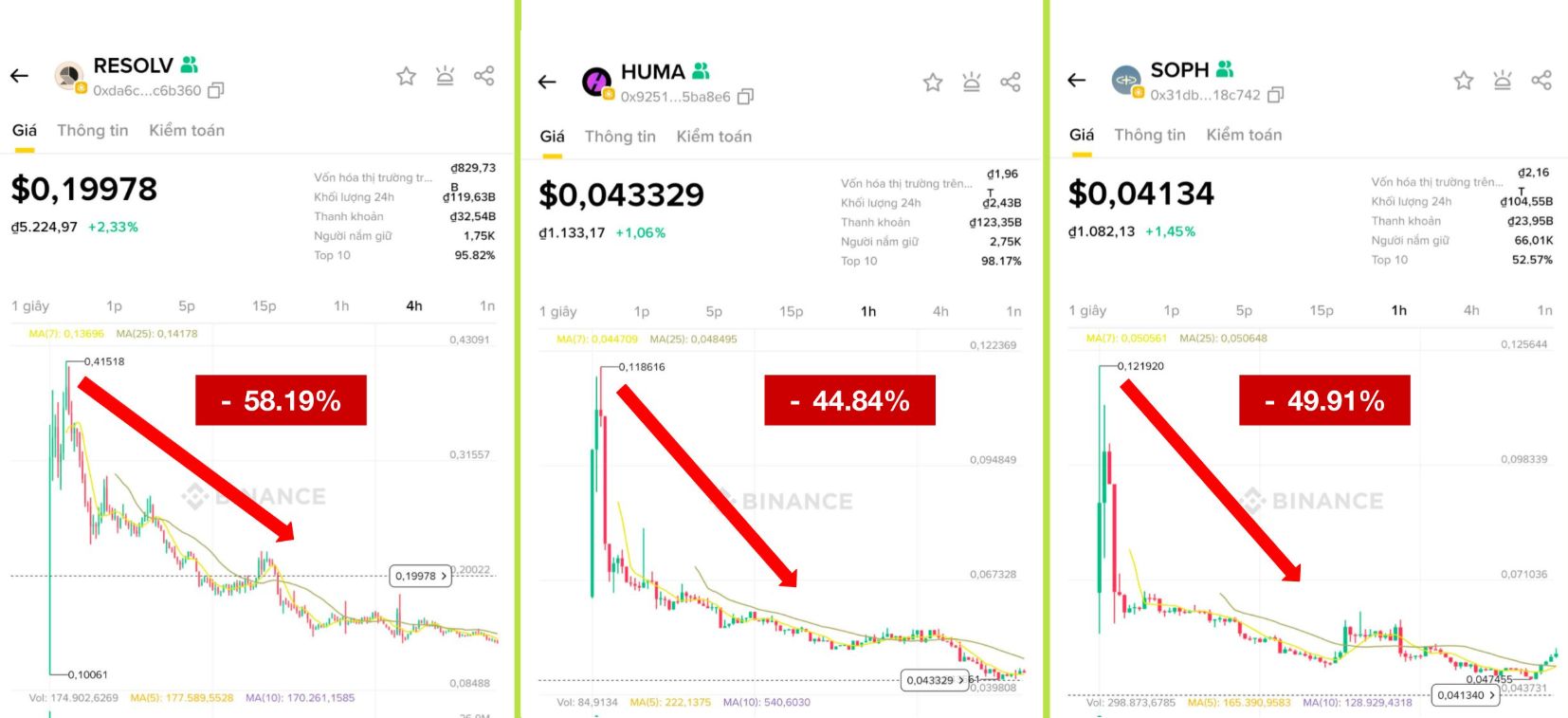

Do Binance Listings Still Offer Real ROI?.

You’d think a Binance listing is a ticket to the moon. But the truth is… most people lose money in the first 24 hours. Why do insiders win and how can you play smarter? Is there still any chance to invest here?

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

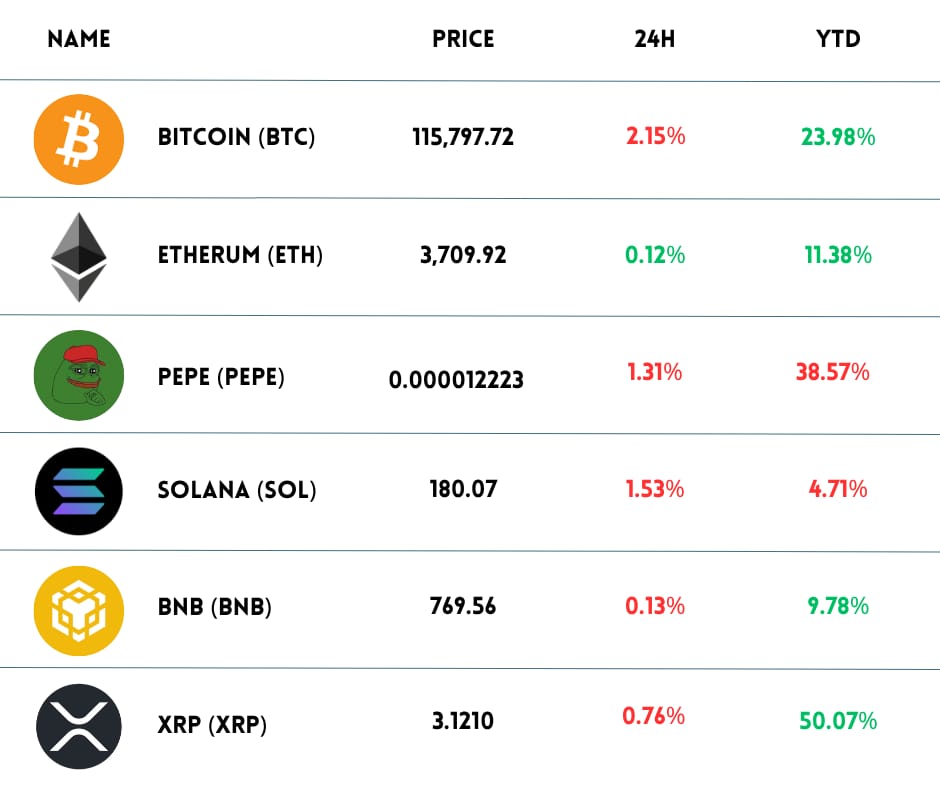

🔴 Is the U.S. planning to strike Iran’s nuclear sites? Trump just shared a CBS News poll on Truth Social: 85% of Republican voters support U.S. strikes on Iran’s nuclear facilities. That number jumps to 94% among MAGA Republicans. Every time the market hits a sensitive zone… Here come the war headlines again.

💸 FTX set the date for the third payout, another $1.9B on the way! Despite the chaos, experts say FTX’s payout process is faster and more transparent than expected. Remember: after funds are sent to BitGo, Kraken, or Payoneer, FTX won’t help if you lose access due to account issues. The responsibility’s on you now.

FTX today announced that the anticipated record date for the Next Distribution is August 15, 2025. Read more details here: prnewswire.com/news-releases/…

— FTX (@FTX_Official)

9:01 PM • Jul 23, 2025

💥 Tether is coming back to the U.S., following the approval of the GENIUS Stablecoin Act. But it will face heavy resistance from other giants like Circle ($USDC.X ( ▼ 0.01% ) ), even Amazon and Walmart have revealed plans to launch their own stablecoins. One more thing: Tether has no plans for an IPO.

Fresh off Circle’s surge on IPO and President Trump signing the first federal bill to regulate stablecoins, we asked @Tether_to CEO @paoloardoino if he wants to bring Tether public bloom.bg/4m2p8Ui

— Bloomberg TV (@BloombergTV)

6:28 PM • Jul 23, 2025

⛔️ Two wallets that joined the $PUMP.X ( ▼ 14.44% ) ICO just dumped their tokens. Each wallet received $4.19M $PUMP & just sold on Jupiter. Each took a loss of around $2.2M. The trigger? There will be no airdrop in the near future despite earlier promises!? ICO participants are now sitting on an ~22% loss…

Under 1b mc. No airdrop no community. Pump fun dead. Exit now.

— Cryptox (@cryptox403)

4:50 PM • Jul 24, 2025

🔐 Anchorage Digital – the first federally chartered crypto bank in the U.S. – has partnered with Ethena ($ENA.X ( ▲ 17.82% ) ) to launch USDtb, backed by BlackRock, the first stablecoin compliant with the new GENIUS law signed. And StablecoinX announced a $360M fund to buy ENA tokens -> token price pump by 10% before a pullback!

Ethena is set to become the first stablecoin developer whose product has a clear path to full compliance with the U.S. GENIUS Act

Through our partnership with @Anchorage, the only federally chartered crypto bank, USDtb will move onshore to become a U.S. federally regulated

— Ethena Labs (@ethena_labs)

1:01 PM • Jul 24, 2025

👻 “Satoshi’s Ghosts” Awaken. Billions in BTC and XRP Just Moved

Crypto markets are buzzing after a wave of old-school wallets suddenly reactivated, moving billions of dollars in $BTC.X ( ▼ 1.65% ) and $XRP.X ( ▲ 1.31% ) right as prices approach new highs.

🐋 Bitcoin Whales Are Waking Up

Out of nowhere, several old-school “OG wallets” – silent since the early 2010s – have started transferring massive holdings.

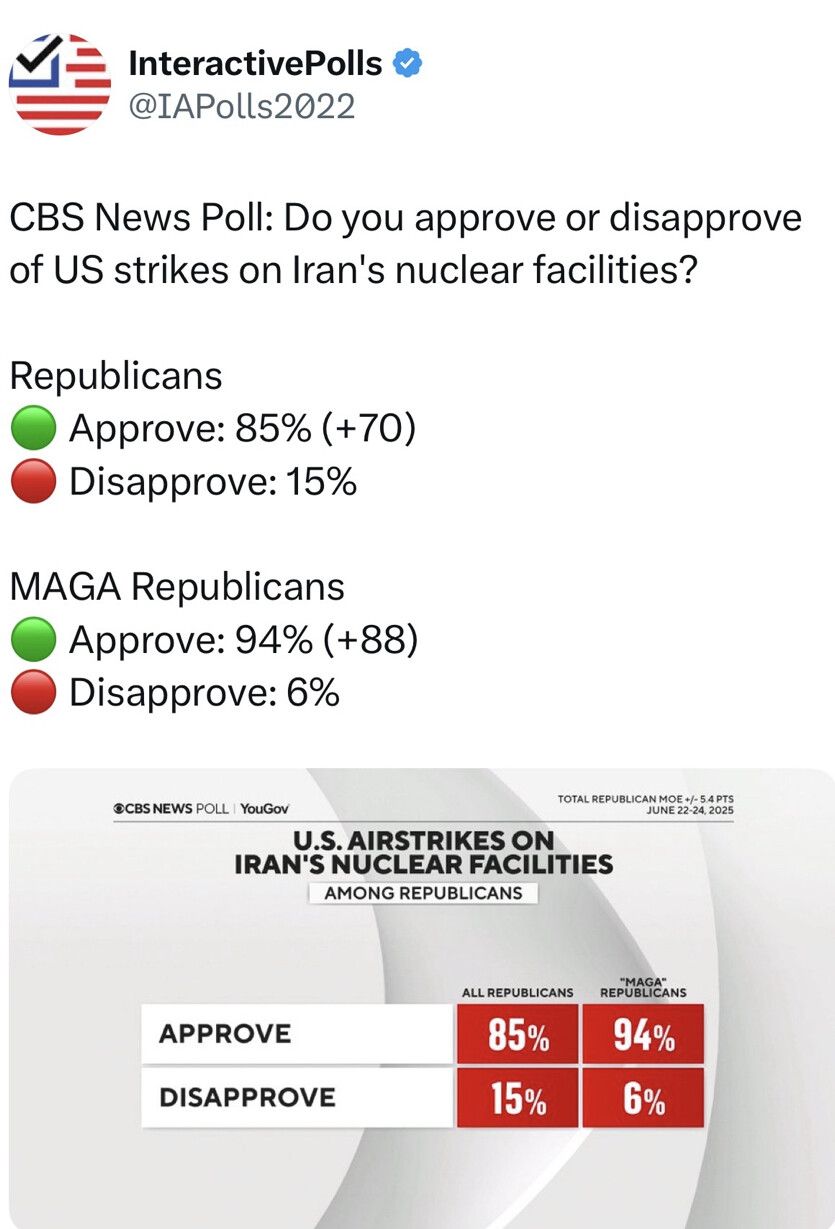

On the morning of July 24, a wallet created back in January 2011 (when BTC was just $0.37) made a small test transfer of 0.0018 BTC, then moved its entire stash:

→ 3,962 BTC (~$468M) to a new address.

Arkham says this wallet originally received those BTC within the first days of 2011… and then went totally dark for 14 years.

-

Old address: 15MZv…HjFUz

-

New address: bc1qc…udryz

That bag is now worth over 320,000x what it was at the time of purchase.

And, this wasn’t the only big move.

-

On July 23, another dormant wallet moved 10,603 BTC – worth $1.26B

-

Earlier this month, an OG wallet moved 40,191 BTC to Galaxy Digital custody

3 wallets (likely belonging to the same whale) just transferred 10,606 $BTC($1.26M) out after being dormant for 3-5 years.

All 3 wallets received $BTC on Dec 13, 2020, when the price of $BTC was $18,807.

intel.arkm.com/explorer/addre…

intel.arkm.com/explorer/addre…

intel.arkm.com/explorer/addre…— Lookonchain (@lookonchain)

3:53 AM • Jul 23, 2025

It’s triggered massive speculation online. Some believe these whales are rebalancing to prepare for profit-taking, especially as BTC hovers around $116,069.

Others wonder… is Satoshi back?

After all, many of these wallets are from the early mining era, and some may belong to Satoshi Nakamoto himself or solo miners from that time.

Coinbase’s Conor Grogan confirms at least one of the wallets belonged to an early solo miner, who would’ve earned 50 BTC per block back then (vs. just 3.125 BTC today).

Is it profit-taking? Position shifting? Or are we watching Bitcoin history come alive?

Either way, these “sleeping giants” just reminded the world: In crypto, the past is never really gone.

🧾 Ripple Co-Founder Reportedly Dumped $161M in XRP

It’s not just Bitcoin whales waking up. $XRP.X ( ▲ 1.31% ) is also seeing large, suspicious movements, this time from an insider wallet.

On-chain sleuth ZachXBT reports that a wallet believed to belong to Chris Larsen, co-founder of Ripple, has moved 50 million XRP (worth ~$161M) since July 17.

Here’s the breakdown:

-

30M XRP → two wallets with a history of sending funds to exchanges

-

10M XRP → a third wallet also linked to exchanges

-

10M XRP → two brand new wallets, with no prior activity

uber drivers in pain

— blanc (@blancxbt)

8:36 PM • Jul 23, 2025

The transfers happened just as XRP hit an all-time high of $3.65 on July 18. Notably, Larsen was previously spotted sending $30M in XRP to Coinbase, likely for selling.

He still controls a massive stash → 2.81 billion XRP, worth around $9B

Since July 17, 2025 an address linked to Ripple co-founder Chris Larsen transferred out 50M XRP ($175M) to four addresses.

~$140M ended up at exchanges/services

30M XRP recipient

rPS9kVPbgZF4vXq2hs6s9Xv2754qdRau98

rnQXgGAjqbF4KoBpcBK5YBHyZEL7nGWWoi

10M XRP recipient— ZachXBT (@zachxbt)

7:01 AM • Jul 24, 2025

The crypto community is paying close attention, especially after the SEC accused Larsen and Ripple CEO Brad Garlinghouse of selling hundreds of millions in XRP between 2017–2020, allegedly exploiting insider status.

As of now, XRP is trading at $3.09, down nearly 5% in the past 24 hours.

📜 2012 Ripple Founders Agreement Resurfaces, Reveals Early XRP Allocation

An old 2012 agreement between Ripple’s co-founders – Chris Larsen, Jed McCaleb, and Arthur Britto – has resurfaced online, sparking renewed debate.

🚨 HISTORICAL DOCUMENT LEAKED 🚨

Signed on Sept 17, 2012, this agreement between Chris Larsen, Jed McCaleb, and Arthur Britto confirms that Britto received 2% of ALL XRP (then called “Ripple Credits”) and more importantly, it gave him lifetime rights to build on the Ripple

— Echo 𝕏 (@echodatruth)

12:04 AM • Jun 3, 2025

According to the document:

-

Arthur Britto was granted 2% of the total $XRP.X ( ▲ 1.31% ) supply (then called Ripple Credits)

-

He was also given lifetime permission to build on the Ripple protocol with no need for company approval

The agreement highlights just how concentrated XRP distribution was from the beginning.

It’s also reigniting long-standing concerns about insider control and the centralization of XRP’s supply, especially as early wallets linked to Ripple insiders remain active and highly funded.

📉 Insider Moves Stir Flashbacks to XRP’s 2018 Peak

On-chain charts show the last major outflows from his wallet happened around XRP’s previous all-time high in 2018 — a pattern that adds weight to concerns about insider-driven price pressure.

Despite the sell-off, $XRP.X ( ▲ 1.31% ) remains one of the best-performing large-cap tokens this quarter.

-

Short-term selling caused a dip

-

But technical indicators show strong support near $3

-

Traders are watching to see if XRP can break back above the $3.40–$3.50 range

There’s clear unease around founder activity and with billions of XRP still under insider control, price action could continue to be influenced by transparency and responsible handling.

If future sales are done OTC or via institutions, the impact on price could be less severe. But for now, the market is watching closely. Too closely.

✨ Is There Still an Investment Opportunity with New Tokens Listed on Binance?

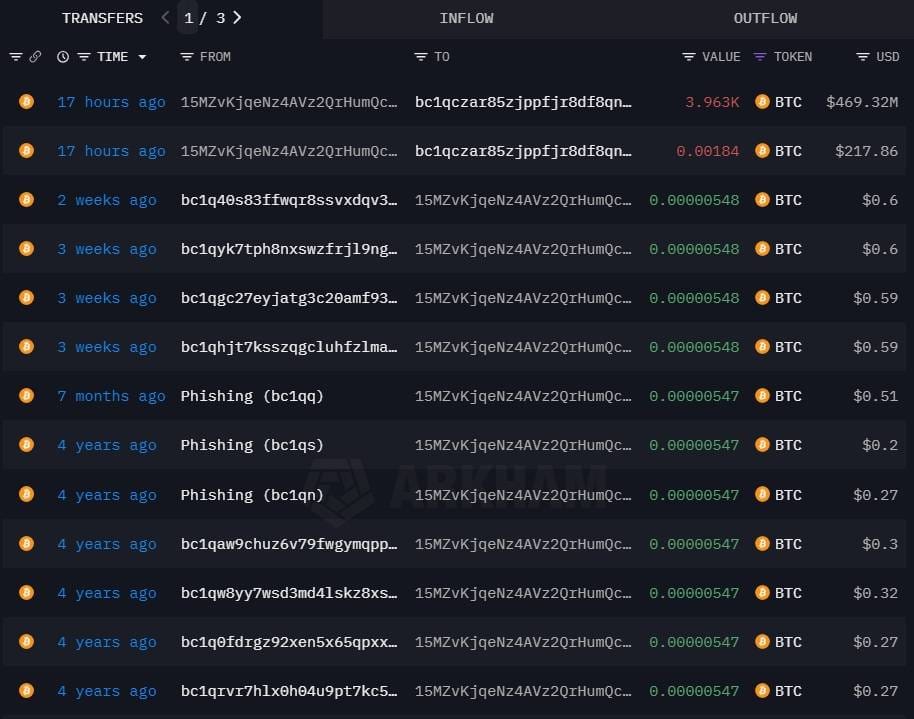

Most people assume that listing on Binance = instant moon. But reality hits different. The majority of new tokens dump hard right after listing, because:

-

VCs and early investors start selling as soon as tokens unlock

-

Retail buyers FOMO in, only to get dumped on by insiders

-

TGE unlocks a huge portion of supply → selling pressure > buying demand

Binance listings often serve as a perfect exit point for early players. Not a buy signal for latecomers.

We’lll explore in detailed today.

1️⃣ Why Do Tokens Crash Right After TGE & Binance Listing?

When a token gets listed on Binance right at TGE, there’s often a sharp price spike (pump wick) in the first few minutes. This is usually driven by dev teams, trading bots, or whales pushing the price up to trigger FOMO.

But once it peaks, early holders start dumping, locking in profits. That creates massive sell pressure → price tanks fast.

Some tokens like $SOPH.X ( ▲ 5.16% ) (-49.91%) and $RESOLV.X ( ▲ 11.47% ) (-58.19%) are recent examples.

$RESOLV looks like a fcking no brainer

✅ low cap – $50 mil

✅ 24h volume exceeding 240% of MC at $129 million

✅TVL …. $500+ MILLION.for MC to catch TVL is a 10x. $1 TP and pull an $SPK?

— JustSumCryptoDude (@CryptoWarrior01)

5:13 AM • Jul 25, 2025

Many new tokens launch with low trading volume. Most activity is just market maker games or airdrop farming.

Once the initial pump fades and real investors try to sell → There aren’t enough buyers to hold the price → it crashes.

Retail investors often assume Binance = guaranteed pump. So they buy in early, expecting a rally… Only to get dumped on by insiders.

Binance has only listed 15 tokens since April 11, 2025 → a sign that it’s being more cautious in this quieter market. But that also puts more pressure on new listings, since the hype cycle isn’t what it used to be.

Less momentum = harder to sustain price. That shiny Binance listing isn’t always a green light. It’s often an exit strategy, not an entry point.

2️⃣ Why Do Projects Still Choose to List on Binance, Even When They Know the Price Might Crash?

It’s no secret: Most tokens dump hard after listing, right after that initial pump.

But projects still want to get on Binance. Badly.

Here’s why 👇

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply