“Stable” in $USDT Stablecoin is Just PR!?.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

Longs? Shorts? Looks like everyone got wrecked today 😂

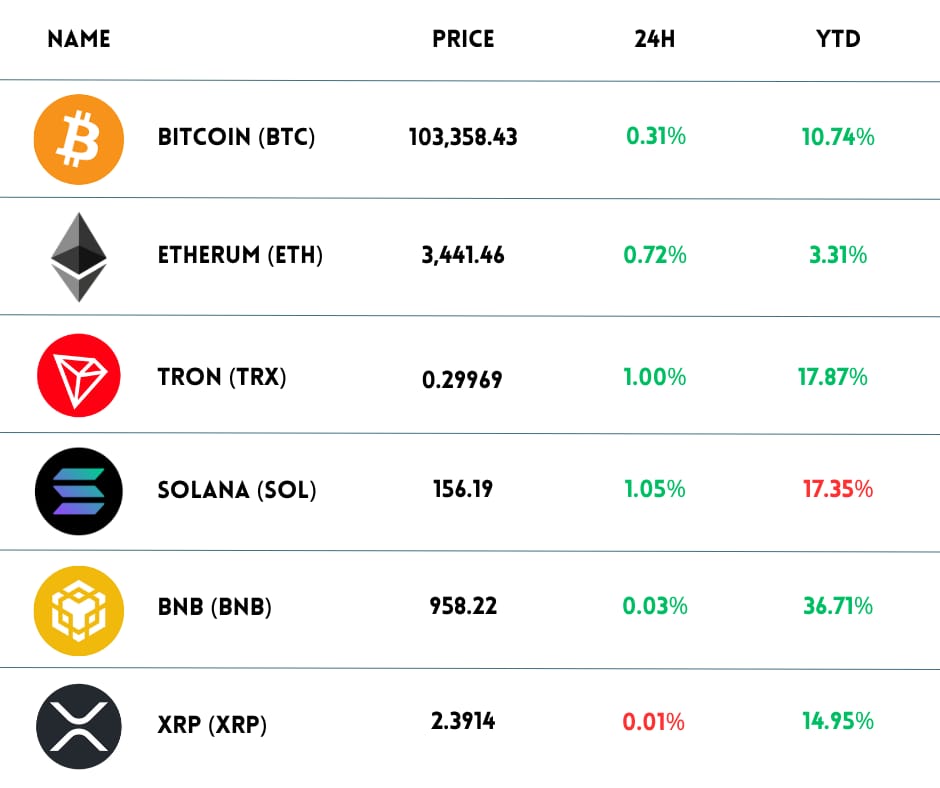

Just yesterday, we were chillin’ at $107K BTC and talking about this week’s macro environment. Now it’s slid back to $103K. The entire market’s basically painted red.

Nearly $200B in market cap vanished, around $466M got liquidated, most of it came from our beloved long gang… 😏

Here’s what we got for you today:

-

👀 ICO season 2.0: The return of token sales

-

⭐ Stablecoins are rising, but don’t be blind

-

⭐ China accuses U.S. of stealing $13B in BTC

-

🔥 Burning hot takes for the road

As I mentioned in my last macro environment post. The last time tech hype hit this level was during the Dot-Com boom, when valuations exploded before crashing hard.

But looking at the current macro environment, this doesn’t look like 1999 yet. I mean everything is under control.

Today we’ll analyze this deeper and also explore the ICO season 2 – the return of token sales as below:

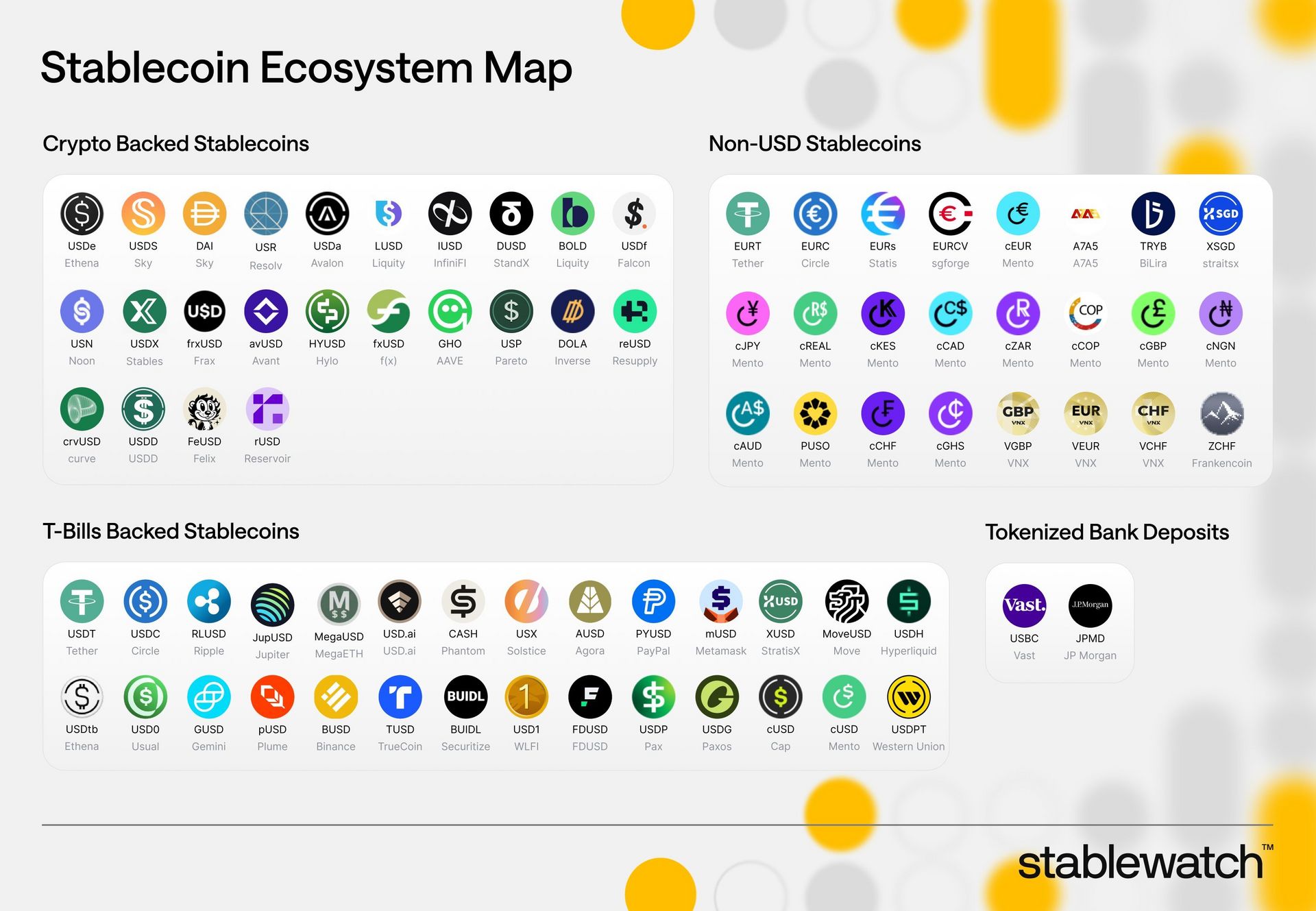

💵 STABLECOINS ARE RISING, BUT DON’T USE BLINDLY

Stablecoins are everywhere right now. But before you use your money or build with them, you really need to know exactly what to check before you trust one.

Source: @panterafii

According to Panterafii, there are 3 big reasons why stablecoins are blowing up lately:

1/ On-chain FX (foreign exchange) demand is booming

People want to swap currencies directly on the blockchain instantly, without intermediaries. It’s reshaping international payments, remittances, and currency conversion.

2/ The rise of agentic payments

Protocols like Coinbase’s x402 protocol are unlocking a future where AI agents can autonomously pay for services, data, or compute power.

Imagine machines trading with machines, that’s the economy we’re heading into.

3/ On-chain transparency is reducing fraud and money laundering

It also creates open financial data that analysts and regulators can actually track.

Now, not all stablecoins are built the same. Here’s how they’re generally structured:

-

Over-collateralized: Backed by assets like $ETH.X ( ▲ 3.04% ) , BTC, or real-world assets (like U.S. bonds). Think $USDS.X ( ▲ 0.05% ) , $GHO.X ( ▲ 0.01% ) , $CRVUSD.X ( ▼ 0.41% ) . They generate real yield but are exposed to asset risk

-

Algorithmic or hybrid: Use supply-demand algorithms to keep peg around $1. More flexible, but fragile, they can collapse if trust is lost

-

Fiat-backed: Like $USDC.X ( ▼ 0.0% ) or $USDT.X ( ▼ 0.02% ) , backed 1:1 by real USD. Safer in theory, but fully dependent on the issuer’s reserves and legal setup

If you’re thinking of holding or using stablecoins, here’s what I usually check:

-

Price stability (peg) → Does it stay within 0.5% of $1? How fast does it recover during volatility?

-

Liquidity → If you sell a few thousand dollars and the price drops, that’s a red flag.

-

Smart contract security → Look at audit quality, oracle transparency, and protection against flash-loan exploits.

-

Custody and compliance → Who holds the collateral? Are there regular audits? Do you have legal protection if something breaks?

-

Yield sources → Is the yield from real revenue (fees, asset returns) or just temporary incentives?

Some examples that highlight these differences:

First, $USDS earns from Treasuries and loan fees so it’s more sustainable, but tied to U.S. RWA policies.

Then, $GHO is tied to stkAAVE so it’s stable, but demand drops can cause volatility.

Next, $crvUSD has a unique “soft liquidation” model, it smooths shocks but is complex to manage.

Another, Ethena’s $USDe uses a delta-neutral hedging strategy, but exposed to derivatives platform risk.

And if you’re on Solana, you’ll see native coins like jupUSD, USX, hyUSD growing fast with cheap fees, fast txs, great for smaller payments.

But even then, liquidity depth and real-world redeemability must be verified before holding them.

Don’t get blinded by high APYs. Check the peg, check the liquidity, check the risks. Because in this new game, the best stablecoin is the one that survives chaos and keeps your money safe.

Earn Bitcoin Without Buying It

Learn how hundreds of Bitcoiners are mining straight from the network and stacking sats at a discount – no middlemen, no pressure, just answers.

-

Featured in Bitcoin Magazine

-

$280M+ equipment under management

-

95% annual rig performance guarantee

We manage over 3,500 rigs for hundreds of people worldwide – all powered by 100% renewable energy.

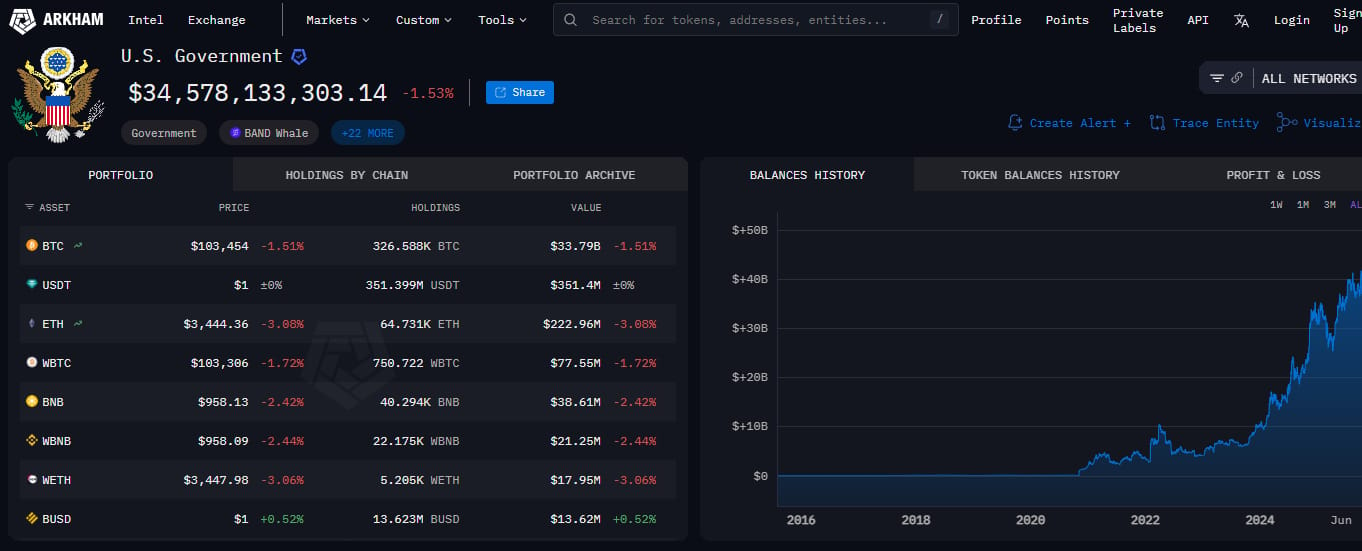

😳 CHINA ACCUSES U.S. OF STEALING $13B BTC?!

Actually, this one feels straight out of a crypto thriller.

China just accused the U.S. of hacking 127,000 BTC from Chen Zhi’s LuBian mining farm back in 2020, and then pretending it was a criminal seizure 5 years later.

If true, this could be the biggest government-led hack in crypto history. Here’s what happened:

-

In Dec 2020, LuBian (owned by Chen Zhi, boss of Prince Group in Cambodia) lost 127,272 BTC, worth about $3.5B at the time

-

The hack was way too advanced for random hackers. Chinese cybersecurity teams say only a nation-state could’ve pulled it off

-

The BTC just sat there, untouched, for 4 years

-

Then in mid-2024, bam, all the coins moved to a new wallet

-

Arkham later tagged those wallets as U.S. government controlled

-

TRM Labs + Elliptic also traced the hacked funds back to Prince Group, making the connection stronger

-

Between 2021–2022, LuBian sent 1,500+ OP_RETURN messages on Bitcoin. Basically desperate pleas: “Please let us buy our BTC back”

-

On Oct 14, 2025, the U.S. DOJ charged Chen Zhi and formally seized the 127K BTC, now worth $13B+

But the U.S. never explained how or where they got the coins.

From China side, they’re calling BS. They say that the DOJ didn’t just “seize” the BTC. They planned the hack years ago and laundered it through the legal system by labeling it as criminal property.

They also pointed out that BTC moved slowly and quietly, not like a typical criminal cash-out. Chen Zhi is currently being prosecuted in the U.S. for:

-

Running massive investment fraud schemes

-

Money laundering

-

Operating “digital slave” compounds tied to forced labor

It looks more like a covert intelligence op. So far, the U.S. DOJ and Treasury have not responded to the accusations.

→ This isn’t just about Chen Zhi (who, by the way, is being charged with fraud, money laundering, and running “digital slavery” compounds).

And with this 127K BTC, the U.S. now holds over 325,000 BTC, or $37B+. That’s a lot of Bitcoin sitting in government wallets.

If you’re the U.S., quietly turning a state-level hack into a “legal seizure” gives you insane leverage, without breaking any “rules” (on the surface).

But if you’re China, this is a nightmare, and a golden chance to call out Western double standards.

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

-

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

-

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

-

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

🔥 BURNING HOT TAKES FOR THE ROAD

In the past 2 months, $ZEC.X ( ▲ 7.81% ) has pumped over 700% (top 20 cryptos globally). Read more

→ Arthur Hayes (BitMEX co-founder) says it’s the #2 holding in his portfolio, only behind $BTC.X ( ▲ 0.35% ) . Read the post

FED officials are seriously divided over whether to cut interest rates in December. The FED is flying blind with patchy data… Read more

Bybit is currently in talks to acquire Korbit, one of South Korea’s oldest and most tightly regulated crypto exchanges. Read more

Ledger, the world’s top crypto hardware wallet maker, is eyeing an IPO or major private raise in New York by 2026. Read more

🤡 SPICY MEME

Noob squad

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply