ETF Buys = Sell. ETF Sells = Sellx2.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

😵 Everything is a dump signal now?! Gov shutdown = dump. Gov reopens = dump. Rate cuts = dump. No rate cuts = dump.

ETFs buying = dump. ETFs selling = dump. Gold pumps = dump. US stocks pump = dump. US stocks dump = dump…

Like… what’s left? This really might be the worst bull market of all time 😅

Here’s what we got for you today:

-

👀 What the end of the shutdown means

-

⭐ Our honest advice in this red market

-

⭐ A major power shift inside the Fed

-

🔥 Burning hot takes for the road

Here’s a simple breakdown of how Federal Reserve and Monetary Policy shifts shape liquidity, risk, and crypto today:

🧠 SURVIVE FIRST. PROFIT LATER MY DEAR!

Too many new folks jump into crypto thinking it’s a fast track to getting rich. They see a couple altcoins pump and think they’ve made it.

But this isn’t a sprint. Crypto is an endurance game. The key is “Are you still in the game?” You only get to win if you survive long enough to learn, adapt, and try again.

Source: @tradinghoex

Today’s read from Tradinghoex reminded me of my own crypto journey. He said there are 2 types of people who survive in crypto:

1️⃣ The multi-cycle cockroaches

These are the people who’ve been through it all:

-

2017 ICO mania

-

DeFi Summer

-

NFT euphoria

-

The FTX collapse

They’ve lost money, got rekt on leverage, been rugged, and still stayed. Each cycle made them smarter, more selective, and more resilient.

They’re still here because they learned to fall and get back up.

2️⃣ The lucky survivors

Honestly… this might be me 😂 They’ve done it all wrong, held the top, got scammed, overleveraged… Yet somehow, they’re still alive.

Maybe they kept most funds in cold wallets.

Maybe they rebuilt from scratch a few times.

Maybe they hit a lucky trade or had someone back them.

Doesn’t matter how.

This might be the right time to read this post:

Twitter tweet

Here’s what I’ve learned over the years:

-

Protect your capital first, profit later

-

Only go in when the risk/reward is clear. Don’t FOMO

-

Never all-in. Keep dry powder for the next chance

-

Watch out for platform risk, wallet risk, and human risk

-

Hold some cash. The best plays appear when others panic

Don’t freeze up waiting for the perfect setup. There’s no such thing. Those who win long-term are the ones who know when to defend and when to strike.

Learn before you earn. Crypto is not a game of luck. It’s study, fail, restart.

Every trader has gone through the “learn → lose → relearn → rebound” phase.

Bull markets make you money. Bear markets teach you how not to lose it. If you’re still here, still learning, still building, you’re already ahead of most.

Crypto doesn’t reward the fastest. It rewards the most adaptable!

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

-

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

-

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

-

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

🔥 A POWER SHIFT IS HAPPENING INSIDE THE FED

For the past 40 years, Fed policy was shaped by one voice, the Fed Chair. Every vote is usually 12-0 or 11-1. Total consensus.

→ Markets trusted that if Powell said something, it would happen.

But now, things are changing fast. And it’s not Powell who holds the power anymore. According to Bianco Research, Fed policy is no longer decided by what the Chair wants.

→ It’s all about the votes, 12 members of the FOMC, and whichever view gets 7 votes wins. Even if Powell disagrees, he can’t do much about it.

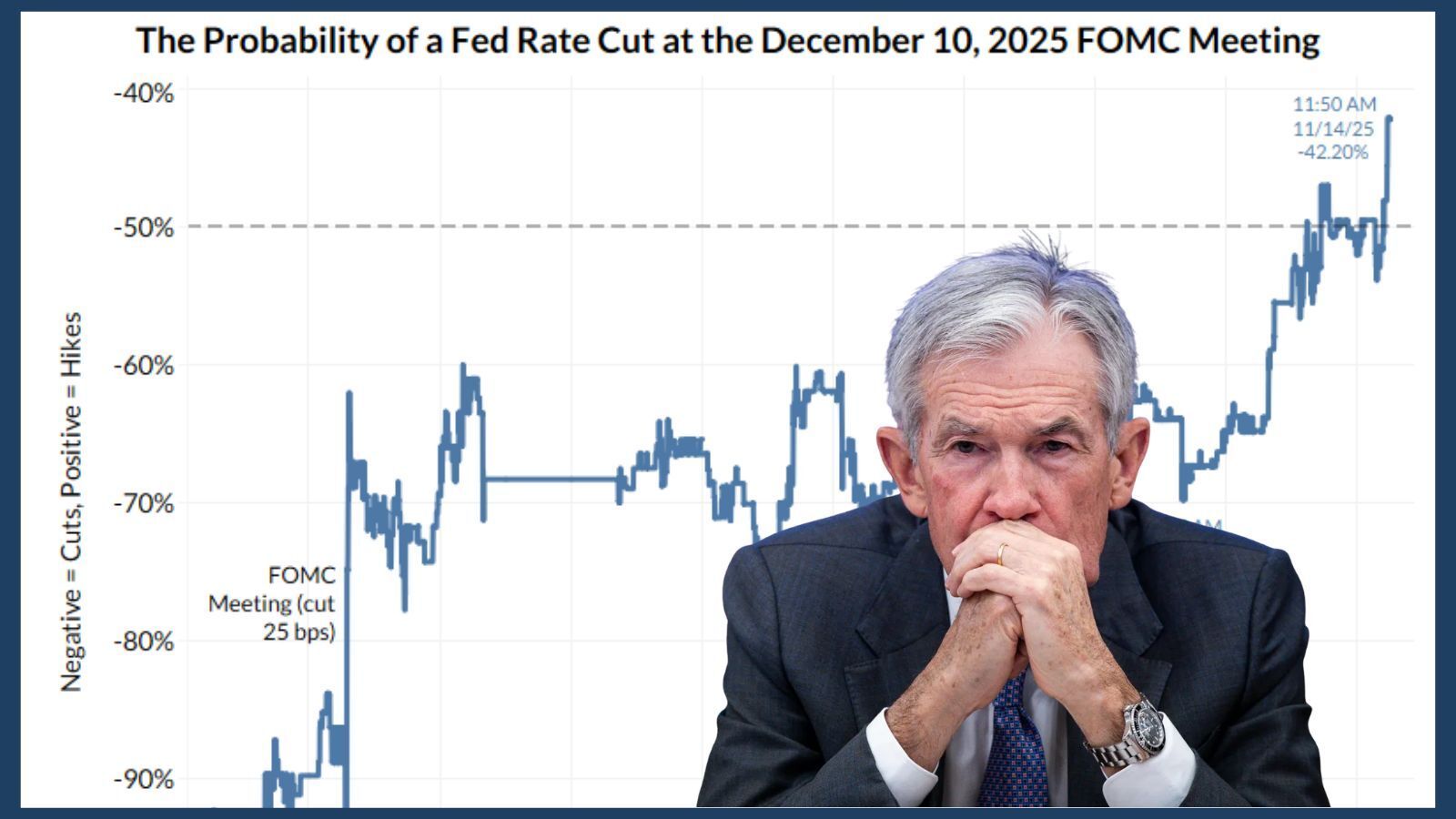

And this is exactly why rate cut odds for Dec 10 just dropped from 70% → 42%, even though:

-

There were no major economic reports (gov was shut down until Wed)

-

Powell didn’t say anything

So what changed? The votes shifted. Here’s the current mood inside the Fed:

-

4 members want to cut rates (Miran even wants to cut by 50bps)

-

5 want to hold rates steady

-

3, including Powell, are still neutral or unclear

This kind of split is quite rare. It means the old “Chair decides, others follow” model might be falling apart. Now, each member seems to be thinking and voting for themselves.

What triggered this?

Many believe it started with Trump’s repeated attacks on the Fed and his attempt to stack the board with loyalists. Ironically, that may have forced members to assert their independence even more.

Miran’s even going public: writing blogs, doing interviews, openly saying what he believes.

If he can do that, others will follow. And suddenly, every member sees themselves as an independent voice, not just a rubber stamp.

That’s a big deal. We might be seeing the end of the 40-year Fed herd-mentality era.

Is this a good thing?

Honestly, it’s a good thing. It won’t make the Fed perfect. But it does make them faster at admitting mistakes, and more responsive to real data, just like markets.

I think this also explains why they paused rate cuts after just two. The group’s views are shifting and it’s no longer just about what Powell wants.

If you’re a trader, watch the individual voices, not just Powell. If you’re an investor, brace for more uncertainty because the Fed is now a debate!

According to the latest data from CME FedWatch:

-

56.4% chance the Fed keeps rates steady at 375–400 bps

-

43.6% chance they cut to 350–375 bps

Pretty much a coin flip…

3 money habits teens can start building now

With a Cash App Card, teens can take their first steps toward independence with a secure debit card. They’ll learn how to spend, save, and manage money, all with your guidance and oversight to help them get started.

1. Learn to spend responsibly: A debit card gives them a safe way to practice managing money under your supervision. It gives you the opportunity to teach them how to make smart spending choices.

2. Start saving for their goals: Setting goals can help them see how saving a little at a time can help them reach their short-term and long-term goals.

3. Manage their own money: Whether they get paid with direct deposit or use Cash App to get allowance or gifts, they get real experience with money.

🔥 BURNING HOT TAKES FOR THE ROAD

The term “Death Cross” is now dominating trader discussions. CTs Global are losing confidence. Many believe a Crypto Winter is confirmed. Read more

After 50 $ETH.X ( ▼ 4.75% ) theft, OKX CEO offers a 10 $BTC.X ( ▼ 5.25% ) reward to anyone who provides proof of a security vulnerability in OKX Wallet. Read more

No, Strategy isn’t dumping 47K BTC (don’t believe the rumor). It was just a routine wallet shuffle or custodian update. Read more

BitMine just appointed Chi Tsang as its new CEO, replacing Jonathan Bates. It also launched $1B buyback. Read more

Arthur Hayes just dumped $2.45M in altcoins & ETH, while still calling for $BTC at $200K by year-end? Read more

🤡 SPICY MEME

It’s super effective

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply