AI’s explosive rise, fueled by government spending and corporate arms races, is setting the stage for a new era.

Table of Contents

🎈 AI Bubble or Just the Beginning?

People are talking a lot about whether AI is in a bubble.

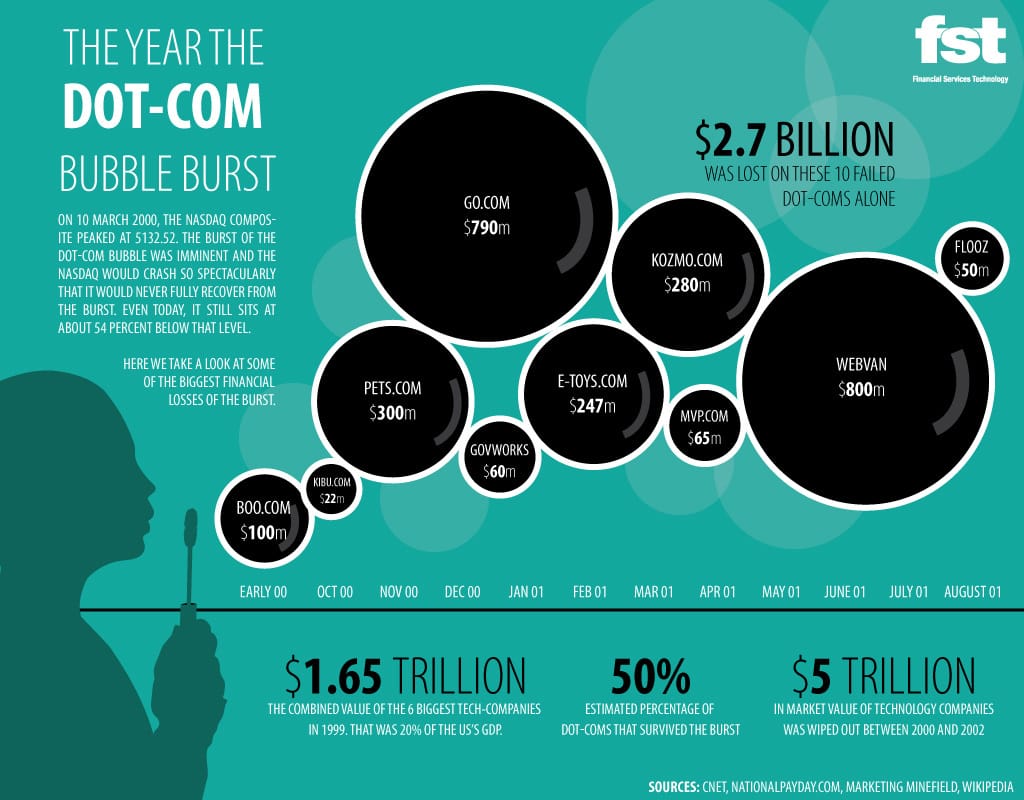

As I mentioned in my last macro environment post. The last time tech hype hit this level was during the Dot-Com boom, when valuations exploded before crashing hard.

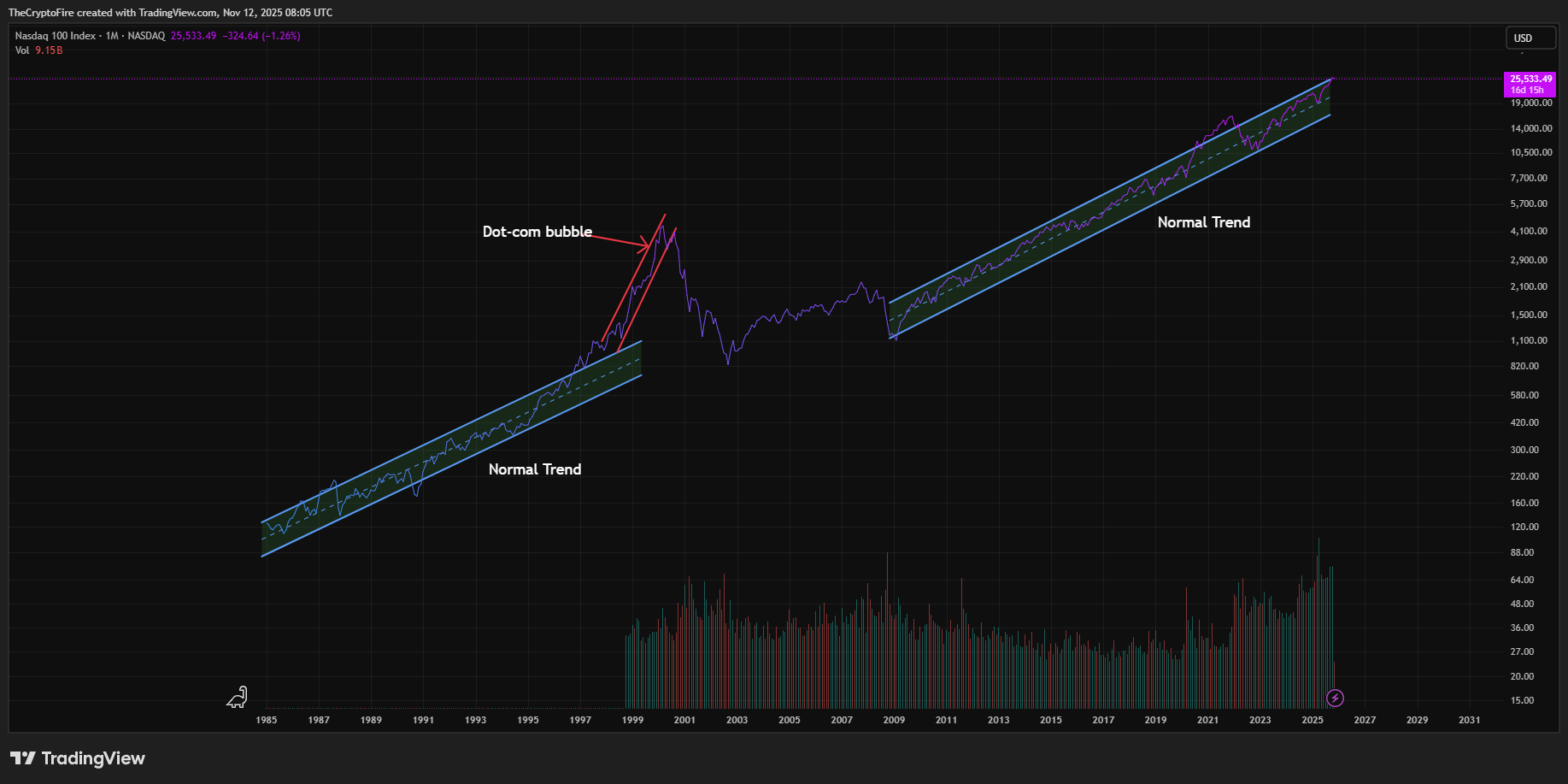

But looking at the current macro environment, this doesn’t look like 1999 yet.

I mean, everything is under control!

The Nasdaq, which tracks tech stocks, is still within a normal upward trend. Back in the Dot-Com era, the index shot far beyond its long-term average before collapsing.

Today, even with names like NVIDIA $NVDA ( ▲ 0.33% ) , Microsoft $MSFT ( ▲ 0.48% ) , and OpenAI pushing huge gains, valuations are still linked to real revenue and use cases.

The macro environment supports this kind of growth because liquidity remains high, and tech is seen as the next productivity wave.

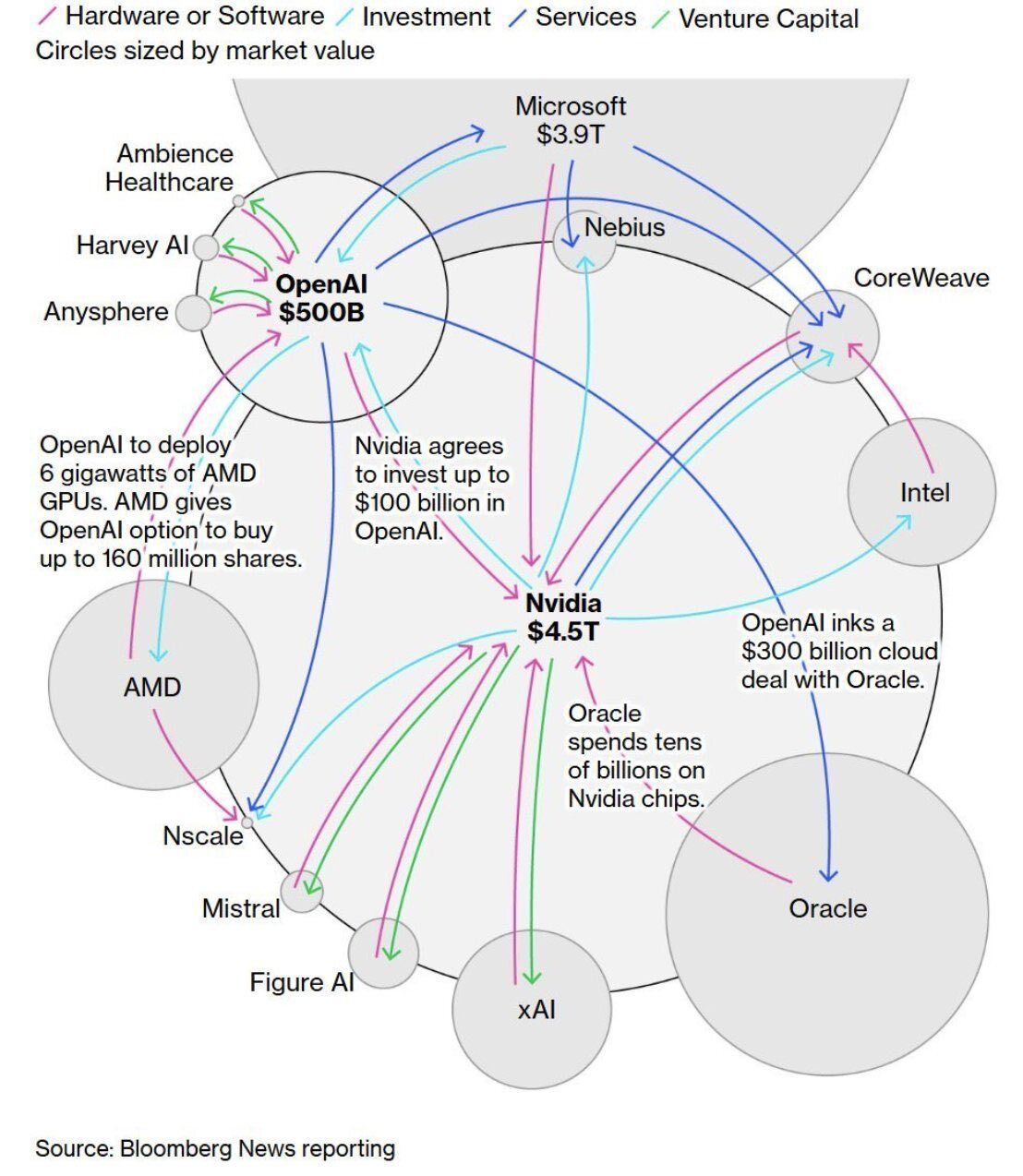

The main red flag right now isn’t broad overvaluation but vendor financing when companies in the same ecosystem fund each other.

OpenAI is generating about $13 billion a year, mostly from ChatGPT subscribers, but it’s committed to spending over $1.4 trillion in the next decade to secure massive computing power from partners like Oracle, Nvidia ($100 billion), AMD ($100 billion), and TSMC ($20 billion).

To close that gap, the company plans to expand into government contracts, hardware, video, and cloud services through its Stargate project. With major U.S. corporations depending on these deals, OpenAI’s ability to make the math work could impact the wider American market.

The way this works is through a circular transaction model:

-

Company A buys ChatGPT services from OpenAI.

-

OpenAI records that as revenue.

-

Then OpenAI buys products or services from Company A, and Company A records that as its own revenue.

The money is balanced out through net-off accounting, which is more about financial recording than real cash flow. This double-counting inflates both company revenues and even contributes artificially to GDP.

During the Dot-Com bubble, these loops were built on debt and hype. This time, the macro environment looks stronger.

Most AI firms are sitting on solid cash reserves or steady cash flow. They aren’t borrowing to pay one another, which means less risk of chain defaults.

That said, OpenAI remains the big variable. It’s raising huge sums with relatively low revenue right now. But projections for $20 billion this year and $40 billion next year change the story.

For now, it looks less like a bubble and more like the early innings of an industrial revolution. The macro environment supports more expansion before any serious correction.

The bad scenario must be considered

The macro environment is shifting fast as countries treat AI like a new nuclear arms race. The U.S., China, and Europe are pouring billions into chip manufacturing, compute clusters, and research subsidies.

This money is largely printed or borrowed, increasing the money supply, which is another form of monetary debasement.

When governments expand their balance sheets to fund innovation, the purchasing power of existing currency weakens.

That’s why scarce digital assets like Bitcoin and Ethereum rose early in these cycles. The more capital floods into AI, the more fiat loses relative strength.

AI itself is also capital-intensive. Training large models costs hundreds of millions per run, and companies like NVIDIA and OpenAI are driving demand for energy, chips, and data infrastructure at unprecedented speed.

The result? Central banks and sovereign wealth funds must inject liquidity to keep pace.

💸 SoftBank’s All-In AI Strategy

SoftBank’s latest move says a lot about how big investors view this macro environment.

The company sold all of its $5.83 billion NVIDIA shares and part of its $9.17 billion T-Mobile stake to raise roughly $22.5 billion, and it poured all of it into OpenAI.

Twitter tweet

At first glance, it looks like SoftBank is exiting the chip trade. But in reality, it’s doubling down on the AI layer itself.

NVIDIA $NVDA ( ▲ 0.33% ) already captured the hardware value. Now, OpenAI is where the application and platform value sit.

SoftBank’s Vision Fund just posted a $19 billion profit, so it’s not acting out of desperation. It’s repositioning for the next phase of the macro environment, where AI defines productivity, data, and financial flows.

Twitter tweet

This also shows how major capital allocators are responding to monetary debasement. Instead of sitting on cash that’s losing value in real terms, they’re moving into assets and projects with exponential potential. SoftBank’s expected ownership in OpenAI will rise from 4% to 11%, a huge bet on long-term AI dominance.

It’s not a short-term trade; it’s a macro play. In an environment shaped by liquidity expansion and technological acceleration, holding equity in the AI ecosystem is one of the few ways to hedge against monetary debasement while still capturing growth.

🥛 ICO Season 2.0: The Return of Token Sales

The macro environment also supports something we haven’t seen in years: the comeback of initial coin offerings (ICOs).

Remember when Ethereum sold $ETH.X ( ▲ 3.04% ) at $0.31? That open-access model is coming back.

Coinbase just announced its Token Sale Platform, built for both retail and institutional users. It flips the script of the last cycle.

Twitter tweet

Instead of giving early investors the first cut, it prioritizes small allocations first. Large buyers get filled last. That’s a bottom-up approach in a market that’s been top-heavy for years.

There are also built-in incentives. Users who dump their tokens right after listing get smaller allocations in future sales. That discourages pump-and-dump behavior and rewards holders who actually believe in projects.

The platform plans one major launch per month, which could reset how retail users access early-stage crypto assets.

Twitter tweet

There’s already speculation that Coinbase might use this platform to launch a Base token, possibly a fair launch with no pre-mines or VC allocations.

If that happens, it’ll mark a real cultural shift.

The macro environment is pushing toward transparency and user inclusion, not insider access. ICO Season 2.0 could be the clean restart crypto needed.

⚡ Key Takeaway

-

AI isn’t in a full bubble yet: The macro environment shows controlled growth. Unlike the Dot-Com era, today’s AI leaders like NVIDIA and OpenAI have strong revenue foundations, not just hype.

-

Liquidity remains the key driver: Global central banks and governments are still injecting money to stay competitive in the AI race. This easy-money cycle keeps valuations high and markets active.

-

Monetary debasement is real: As states print or borrow to fund AI expansion, the value of fiat weakens. That shift naturally boosts scarce assets like Bitcoin and Ethereum, which act as inflation hedges.

-

SoftBank signals where smart money is going: Its $22.5B move from NVIDIA to OpenAI shows confidence that the next growth phase will come from the AI application layer, not just hardware.

-

AI expansion and crypto are linked: The same liquidity driving AI innovation fuels crypto appreciation. Both rely on the same macro forces – capital expansion and monetary debasement.

-

ICO Season 2.0 could redefine fairness: Coinbase’s new Token Sale Platform rewards holders and gives smaller investors priority, hinting at a new, more transparent crypto era.

-

We’re still early in the cycle: The macro environment favors growth, not collapse. The real risk lies ahead, but for now, liquidity and innovation remain dominant.

If you’re interested in other topics and want to stay ahead of how Crypto are reshaping the markets, from whale strategies to the next major altcoin narrative, you can explore more of our deep-dive articles here:

-

Latest Crypto News: Bitcoin Reawakens, TAO Halving Hype Builds

-

AI in Trading: How ChatGPT Atlas Could Redefine Trading Strategy*

*indicates premium insights available to Pro readers only.

Leave a Reply