$ENA Pumps 120%. Stablecoin Not Hold Dollars!.

Is this the moment altcoins break free from Bitcoin? Bitcoin’s falling, but altcoins are flying. NFTs are suddenly coming back to life. A secret indicator just flashed “Altseason incoming”…

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

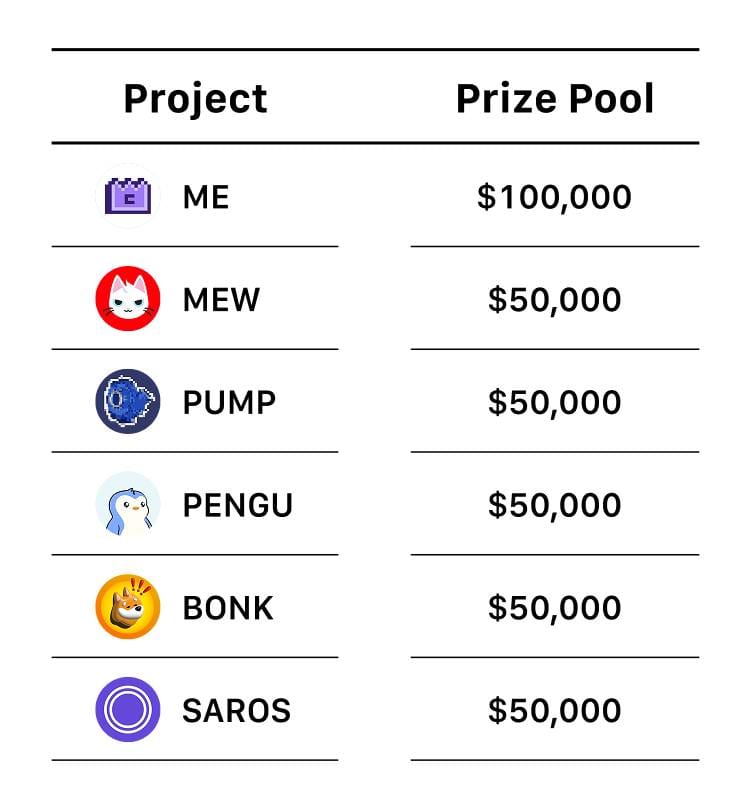

🚀 If you’re into the Solana ecosystem, this is your moment. From July 21 to August 20, MEXC is hosting Solana Ecosystem Month with a huge lineup of rewards and incentives like: Zero-fee spot, Stake $SOL.X ( ▼ 1.38% ) for up to 400% APR, $100,000 in rewards. Bonus: You’ll get extra rewards from 6 exclusive side events. Here’re the full details!

🐶 Bit Origin just bought $40.5M worth of $DOGE.X ( ▼ 4.27% ) , officially kicked off its Dogecoin treasury plan. They believe Dogecoin is now entering a breakout phase, they see DOGE playing a central role in “X Money”. In fact, DOGE beat $XRP.X ( ▼ 2.04% ) and $USDC.X ( ▲ 0.01% ) in late 2024, reaching a $41B market cap – the first memecoin to do so.

🚨 We’re excited to announce!

We have acquired ~40.5 million Dogecoin (DOGE) as part of our first treasury acquisition under the $500M capital facility.

Our new origin has begun.

bitorigin.io 🐶✨globenewswire.com/news-release/2…

— BTOG (Bit Origin) (@BitOriginLtd)

1:32 PM • Jul 21, 2025

👨🚀 After 3 years of waiting, TRON founder Justin Sun is finally heading to space aboard Blue Origin’s NS-34 mission. He paid $28M for the seat back in 2021, and now he’s set to cross the Kármán line in the coming weeks. While $TRX.X ( ▲ 1.0% ) hasn’t moved much yet, Sun’s high-profile flight could give the token a new boost, will he take TRX to the moon too?

In 2021, I bid $28M for a seat on @blueorigin’s New Shepard rocket—funds that went to @clubforfuture, Blue Origin’s foundation, to support 19 space-based charities inspiring the next generation of STEM leaders.

Proud to join Blue Origin’s NS-34 mission and continue encouraging

— H.E. Justin Sun 🍌 (@justinsuntron)

2:52 PM • Jul 21, 2025

📈 On July 23, major ETF issuers – Fidelity, VanEck, 21Shares, WisdomTree, Galaxy, and Franklin Templeton – filed amendments with the SEC to enable in-kind redemptions for their Bitcoin and Ethereum ETFs. This means instead of receiving cash when redeeming ETF shares, authorized participants can get the actual crypto (like BTC or ETH).

SEC Division of Trading & Markets has *approved* the Bitwise 10 Crypto Index ETF…

However, like with the Grayscale Digital Large Cap ETF, this approval order is stayed.

IMO, both of these should be allowed to convert/uplist asap.

Bizarre situation.

— Nate Geraci (@NateGeraci)

9:22 PM • Jul 22, 2025

😮 A new ETH whale is forming, Dynamix, a NASDAQ-listed company, just announced it’s merging with Ethereum-focused startup Ether Machine → they plan to buy up to 400,000 $ETH.X ( ▼ 0.93% ) , worth $1.5 billion → surpassing SharpLink Gaming. Behind it all is a dream team like David Merin (Ex-Consensys), Darius Przydzial (ex-JP Morgan),…

We are The Ether Machine.

Today we launch the largest public vehicle ever built to own and manage ETH with over $1.5B in committed capital.This is Ethereum’s institutional chapter.

Not passive. Not synthetic. Not outsourced.

⬇️— The Ether Machine (@TheEtherMachine)

10:21 AM • Jul 21, 2025

🔥 Ethena Token Pumped 120% in 2 Weeks! Can It Hold in H2/2025

$ENA.X ( ▼ 7.4% ) , the token behind Ethena, just had a massive rally – up over 120%, making it one of the hottest names on the market right now.

$ENA pumping nicely. Clear breakout. This one can get to the highs in matter of days.

120% up from the lows just 2 weeks ago.

— Crypto Academic (@cryptoacademic)

11:55 AM • Jul 20, 2025

All signs point to “Fee Switch” activation – a long-awaited feature that could start funneling protocol revenue back to token holders. That’s got investors excited… and speculators even more hyped.

Can ENA keep the momentum going in H2/2025 or is this just a quick pump before the cooldown?

📊 Fee Switch: The growth engine behind $ENA, but it’s not fully unlocked yet

Lately, $ENA’s price has surged, and a big reason is the growing hype around Ethena’s “Fee Switch” – a mechanism that shares protocol revenue with sENA holders (that’s staked ENA).

Update on Ethena’s Fee Switch

Congrats to @ethena_labs on surpassing $400M in USDe revenue – $150M over the Fee Switch threshold.

But revenue isn’t enough.

The DAO must meet 5 parameters to activate $ENA revenue-sharing.

2 of 5 are complete.

Here’s the status👇🧵

— Entropy Advisors (@EntropyAdvisors)

5:50 PM • Jun 17, 2025

But here’s the catch…

The Fee Switch only activates if 5 specific conditions are met. As of July 2025, Ethena has checked off 4 out of 5:

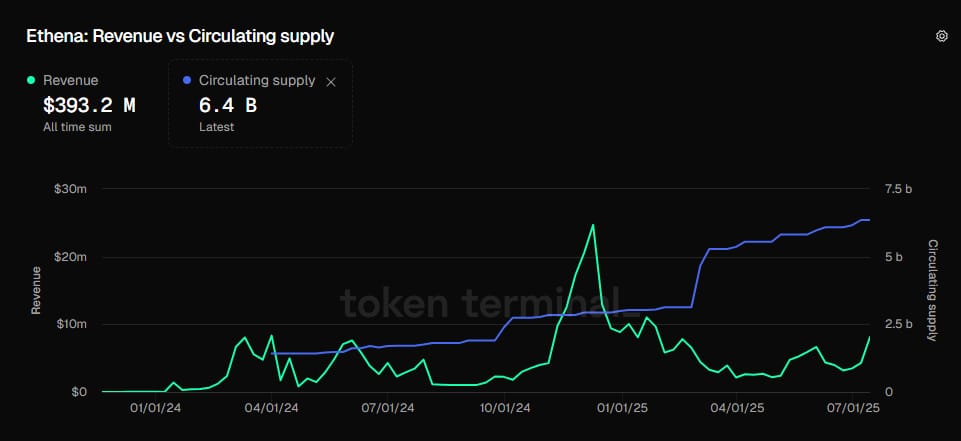

1. Revenue milestone smashed: Ethena’s cumulative revenue is now ~$400M, well above the $250M target. That puts them ranked #32 across the entire crypto market.

2. USDe supply > $6B: That means USDe has officially flipped DAI, becoming the #3 decentralized stablecoin, just behind USDT and USDC, a big milestone.

3. Reserve ratio > 1% of total USDe supply

4. Spread APY is strong: Yield on sUSDe is ~10%, giving over a 5% premium versus safer assets like sUSDS or USDC on AAVE.

the sUSDe pool with September maturity just got dumped by some whales and the Implied APY is at 10.6%

yesterday that same pool was at 12%, so if you was lookin for a opportunity to get exposure on Ethena S4, this is your chance.

NFA

— Profeh.eth (@0xprofeh)

9:00 PM • Jul 22, 2025

Still missing one final piece:

5. CEX integration: USDe is live on Bybit, MEXC, and Bitget (3 out of 5). But they still need Binance or OKX to hit full compliance and flip the switch.

USDe is now live on both @HyperliquidX exchange & HyperEVM 🫳🏻

HyperCore users will earn daily rewards auto airdropped on top of their USDe spot exchange balances

USDe fills the opportunity for a scalable rewarding dollar asset within the Hyperliquid exchange & ecosystem

HYENA

— Ethena Labs (@ethena_labs)

12:49 PM • May 5, 2025

So we’re close… but not quite there. Until then, it’s all about momentum and anticipation.

📈 Ethena is expanding fast but is low staking a red flag?

While $ENA’s rally is partly fueled by the “Fee Switch” hype, another big factor is ecosystem growth and it’s accelerating.

Two major pillars are leading the charge:

-

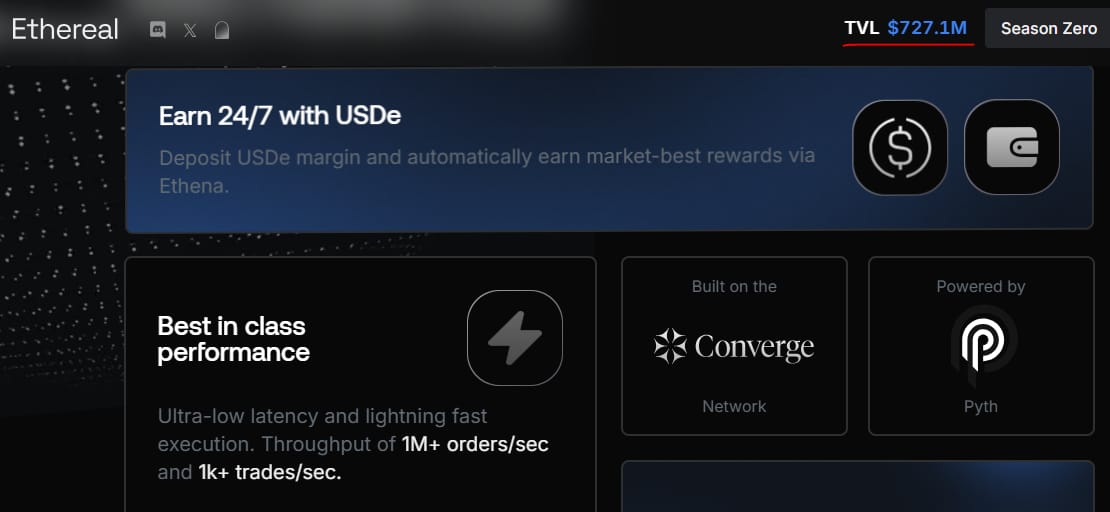

Ethereal (perp DEX): Already passed $700M TVL. That’s a lot of user trust and usage.

-

Terminal (tokenized asset liquidity hub): Around $70M TVL

Ethena’s presence is also growing across chains. Highlights:

-

On Bybit, $USDE.X ( ▲ 0.06% ) just flipped USDC in trading volume ($540M vs. $444M)

-

On TON, USDe hit $87M TVL in just 6 weeks

But here’s the concern… Only ~6% of $ENA is staked right now. That means most holders haven’t committed long-term, even as most staking rewards and airdrops are going to sENA holders.

This could lead to dilution risk if ENA’s circulating supply keeps rising without strong staking incentives or lockups.

We’ve seen this before, like with $TIA.X ( ▼ 2.56% ) in 2024, where low staking led to massive sell pressure every time tokens unlocked.

📈 Rate cuts coming and that might be Ethena’s biggest advantage.

Analysts expect the Fed to start cutting rates by Sept 2025. That’s usually bad news for traditional stablecoins like USDC or USDT, since their returns mostly come from T-bills.

But for Ethena, it’s a whole different story. Unlike others, Ethena doesn’t hold cash or bonds. Instead, it uses a delta-hedging strategy – holding crypto assets (like $ETH) while shorting perps to offset volatility.

So when markets flip bullish and people pile into long positions, funding rates go up and Ethena (which is short) collects that yield.

→ Higher funding = higher protocol profits.

🔍 Case in point: After the Fed’s rate cut in Dec 2024, Ethena hit a revenue record of ~$12M that month alone.

On the regulatory side, Ethena isn’t sitting still either. They’ve already met with the SEC Crypto Task Force to explain:

-

how USDe works,

-

how it differs from traditional stablecoins,

-

and why it should be classified differently.

This is a bold but smart move, especially with the U.S. actively shaping its crypto regulations right now.

If Ethena pulls this off, it could become the first stablecoin that pays real yield and scales globally, something $USDT and $USDC haven’t cracked yet.

🧩 Ethena: Big potential, but dilution risk still looms

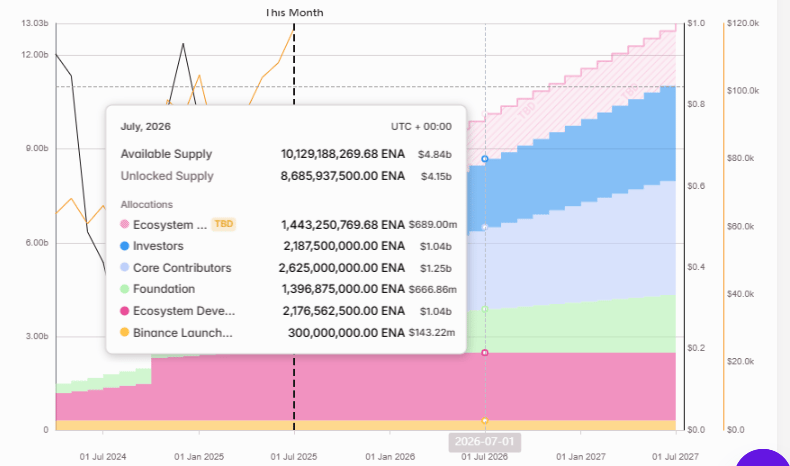

Ethena is now one of the most-watched DeFi protocols going into late 2025. But before aping in, investors should step back and look at the full picture, especially around tokenomics and dilution risks.

Currently:

-

$ENA’s market cap sits around $3.1B

-

About 41% of total supply is unlocked

But by July 2026, circulating supply is expected to increase by 2.4B ENA → that’s a 38% inflation rate in just one year.

If the price stays around $0.5, that’s ~$1.2B worth of new tokens entering the market — a serious dilution risk, especially when compared to mature DeFi projects like Aave or Curve, which have much slower inflation.

Yes, there’s still strong upside, especially with Fee Switch activation possibly pulling in more capital. If those timelines align, $ENA might sustain its momentum.

If not, a mid-term correction could be hard to avoid. Keep your eyes on both the expansion pace and the unlock schedule, that balance will be everything.

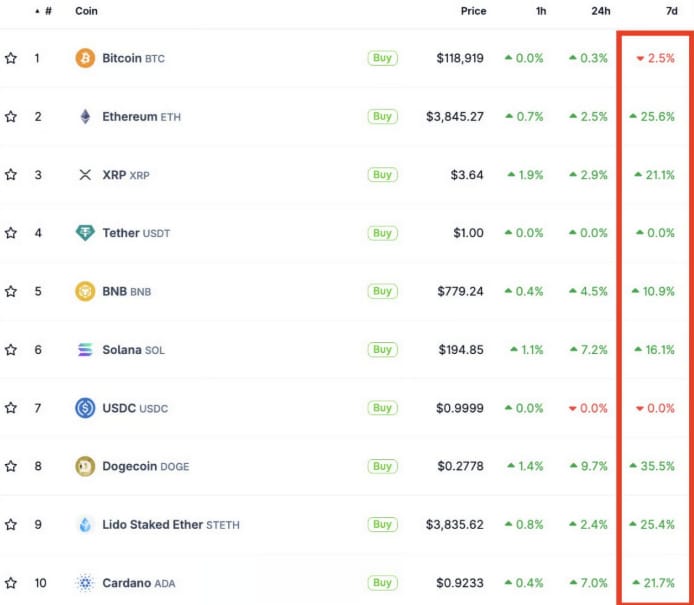

🚀 BTC Down, Alts Up: Last Call Before the Altcoin Rocket Launches?

With $BTC.X ( ▼ 0.47% ) pulling back but altcoins suddenly popping, many are asking the same question: Is this the last chance to get in before the real altcoin rally begins?

In this post, let’s break it down:

-

Why are alts pumping while Bitcoin is dropping?

-

NFT revival = early altseason signal?

-

BTC Dominance is falling, where’s the money going?

1️⃣ Why Is Bitcoin Dropping While Altcoins Are Popping?

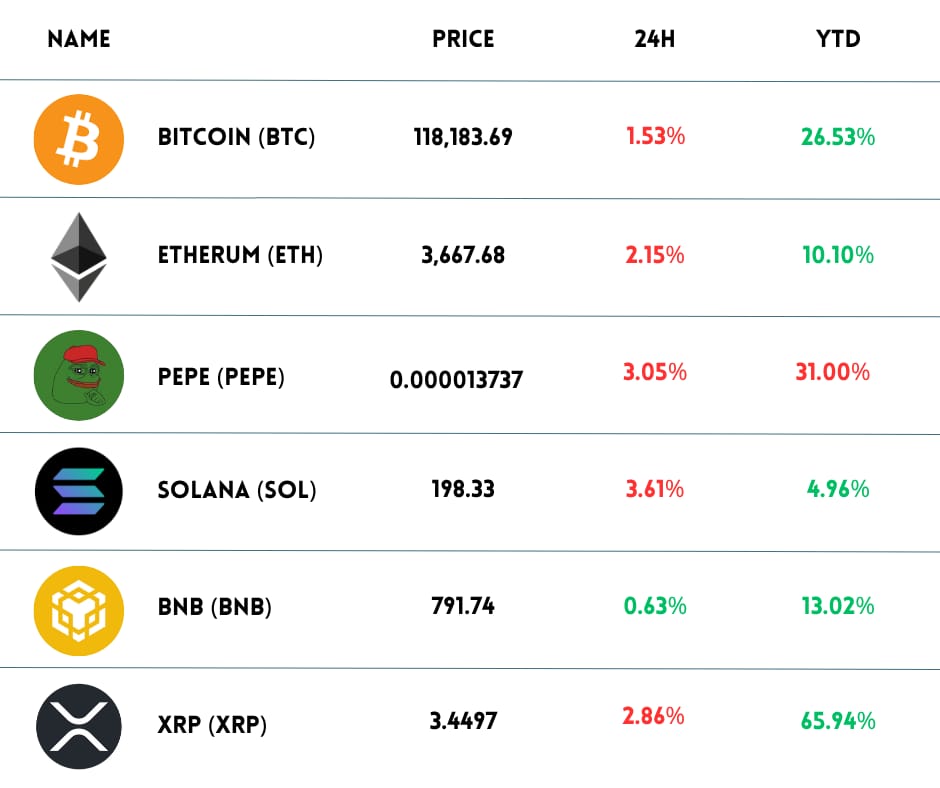

If you haven’t noticed, Bitcoin is the only coin in the top 10 that’s down this past week, while many altcoins are pumping. So… what’s going on?

Here’s what’s driving the shift:

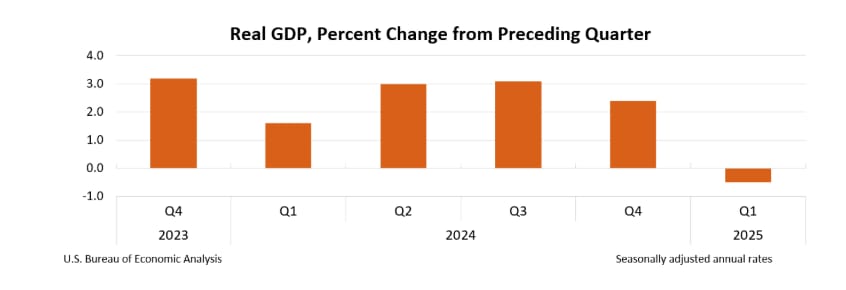

a. Macro signals are turning “risk-on”

Investors are betting that the Fed will start easing soon. There’s even a rumor going around that Fed Chair Powell might step down.

BREAKING: Fed Chair Powell is considering resigning, says Chairman of the US Federal Housing Finance Agency in a statement

h/t @KobeissiLetter

— حسن سجواني 🇦🇪 Hassan Sajwani (@HSajwanization)

7:22 PM • Jul 11, 2025

Plus, U.S. GDP dropped 0.5% in Q1/2025, adding pressure for rate cuts. This makes the market feel more comfortable taking on risk.

b. Institutional money is flowing into Ethereum

Ethereum Spot ETFs just brought in $2.2B in one week. And big firms like Sharplink are loading up, they bought 280,706 ETH recently. That creates FOMO, and altcoins usually ride the wave.

🚨 IT’S RIGGED! ETHEREUM BULLS JUST GOT UNLEASHED

The ETH ETF flows are going parabolic 📈

→ $2.1B+ in just 1 week

→ 80% of it into BlackRock

→ Fresh wallets piling in

→ SEC unofficially saying “ETH ≠ security”And now, CNBC is running full-blown ETH segments…

You know

— DeFi_Jack (@DeFiJackpot)

10:44 PM • Jul 22, 2025

c. Bitcoin Dominance is falling

BTC dominance dropped to 61%, meaning more capital is rotating from BTC into altcoins like ETH and SOL. Investors are likely taking profits from Bitcoin and trying to chase higher returns elsewhere.

Bitcoin dominance has dropped by 6.74% over the past 30 days.

It’s currently sitting at 61.12%.

Alt season is loading…

— Yannis (@yannisDeFi)

2:42 PM • Jul 22, 2025

This looks like a shift in sentiment from “play it safe” (risk-off) to “let’s go for gains” (risk-on).

Bitcoin is the safety net. But when confidence returns, the market chases altcoins, and that’s exactly what’s happening.

2️⃣ NFTs Are Back. Is That a Signal Altseason Is Coming?

NFTs have suddenly come back to life this past week and that’s sparked two opposite reactions from the market:

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply