Hidden Formula to Pump a “Dead” Coin.

A coin dumped 80% after launch… then silently 10x’d in two weeks. I bet you know that coin. It was a “dead” project, until it got plugged into Coinbase’s secret weapon, quietly stopped airdrops, and then allegedly started buying back its own tokens.

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

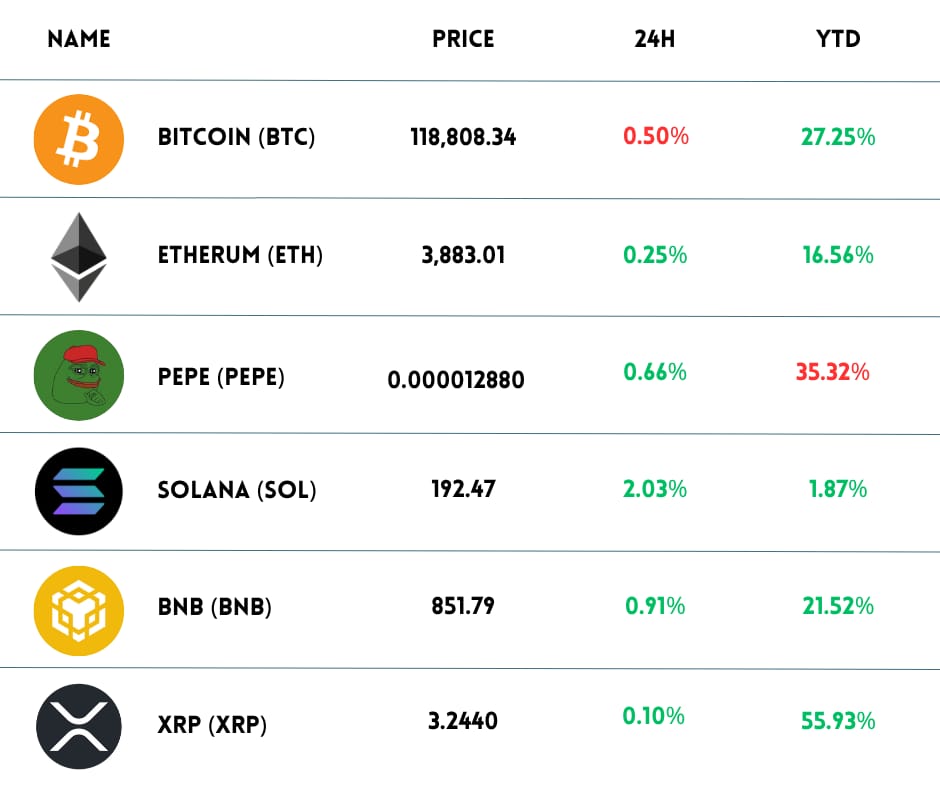

😂 Galaxy Digital reportedly sold off over 80,000 $BTC.X ( ▲ 0.37% ) , around $9 billion, in a single night. This was probably one of the biggest profit-taking events in Bitcoin history. And yet… $BTC only moved about 2–3%. Bitcoin’s grown up. Even billion-dollar exits don’t shake it like they used to. Happy though…

JUST IN: Galaxy Digital completes sale of over 80,000 $BTC worth more than $9 billion for Satoshi era investor.

— Whale Insider (@WhaleInsider)

9:05 PM • Jul 25, 2025

👀 Polychain just sold $62.5M worth of $TIA.X ( ▲ 3.09% ) back to the Celestia Foundation, fully exiting with a 12x return before the upcoming Lotus upgrade. This follows heavy backlash after Polychain dumped $242M TIA, mostly from staking rewards. TIA now trades at $2.06, down 90% from peak. No comments yet from either side.

The Celestia Foundation has worked with Polychain Capital to assign Polychain’s entire remaining TIA holdings to new investors.

This month, the Foundation purchased 43,451,616.09 TIA from Polychain Capital for $62.5m. Polychain will shortly be undelegating their entire staked

— Celestia 🦣 (@celestia)

3:31 PM • Jul 24, 2025

😳 Companies are hoarding $ETH.X ( ▲ 1.44% ) at a crazy pace. Just last week, they held 728.5K ETH (~$2.63B). Now? It’s already at 1.3M ETH (~$4.9B), a 78% surge in 7 days. Bit Digital also announced a capital raise to buy more ETH, estimated to exceed $2B. And this week, The Ether Machine and BTC Digital joined in, adding a combined 172.1K ETH.

Total $ETH bought by ETFs this month: 1,368,980

Total ETH minted this month: 72,513

ETFs have bought 18 months of ETH supply in just 3 weeks, and you’re bearish.

The game has changed for #ETH now, and it’s going to $10K this cycle.

— Elja 🌋 🦍🔸 (@Eljaboom)

7:12 AM • Jul 26, 2025

🦅 NFT projects with a “US vibe” are getting special treatment. If you pay attention, projects that pumped hard recently have one thing in common: $ZORA.X ( ▲ 12.07% ) and $REKT.X ( ▼ 13.31% ) are based in the US, $PENGU.X ( ▼ 1.26% ) has a mostly US community. People keep saying NFT season is dead, but maybe it’s just cold outside America!

$ZORA received $58M investment from COINBASE.

Today $ZORA = $STRK 2 months ago.

✦Cost – $10

✦Potential – $18000+Maximize your chances of receiving the $ZORA airdrop with this ourZORA Airdrop Strategy 👇🧵

— Discover (@0x_Discover)

2:30 PM • Feb 20, 2024

📊 $BNB.X ( ▲ 6.62% ) smashed its ATH at $855, CZ might be richer than Bill Gates now? In the past 24h: $249.5M liquidated across crypto; 94,118 traders wiped out, $3.92M in short BNB positions. BNB Chain activity is booming. Binance still leads globally, despite legal storms. Public companies (Nano Labs, 10X Capital,…) are now stockpiling BNB.

$𝘉𝘕𝘉 𝘪𝘴 𝘲𝘶𝘪𝘦𝘵𝘭𝘺 𝘳𝘦𝘸𝘳𝘪𝘵𝘪𝘯𝘨 𝘵𝘩𝘦 𝘳𝘶𝘭𝘦𝘴 𝘰𝘧 𝘢𝘭𝘵𝘤𝘰𝘪𝘯 𝘳𝘢𝘭𝘭𝘪𝘦𝘴. 𝘕𝘰 𝘩𝘺𝘱𝘦, 𝘯𝘰 𝘯𝘰𝘪𝘴𝘦—𝘫𝘶𝘴𝘵 𝘱𝘶𝘳𝘦 𝘮𝘰𝘮𝘦𝘯𝘵𝘶𝘮.

$BNB cruising to new ATHs.

While others wait for headlines, BNB is already moving. It just reached $850, and

— Maya 💙💛 (@Mayacrypt)

7:10 AM • Jul 28, 2025

⚖️ Dragonfly vs. DOJ: Top Crypto VC Faces Criminal Charges Because of Tornado Cash

The long-awaited trial of Roman Storm, co-founder of Tornado Cash, is underway, and prosecutors are digging deep. So far, they’ve:

-

Tried to link Tornado Cash to specific victims

-

Connected Storm to overseas transactions

-

And now… brought Dragonfly Capital into the picture

Some online commentators speculate Dragonfly may have advised against KYC, but that’s still unconfirmed and disputed.

The US DOJ revealed it’s considering prosecution against Dragonfly Capital partners over their 2020 investment in Tornado Cash – the controversial privacy tool now at the center of a case that could reshape Web3 investment rules in the US.

😔💔 I’m Roman Storm. I poured my soul into Tornado Cash—software that’s non-custodial, trustless, permissionless, immutable, unstoppable. In 31 days, I face trial. The DOJ wants to bury DeFi, saying I should’ve controlled it, added KYC, never built it. SDNY is trying to crush

— Roman Storm 🇺🇸 🌪️ (@rstormsf)

12:29 PM • Jun 13, 2025

😬 Dragonfly Capital may face criminal charges for investing in Tornado Cash

The bombshell came during the trial of Roman Storm, Tornado Cash co-founder, who’s charged with:

-

Conspiracy to launder money

-

Running an unlicensed money transmission service

-

Violating international sanctions. He faces up to 45 years in prison.

Prosecutors showed internal messages and emails between Storm and Dragonfly partners Tom Schmidt and Haseeb Qureshi, aiming to:

🚨NEW from the @rstormsf trial: The DOJ is apparently still considering charges against an unspecified number of people at crypto VC firm @dragonfly_xyz, not just General Partner @tomhschmidt, according to AUSA Rehn.

After saying this in court, Rehn asked for the transcript of

— Eleanor Terrett (@EleanorTerrett)

2:59 PM • Jul 25, 2025

-

Establish New York jurisdiction (Schmidt lives in Manhattan)

-

Show Dragonfly profited directly from Tornado Cash

-

Prove developers had technical control (e.g., changing the frontend) → undermining “fully decentralized” claims

⚠️ Key detail: Emails from 2020 show Dragonfly discussed compliance concerns early on, including potential KYC implementation – meaning they were aware of the legal risks from the start.

Storm’s defense team tried to call Schmidt as a witness to clarify their conversations and investment goals.

But the DOJ denied immunity, meaning Schmidt’s testimony could be used against him. He responded by invoking his Fifth Amendment right to remain silent.

The most important trial in crypto’s history is finally here, as Tornado Cash founder Roman Storm faces down decades in prison time for very serious charges in America 🇺🇸

So why is @VitalikButerin, @ethereum and seemingly every name in $ETH on his side? ⬇️

— Coinage (@coinage_media)

1:45 PM • Jul 27, 2025

When asked directly by Judge Failla:

“Are you considering prosecuting all of Dragonfly?”

DOJ’s Nathan Rehn replied:

“Not all. But Schmidt — and one other.”

Immediately after, the DOJ moved to seal the exchange, signaling just how sensitive and far-reaching this case might be.

⚖️ Then, Dragonfly fires back at DOJ: “We stand by our investment”

In a public statement on X, Haseeb Qureshi of Dragonfly strongly defended their position amid DOJ scrutiny:

Dragonfly invested into PepperSec, Inc., the developers of Tornado Cash, in August of 2020. We made this investment because we believe in the importance of open-source privacy-preserving technology. Prior to our investment, we obtained an outside legal opinion that confirmed that

— Haseeb >|< (@hosseeb)

4:37 PM • Jul 25, 2025

Qureshi stressed: Dragonfly never operated or controlled Tornado Cash. They’ve had no contact with malicious users. They’ve always encouraged legal compliance in their portfolio

Roman Storm’s defense team called Tom Schmidt, general partner at Dragonfly, to testify in court. But Schmidt’s lawyer invoked the Fifth Amendment, arguing that testifying could incriminate him personally, so he declined to appear.

It’s unclear whether the court will accept this claim. But here’s the twist: Schmidt was called as a defense witness, so technically he could have refused without needing constitutional protection, unless the DOJ is seriously considering charging him.

👉 If prosecutors choose not to indict Dragonfly, it could actually undermine Schmidt’s plea for immunity.

And most importantly: Tornado Cash has a legal right to exist. He also revealed Dragonfly has been cooperating with the DOJ since 2023 and had external legal counsel confirm the investment was compliant with laws at the time it was made.

Qureshi warned: Prosecuting a VC just for investing in a decentralized project would be unprecedented — and could threaten the entire US investment landscape in privacy tech and blockchain.

Legal experts like Jake Chervinsky and Matt Huang echoed the concern, saying such a move would create a “chilling effect” on the whole sector → especially DeFi, privacy, and decentralized protocols.

DOJ’s theory of liability in the Storm case is basically “did you glance in the direction of a blockchain? crime!”

This trial is nothing but a relic of the Biden admin’s war on crypto. Somehow the prosecutors missed the memo that the war is over and the anti-crypto army lost.

— Jake Chervinsky (@jchervinsky)

4:39 PM • Jul 26, 2025

Roman Storm should be freed. It is not a crime to write code.

It is equally absurd for SDNY to suggest charges against VCs that backed Roman.

— Matt Huang (@matthuang)

6:54 PM • Jul 25, 2025

For now, Dragonfly’s legal exposure remains uncertain. The trial with closing arguments expected this week. This could be a defining moment for how the US treats Web3 innovation.

✨ The Hidden Formula to Pump a “Dead” Coin Again!?

Shu Zu claims he’s figured out the core conditions that allow a token – even one seen as “done for” – to bounce back and pump again. Is this really possible? Let’s break it down:

-

What exactly did Shu Zu identify as the trigger for price revival?

-

Let’s look at the $ZORA.X ( ▲ 12.07% ) case study

-

ZORA used 2 key strategies to rewrite its investment story

1️⃣ What conditions did Shu Zu find that make a coin pump again?

Recently, Zhu Su – co-founder of 3AC (yes, the one that collapsed after Terra LUNA – you can read the details here) – shared some surprisingly solid insights on how a project that looked dead can bounce back:

The remaining bull case for pump here is this is nearly 50% down from the ICO price. Those sale proceeds can be used modestly to rebuy, as they have effectively scalped the ico buyers. A rapid move back higher would change the narrative, and his confirmation of no airdrop would

— Zhu Su (@zhusu)

5:29 AM • Jul 25, 2025

🔻 1. Project still holds a chunk of raised capital (from ICO/Private Sale).

That leftover treasury can be used to buy back tokens on the open market, creating real demand and price movement — especially effective in bear markets or low liquidity phases.

🔻 2. Stopping airdrops avoids sudden supply shocks.

This gives confidence to investors that their holdings won’t be diluted by free token emissions.

🔻 3. When a project actively buys tokens, builds demand, and maintains a strong narrative, it can reignite interest from both old and new investors — leading to a powerful price recovery.

For me, these aren’t just theories. Some projects have already proven this works. Take a look at what happened with $ZORA.X ( ▲ 12.07% ) in the next section.

2️⃣ Case Study: Why did $ZORA bounce back so hard?

Let’s break down what happened with $ZORA.X ( ▲ 12.07% ) – one of the most dramatic comebacks in recent months.

ZORA launched on April 23, 2025 at $0.04, with 10% of its 10B token supply airdropped to early users and listings on major exchanges. But the hype didn’t last long, as user activity dropped, so did the price.

Shortly after, the price crashed over 50%, dropping to just $0.0085 – way below its ICO price of $0.0193.

$ZORA is live.

CA: 0x1111111111166b7fe7bd91427724b487980afc69

— $zora (@zora)

3:11 PM • Apr 23, 2025

That changed in mid-July. On July 17, Coinbase launched Base App, a rebranded version of its wallet – built on Farcaster and Zora infrastructure. This app lets users tokenize and trade content, and ZORA token plays a key role in:

-

Minting content coins

-

Paying referral fees

-

Unlocking ecosystem rewards

This integration triggered ZORA’s comeback and more catalysts followed. On July 25, Binance Futures listed ZORAUSDT Perpetuals with 50x leverage. That combo of more utility + better access helped push ZORA up 360% in just 7 days.

That means:

-

3.12x up from ICO price

-

7x from pre-pump lows

$ZORA’s market cap jumped from $35M to nearly $300M, creating big wins for investors. According to Onchain Lens:

As $ZORA touched a market cap of over $300M, a whale holding a 3x long position on $ZORA is having a floating profit of over $2.2M.

hypurrscan.io/address/0x2982…

— Onchain Lens (@OnchainLens)

3:02 AM • Jul 28, 2025

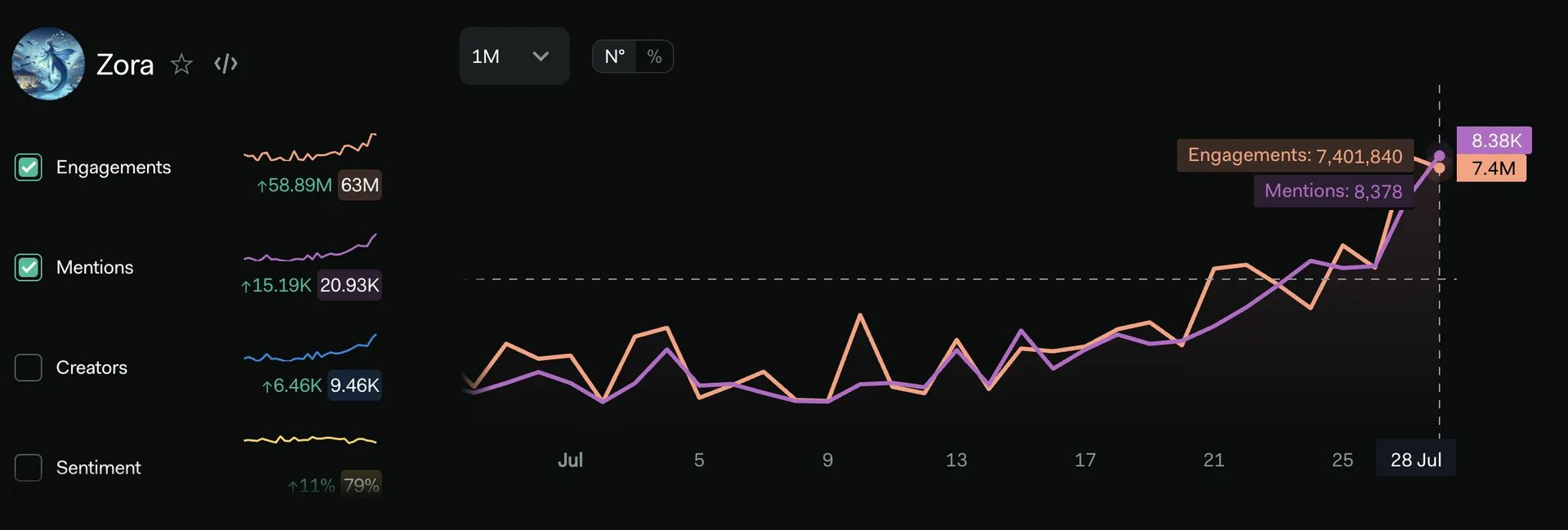

And it wasn’t just price that pumped. Social metrics exploded too:

-

Mentions surged from 2,893 → 8,378 → +189.6%

-

Engagement grew from 4.2M → 7.4M → +76.2%

On July 27, over 54,000 coins were minted, a new daily high. 22,567 unique creators also hit an all-time record.

What caused this insane rebound? Combining Zhu Su’s thesis and on-chain data reveals three big signals:

1. Whale accumulation: According to @nansen_ai, whale wallets bought 7.9% of total supply after ZORA dropped 50%. Also, exchange-held ZORA dropped from 6.05B to 4.61B tokens between May–July (–23%). That’s a classic accumulation pattern.

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply