Redtober Rekt BTC’s 6-Year Reign, Moonvember?.

63+ Cheat Sheets | Advertise | SuperAI x Crypto | Free One-Shot Guides

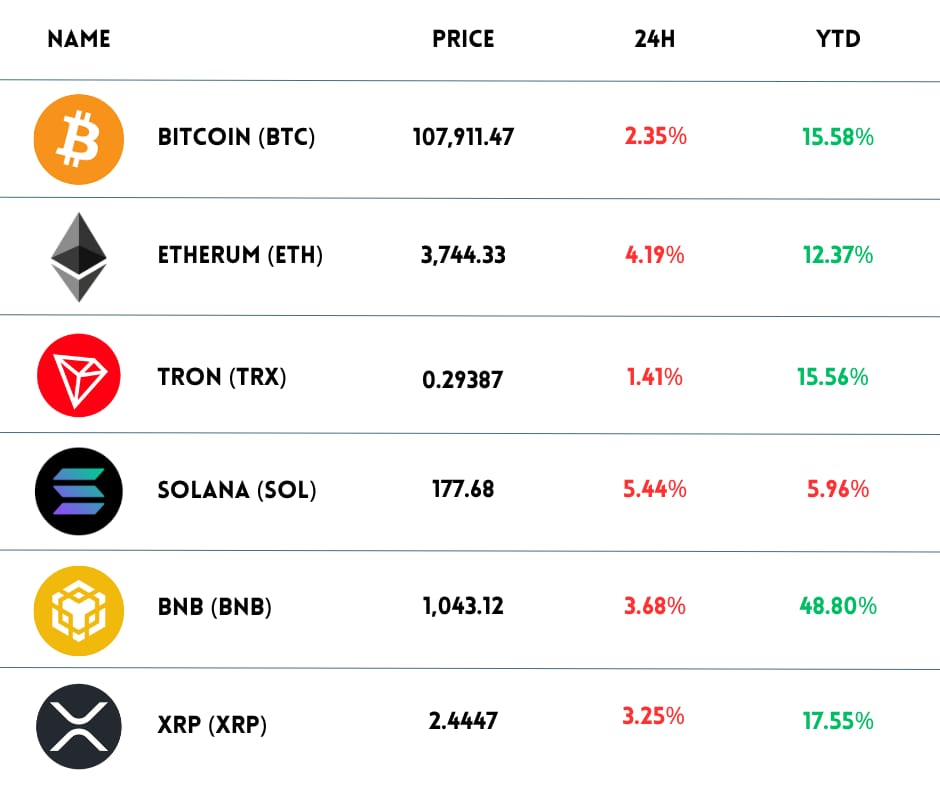

We started Oct 2025 with hope, but “Uptober” crashed, $BTC.X ( ▼ 2.76% ) in limbo 😵

Even with good news like the Fed cutting interest rates as expected and a positive U.S.–China trade outlook, BTC & $ETH.X ( ▼ 5.37% ) kept sliding toward the end of the month.

That crash ended Bitcoin’s 6-year streak of gains in October. The last time BTC dropped in October was 2018. Will “Moonvember” come back this year? Hopefully.

Here’s what we got for you today:

-

👀 AI bubbles, and early-cycle momentum

-

⭐ “Fed cuts rates → Bitcoin moon”, hold on…

-

⭐ After Binance US, Coinbase’s in the hot seat

-

🔥 Burning hot takes for the road

ETH might shock everyone again. While traders chase $BTC and $SOL.X ( ▼ 9.97% ) , something bigger is forming quietly.

Whales are loading up. Charts look exactly like the last pre-ATH base. If history rhymes, $ETH’s next move could flip the whole market upside down.

But altcoins aren’t following this time. You won’t find it here. As always, we’re keeping this one Telegram-only, no leaks. Only takes one scroll to see the setup. Don’t miss it.

⚠️ The real insight is what needs to happen next and who might trigger it.

✋ DON’T BUY UNTIL THE MONEY PRINTER WHIRS

Everyone’s saying rate cuts = new uptrend… but hold on a sec. A lot of people are super hyped thinking “Fed cuts rates → Bitcoin moon.”

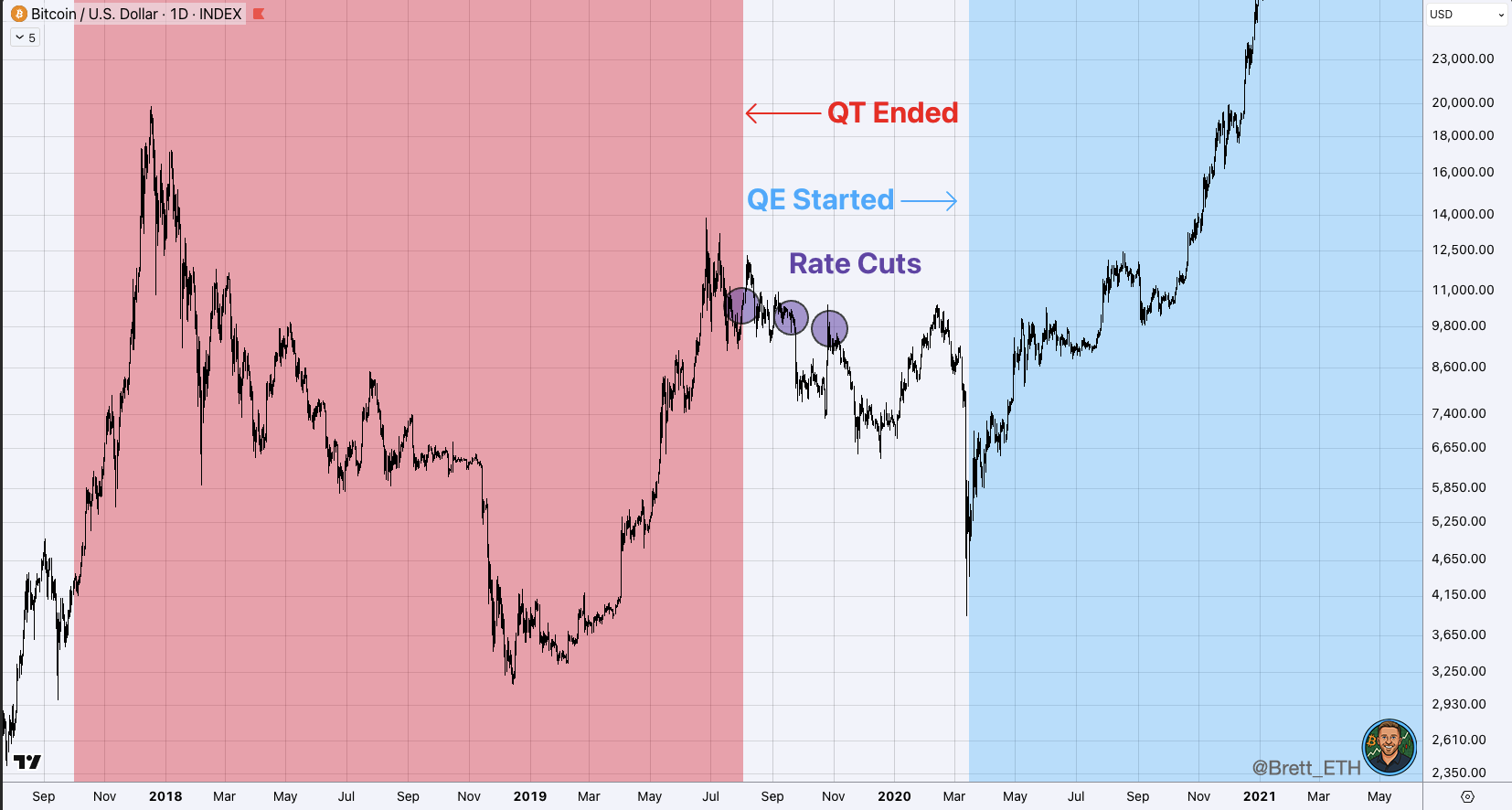

But if we rewind to 2018–2020, it didn’t really play out that way. 3 clear phases:

Bitcoin vs. QT Ending + Rate cuts

1/ QT (tightening) phase: 2018 to mid-2019 → Fed sucked liquidity out of the system (QT = Quantitative Tightening) → Bitcoin nuked from ~$20K to $3K. No money = no pump.

2/ QT ends, rate cuts begin: mid 2019 → Fed paused QT and started cutting rates. Market got excited… but BTC still dropped another 35%, ETH down 45%.

→ Why? Because “stop tightening” ≠ “start printing.” No new money yet.

3/ QE begins: early 2020 → Fed flips the switch. Starts buying bonds (QE = money printer go brrr). Liquidity returns → BTC rips.

→ Even after the COVID crash, market recovered fast. That’s when the 2020–2021 bull run really started.

So yeah, cutting rates sounds bullish. But history says real upside only kicks in once QE starts. Now here’s the fun part:

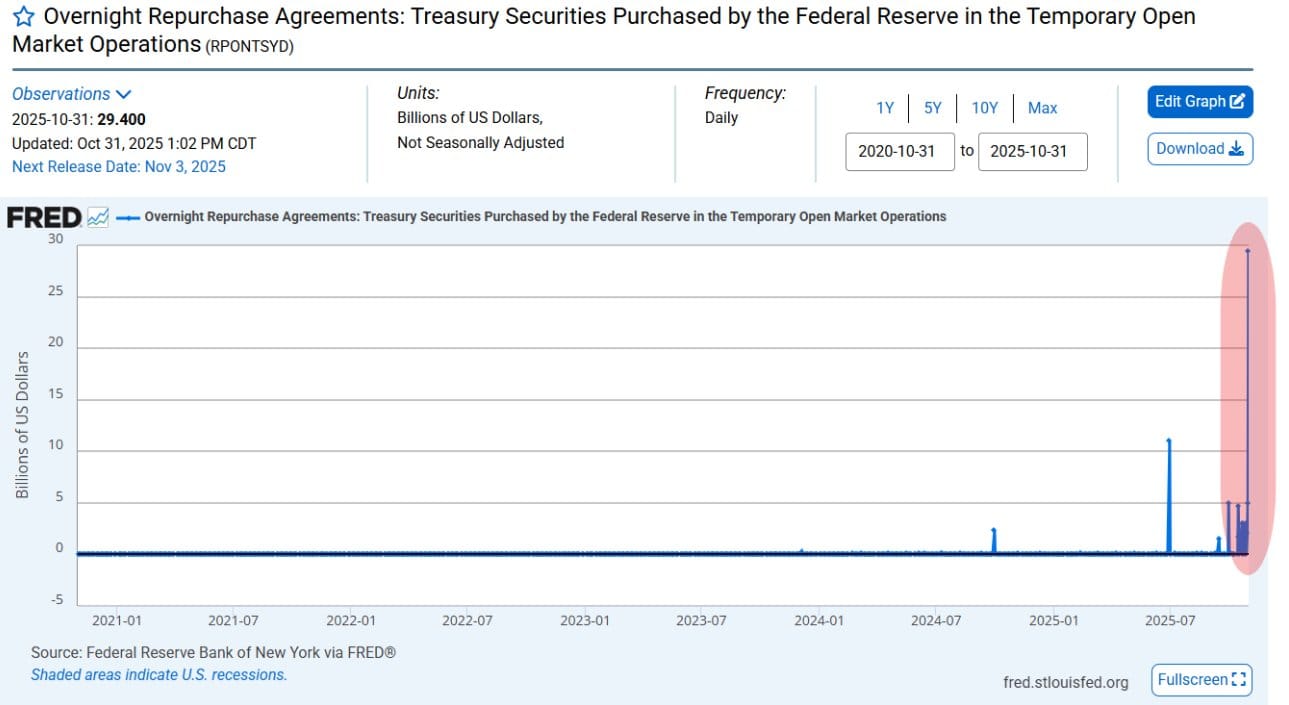

Last Friday, the Fed lent $50B to banks through a repo program (SRF). That’s the highest ever since it launched in 2021.

TL;DR:

-

Banks are short on cash

-

End of the month = more bills to pay

-

U.S. gov shutdown = Treasury hoards cash → less money in circulation

-

Fed’s other tool (RRP) also sucked out $30–50B this week

Basically, banks are scrambling for short-term liquidity. But no, this isn’t some financial meltdown. Just a temporary cash crunch.

Experts think October was peak tightness, and from November onward, things should loosen up again.

Fed even hinted they’ll stop draining money soon. Once the U.S. starts spending again, liquidity will flow back in.

Honestly, this feels like late 2019 – early 2020 vibes. The Fed’s not calling it “QE” yet but it kinda smells like it.

You know how they always say “not printing money”… then they print anyway?

If liquidity really does come back in the next few weeks, we could see BTC front-run that. If the Fed starts printing again (even with a new name), we all know what usually happens next.

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

😮 COINBASE CAUGHT IN TRUMP FAVOR STORM?

Just a day after Binance US was accused of being “favored” by Trump for listing the $USD1.X ( 0.0% ) stablecoin, Coinbase is now in the hot seat.

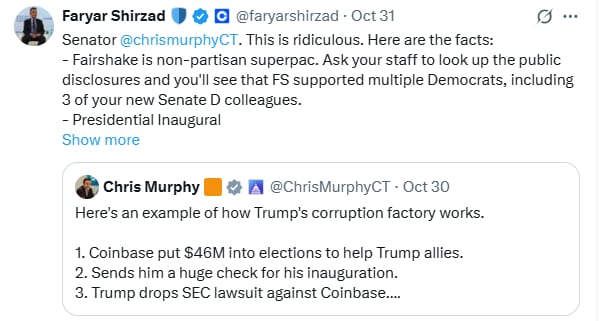

Democratic Senator Chris Murphy says Coinbase also benefited from shady political connections:

-

He claims Coinbase funneled $46M into Trump’s election campaign

-

They also supposedly donated to Trump’s inauguration

-

And… helped fund a $300M White House ballroom project

-

Right after that? The SEC lawsuit against Coinbase magically vanished

Murphy called this all part of “Trump’s corruption factory.”

There’s now a group of Democratic senators demanding that the White House disclose full financial details around the ballroom funding.

So yeah… people are starting to ask: Is crypto becoming Washington’s new political playground?

Faryar Shirzad, Coinbase’s Chief Policy Officer, called the accusations “ridiculous.”

Here’s what he said:

-

The Fairshake PAC, the largest political fund in crypto, is non-partisan. It’s supported Democrats too, including 3 of Murphy’s Senate colleagues

-

Donations to presidential inaugurations? Totally normal

-

The ballroom contribution came via a non-profit (Trust for the National Mall), alongside many other companies. It wasn’t political

-

And about the SEC case, he said the previous SEC leadership abused its power, and dropping the lawsuit was a legally sound move, not a favor

He also pointed to the GENIUS Act, saying nearly 100 new stablecoin initiatives have launched since, proving how fast crypto is growing in the U.S.

And no, stablecoins aren’t killing banks. Most demand is coming from outside the U.S., and it’s actually boosting USD liquidity globally.

Meanwhile, CZ is rumored to be prepping a defamation lawsuit against Senator Elizabeth Warren unless she takes back her public claims.

Do I think crypto is becoming a political pawn in D.C.?

Yeah, kind of. When you’ve got major exchanges getting dragged into campaign financing and pardon rumors… it’s not just about tech anymore.

9 Amazon Prime Perks You Need to Be Using

Free music/podcasts, access to lightning deals, and try before you buy are just a few of the many perks that Prime has to offer. Make sure you’re not missing out, and get the most out of Amazon Prime.

🔥 BURNING HOT TAKES FOR THE ROAD

CZ rescues Aster again, token up 20%+. He just bought $1.9M worth of $ASTER.X ( ▼ 18.36% ) & even said “he’ll never sell”. Read the post

Trump just defends pardon decision & says “I don’t know who CZ is”. The “pardon-for-favors” narrative is false. Read more

Western Union quietly rebrands its stablecoin to WUUSD just 24 hours after the launch? Read more

3 important token unlocks to watch in the first week of November 2025. Read more

ether(.)fi DAO plans to spend up to $50M to buy back $ETHFI.X ( ▼ 6.36% ) whenever the price drops below $3. Read more

🤡 SPICY MEMES

Transparency in action

But Bitcoin doesn’t love me

💌 SHOUTOUT FROM OUR FIRESTARTER

Thanks sweetie ❤

We read your emails, comments, and poll replies daily

Hit reply and say Hello, we’d love to hear from you!

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here. Cheers!

⚠ This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply