows a farmer in Africa to settle payments in 3 minutes instead of 3 days. It allows billions of dollars to move across borders without a bank’s permission. That utility is the value creation.

Schiff is betting on the past (physical rocks). CZ is betting on the future (programmable money). The market has already chosen the winner.

There’s a reason mobile home parks are getting so much institutional love.

They remain one of the key affordable-housing sources nationally, have limited supply and high tenant retention (10-12Y). Investors can see tremendous upside with professionally-managed MHP portfolios such as Vintage Capital’s, which targets a 15-17% IRR and makes monthly distributions. Invest directly in individual deals or via a 10+ property fund. 1031s also available.

🔥 BURNING HOT TAKES FOR THE ROAD

JPMorgan just dropped a bombshell prediction: if Bitcoin starts trading like gold, their target price is… way higher than you think. Read more

Kalshi just signed an exclusive deal with CNBC to stream real-time prediction data. Looks like betting markets are officially going mainstream in 2026. Read more

The hammer drops for Do Kwon. U.S. prosecutors are officially seeking a 12-year prison sentence for the Terraform Labs collapse. Read more

Meta is finally pulling back. Zuckerberg is considering slashing the metaverse budget by 30% as the company pivots harder into AI. Read more

Eric Trump’s crypto project just took a massive hit, tumbling nearly 40% as the broader market “crypto winter” sentiment drags it down. Read more

🤡 SPICY MEME

Q1 Q2 Q3 Q4

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply