Longest U.S shutdown = Bear Trap?.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

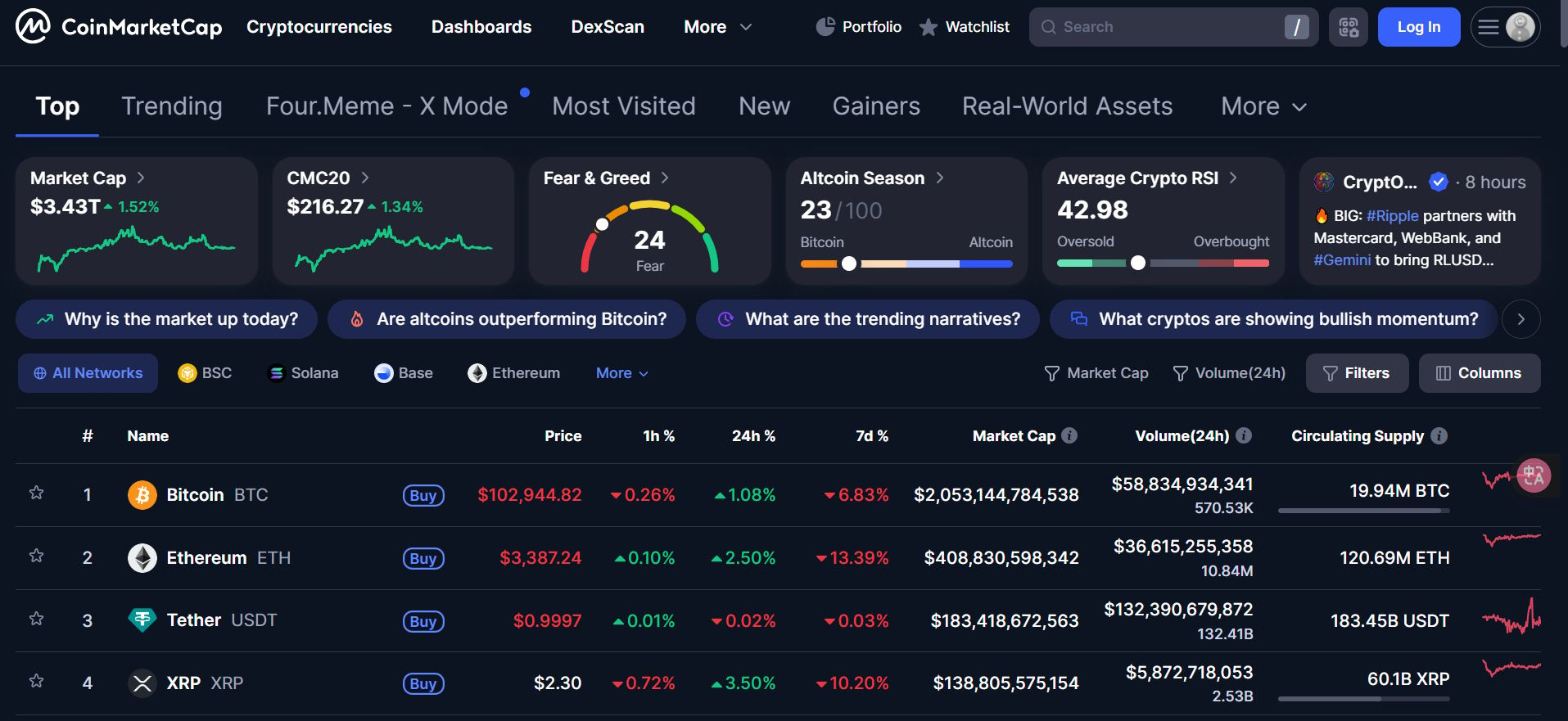

Things are looking a bit better today, fam. But the market still feels shaky. Charts are showing signs of recovery, but confidence? Not quite there yet. Fear & Greed Index still sits at 24!

$BTC.X ( ▼ 1.64% ) ’s getting back up (maybe warming up for the next bull run), $ETH.X ( ▼ 2.49% ) ’s slowly crawling back, but $SOL.X ( ▼ 3.27% ) … man, that one’s still dragging its feet. Every pump feels like a setup, and the whales? Yeah, they’re having their fun again.

Feels like we’re stuck in that strange zone between hope and hesitation. Everyone wants to believe the bottom’s in, but no one’s brave enough to call it…

Here’s what we got for you today:

-

👀 New crypto narratives driving the next big moves

-

⭐ Longest U.S. shutdown yet – Bear run next?

-

⭐ Red day, fear high. Lessons from yesterday

-

🔥 Burning hot takes for the road

The market’s showing some early signs of rotation again. Whales are quietly loading, not just the shiny new narratives but even the old coins that everyone forgot about. That’s usually how it starts before the next parabolic leg.

If you want to see how the big players are positioning, check out our blog below. These narratives are the sectors that might lead the next run and how to spot the shift before the crowd does!

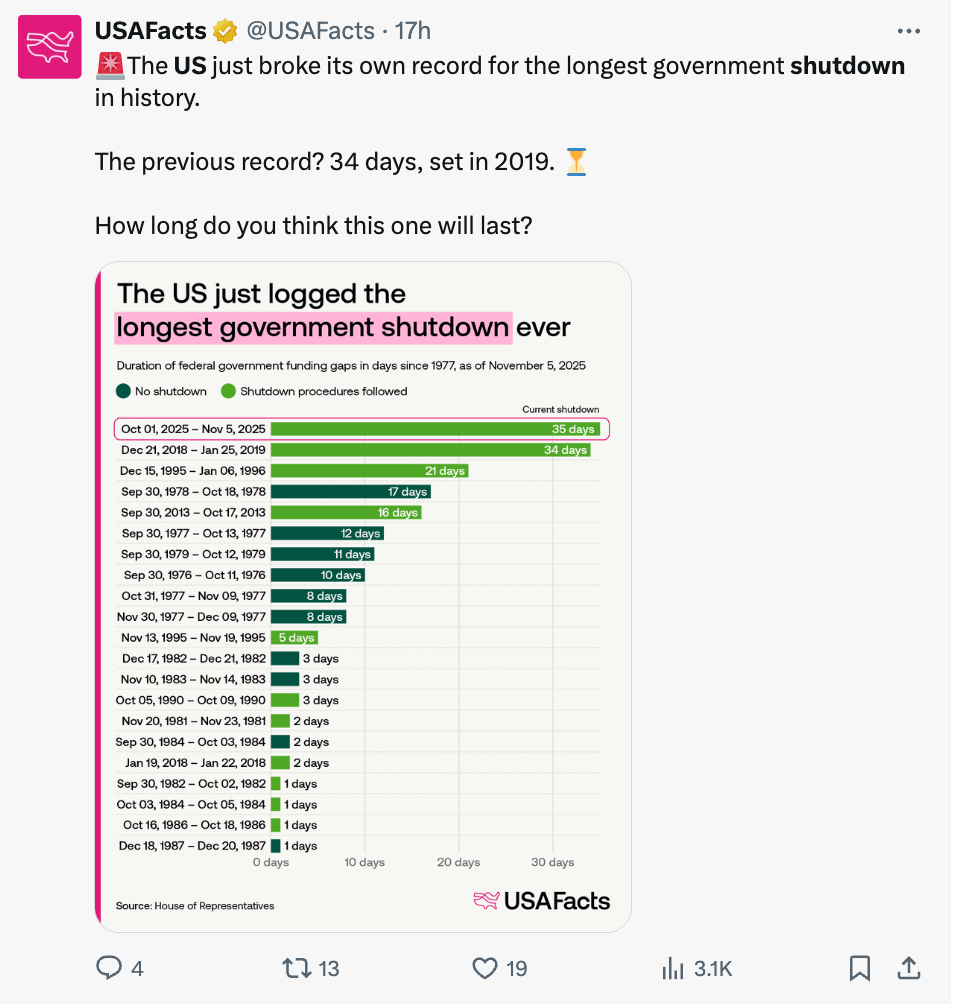

😯 LONGEST U.S. SHUTDOWN EVER… BEAR RUN INCOMING?

Man, the clock keeps ticking, and Washington just set a new all-time record.

The U.S. government shutdown has now stretched to day 37, officially beating the 2019 record of 34 days.

Why? The same old story:

A budget deadlock between Republicans and Democrats that’s turned into a political staring contest. Except this time, the stakes are way higher.

Here’s what’s happening:

Hundreds of thousands of government employees are still unpaid.

Federal welfare programs are running on fumes.

And the Fed? Flying blind. With key economic data, like inflation, jobs, and PPI numbers on hold, every policy move now feels like guesswork.

Treasury Secretary Scott Bessent says the White House is “ready for every scenario,” even if Trump’s tariff policy gets challenged in the Supreme Court. He’s confident they’ll win, but if not, they’ll fall back on legal tools like Section 232 or 301.

The irony? The U.S. – China relationship is actually improving after the Trump – Xi meeting in South Korea, with plans for two state visits in 2026. But back home, the government’s still closed for business.

For crypto, the timing couldn’t be worse.

The Market Structure Bill, the one meant to finally define clear rules for exchanges and tokens, was supposed to pass before the end of this year. Now? It’s frozen.

If this shutdown lasts much longer, insiders say we might not see movement until 2026.

And that means one thing: the U.S. crypto market stays in limbo while the rest of the world moves ahead.

This feels like one of those “calm before the storm” moments. Everyone’s waiting, the Fed, Wall Street, and even crypto, for Washington to hit play again.

Analysts say it could finally end this week. And if history’s any guide… that might be bullish.

When that money flows back in, inflation risk rises too, and that could force the Fed into another balancing act later this year.

Question is: how long can the system hold its breath before something breaks?

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

-

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

-

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

-

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

📉 MARKET RED, FEAR HIGH. WHAT WE LEARN FROM THIS DROP

Yesterday felt heavy. Stocks were red. Crypto was red. Even gold slipped.

$BTC.X ( ▼ 1.64% ) broke below $100K for the first time in weeks, a number that sent chills across the market, before clawing its way back to around $102K.

Altcoins? Let’s just say it wasn’t pretty.

Total crypto market cap dropped to $3.48 trillion, and spot Bitcoin ETFs recorded over $560M in outflows. Fear is back on the charts, and it’s loud.

Here’s what went down during the time:

-

More than $2 billion in long positions got liquidated within 24 hours. The “buy-the-dip” crowd got caught mid-air.

-

Stream Finance collapsed after a $93M loss, freezing $160M in deposits. Its stablecoin crashed to $0.28, triggering another wave of panic across yield farmers.

-

Wall Street joins the drop: Nasdaq plunged 2%, with Palantir down 8%, Nvidia 4%, and Meta 1.6%. AI stocks took a hit, not from bad results, but from fear itself.

-

And yes, the U.S. government is still shut down. Day 37 and counting. The longest in history. No policy moves, no data updates, no clarity.

So… what’s the lesson here?

When markets crash, it’s not just prices that fall, discipline does too. Everyone wants to time the bottom, but the truth is: no one can. You don’t win this game by predicting; you win by preparing.

You can’t control the market, only your reactions to it. The pros aren’t panicking because they already have a plan. They know volatility isn’t a punishment; it’s a test of conviction.

Instead, step back, breathe, and ask your self:

-

What if the next bull run takes longer than everyone expects?

-

What if the 4-year cycle breaks, and the market rewrites its own rules?

-

What if your favorite coin never reaches your dream price — at least, not this year?

So, when fear makes you doubt, or FOMO makes you chase, come back to your compass. Remember why you started. The market doesn’t owe you a win. But it always rewards those who respect it.

This might not be the time to go “all in.” It’s the time to stay calm, zoom out, and keep in mind: fear fades, but good habits compound.

Want to take advantage of the current bull run?

If you want to take advantage of the current bull market but are hesitant about investing, online stock brokers could help take the intimidation out of the process. These platforms offer a simpler, user-friendly way to buy and sell stocks, options and ETFs from the comfort of your home. Check out Money’s list of the Best Online Stock Brokers and start putting your money to work!

🔥 BURNING HOT TAKES FOR THE ROAD

Trump vows to make the U.S. a “Bitcoin superpower.” Policy = faster ETFs, $BTC.X ( ▼ 1.64% ) first. Read more

Franklin Templeton launched a tokenized money fund in Hong Kong. Asia’s RWA lane is opening. Read more

Ripple expands enterprise wallet/custody. Banks may test XRP rails. Read more

Robinhood ($HOOD.X ( 0.0% ) ) beat with crypto revenue surging. Retail’s nibbling back. Read more

CZ’s buy amount and amount from Aster official post are the same. Coincidence? Read more

🤡 SPICY MEME

Every time my friends, every time…

💌 SHOUTOUT FROM OUR FIRESTARTER

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply