$WLFI Might Actually Deserve a Look.

Golden Cross just hit the altcoin market but this time it’s quite different. Everyone’s screaming “Altseason is here!”, but if you’re betting big without understanding the real story behind this signal, you might be walking straight into a trap.

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

💰 Trump-linked DeFi fund just spent $40,000 to buy 636,683 $BANK.X ( ▲ 7.47% ) tokens from Lorenzo Protocol right after the $1M “USD1 Incentive Plan” results were announced. And guess who won? Lorenzo Protocol took the prize for Best Existing BSC Project when turning USD1 into a yield-generating on-chain asset.

Trump’s World Liberty(@worldlibertyfi) spent 200K $USD1 to buy 78,922 $B($40K), 409,387 $Liberty($40K), 396,371 $EGL1($40K), 72,917,613 $TAG($40K) and 636,683 $BANK($40K) an hour ago.

debank.com/profile/0xa713…

— Lookonchain (@lookonchain)

5:44 PM • Jul 18, 2025

🔥 Bit Digital announced it bought 19,683 ETH (total 120,306 ETH) right after raising $67.3M in a private share sale. They now run one of the largest institutional ETH staking infrastructures. Before this, they had already swapped all their BTC holdings into ETH. $BTBT ( ▼ 4.24% ) stock jumped from $1.99 → $3.84 in the past 30 days = a +66% surge.

Earlier this month, Bit Digital accumulated over 100,000 ETH.

Today, Bit Digital has acquired an additional ~19,683 ETH, bringing our total ETH balance to 120,306.

There is no second best asset to re-write the financial system.

Stay tuned.

— Bit Digital, Inc. NASDAQ:BTBT (@BitDigital_BTBT)

12:03 PM • Jul 18, 2025

🚀 World Liberty ($WLFI.X ( 0.0% ) ) just dropped their launch roadmap: No unlocks for founders, team, or advisors at launch. No pre-sale beyond what’s already public. Only a small portion of tokens from public sale ($0.015 & $0.05 tiers) + OTC will be unlocked. They really know how to time a launch! More details.

Community triumph! $WLFI tradability is approved. We’re targeting 6–8 weeks for the full awakening — strategic alignments (alliances, grand stages, smart unlocks) take time to realize full potential. Something for everyone is brewing…

#WLFIawakening 🦅👀🧵

— WLFI (@worldlibertyfi)

5:28 PM • Jul 18, 2025

🧠 An anonymous whale just grabs 45 NFTs from the iconic CryptoPunk collection in one shot → worth over $7.8 million. After a long slump, NFT markets are waking back up, especially on the Ethereum (surged to $75M this past week) and Bitcoin blockchains. And big players are making moves again!

Someone just swept 45 CryptoPunks for $7,833,185 USD (2081 ETH)!

NFTs will skyrocket!

This person has bought 105 Punks over the past 2 years.

— VanGoya (@vangoyaa)

9:51 PM • Jul 20, 2025

📅 Ethereum has set November 2025 for its next major upgrade: the Fusaka Hard Fork. Many devs proposed to raise Ethereum’s gas limit to 150M. And Vitalik Buterin just revealed that ~50% of $ETH.X ( ▲ 1.34% ) stakers now support increasing the L1 gas limit to 45M. But there’s concern about whether client teams will be ready to deliver within 6 weeks?

2/7 🧵 Fusaka

▶️ devnet updates

▶️ It’s just the middle of 2025 & we have lots of time to ship Fusaka this year, right?

WRONG. If we want to ship by Devconnect, we need our timeline TIGHT.

We’ll go over that in detail. Can we get client releases in the ~next month & a half? 😳— nixo.eth 🦇🔊🥐 (@nixorokish)

12:31 AM • Jul 16, 2025

🟢 GENIUS Act and Its Impact on Stablecoins: A Major Win

Big news for the crypto world: The GENIUS Act – America’s first stablecoin law – was officially signed into law by President Donald Trump. This marks a key moment in the evolution of stablecoins, bringing regulatory clarity for payment stablecoins.

🚨 Trump just signed the first-ever U.S. stablecoin law – the GENIUS Act

In the early morning of July 19, 2025, President Donald Trump officially signed the GENIUS Act at the White House → making it the first stablecoin law in U.S. history.

Just a reminder, here’s what it includes:

-

100% backing by USD or equivalent liquid assets

-

Regular audits for issuers

-

Strict AML (Anti-Money Laundering) compliance

-

Reserves can’t be used for risky investments — only safe ones like short-term U.S. Treasury bonds

-

Licensing at either state or federal level, depending on the issuer

-

Clear oversight roles for the Federal Reserve (Fed) and the Office of the Comptroller of the Currency (OCC)

The crypto community widely supports the law, seeing it as a breakthrough for bringing stablecoins into regulated finance.

Experts say it could:

-

Make stablecoins legally usable in everyday payments

-

Spur financial innovation

-

Improve banking access

-

Boost the on-chain economy

U.S. Treasury Secretary Scott Bessent called it a game-changer:

Today, President Trump signed the GENIUS Act into law, a historic piece of legislation that will pave the way for the U.S. to lead the global digital currency revolution.

— Treasury Secretary Scott Bessent (@SecScottBessent)

10:22 PM • Jul 18, 2025

🗡 Tether vs. Circle face off at the White House… kind of.

At the official GENIUS Act signing ceremony, both Tether CEO Paolo Ardoino and Circle CEO Jeremy Allaire were in attendance.

Though they didn’t speak face-to-face, both made bold statements about how their companies will adapt to the U.S.’s first-ever stablecoin law.

→ And now the battle between $USDT.X ( ▼ 0.01% ) and $USDC.X ( ▼ 0.0% ) is getting a legal twist.

Tether’s stance:

-

Ardoino said Tether (which is registered in El Salvador) will comply with the new STABLE rules for foreign stablecoin issuers.

-

These include strict AML compliance and regular reserve audits.

Incredibly honored and grateful for the invitation to watch @POTUS sign the Genius Act today.

Tether has already brought over 160 billion USDT to over 500 million users worldwide.

Now that President Trump has led the United States to embrace digital assets, we believe we can

— Paolo Ardoino 🤖 (@paoloardoino)

7:34 PM • Jul 18, 2025

-

Historically, Tether has never done a full audit — only quarterly attestations. But earlier this year, they hired a seasoned CFO and promised proper audits are finally coming.

-

He also reconfirmed plans to launch a US-compliant version of USDT to follow GENIUS rules.

-

And yes — he reminded everyone that USDT is still king, with $160B in circulation and a 62% share of the global stablecoin market.

Since 2020 Tether USDt

– Market cap ↑ 34x ($4.7B ➝ $160B)

– On-chain volume ↑ 74x ($14.8B ➝ $1.1T/month)

– Users ↑ 160x (2.8M ➝ 450M)— Paolo Ardoino 🤖 (@paoloardoino)

4:22 PM • Jul 16, 2025

Circle’s response:

-

Jeremy Allaire wasn’t surprised by Tether’s moves, saying Circle has always followed U.S. law.

-

He emphasized that GENIUS will only highlight USDC’s strength, given Circle’s long track record of full audits and regulatory compliance.

-

Oh, and he posted a photo shaking Trump’s hand after the law was signed — a not-so-subtle flex.

A huge moment for America. Thank you @POTUS for your leadership.

— Jeremy Allaire – jda.eth / jdallaire.sol (@jerallaire)

8:07 PM • Jul 18, 2025

Also in the room: Crypto heavyweights including Brian Armstrong (Coinbase), Sergey Nazarov (Chainlink), and the Winklevoss twins (Gemini) – all past attendees of the White House’s March crypto summit.

🚫 But one key absence raised eyebrows: Ripple CEO Brad Garlinghouse was nowhere to be seen. Despite backing Trump’s campaign, reports say he was snubbed after Trump felt “tricked” into endorsing $XRP.X ( ▲ 1.13% ) in a past statement about creating a U.S. strategic crypto reserve.

this is wild lmao

XRP lobbyist misled Trump to write a tweet to pump the coin

— mert | helius.dev (@0xMert_)

6:59 PM • May 8, 2025

🔥 The GENIUS Act just became law but it’s not without controversy.

While it marks a historic step toward regulating stablecoins in the U.S., not everyone is cheering. The law has opened the door for innovation, but it’s also raised serious concerns about ethics, fairness, and conflict of interest.

Critics raise red flags, such as:

-

Multiple Democratic lawmakers and ethics watchdogs have spoken out.

-

Their main concern is that the law could personally benefit Trump’s family, especially since he’s publicly backed World Liberty Financial — the issuer of USD1 stablecoin.

-

And the fact that Trump himself pushed the House to pass GENIUS only adds fuel to the fire.

Letitia James, the AG of New York, sent an 8-page letter to Congress demanding a full rewrite of the GENIUS Act.

She argues the bill lacks key safeguards to protect U.S. consumers and banks. Her proposals include:

-

Only banks should be allowed to issue stablecoins, non-bank issuers should be banned

-

Block foreign-based issuers (like Tether) from operating in the U.S.

-

Require digital identity verification for all stablecoin users

-

Enforce FDIC-style capital and insurance standards on issuers

Despite the pushback, GENIUS passed both the House and Senate with bipartisan backing → something you rarely see in today’s divided politics.

The law is now seen as a greenlight for companies like Circle, Paxos, and others – even foreign issuers – to run legal, transparent, and safer stablecoin operations in the U.S.

GENIUS brings legal clarity to stablecoins but the road ahead is still full of debates, oversight challenges, and political tension.

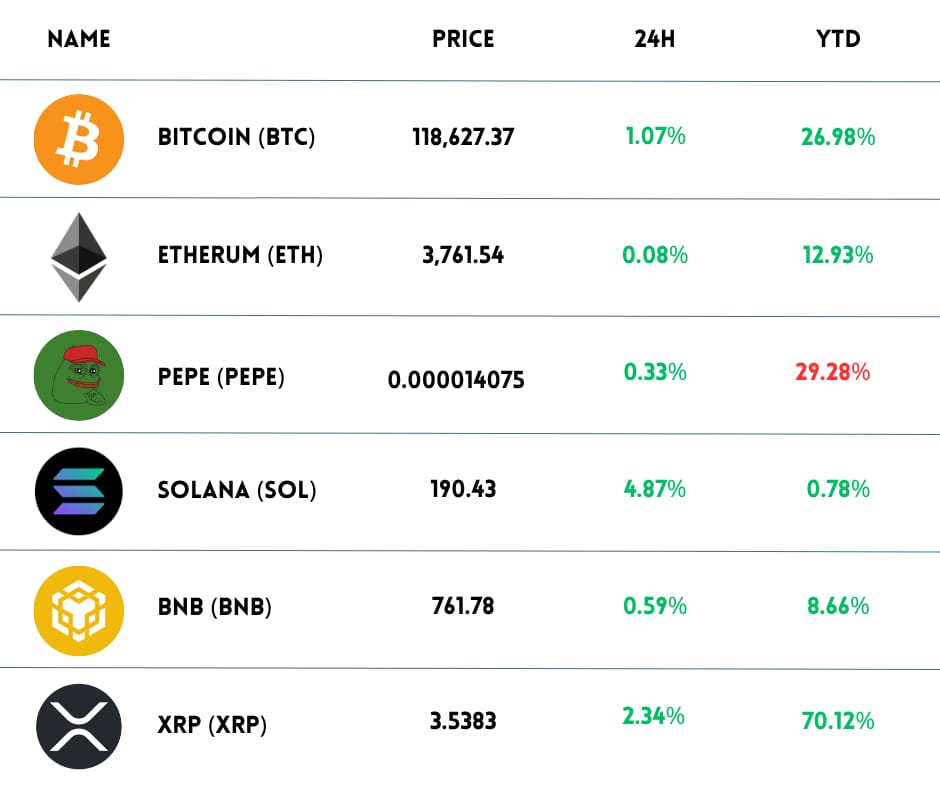

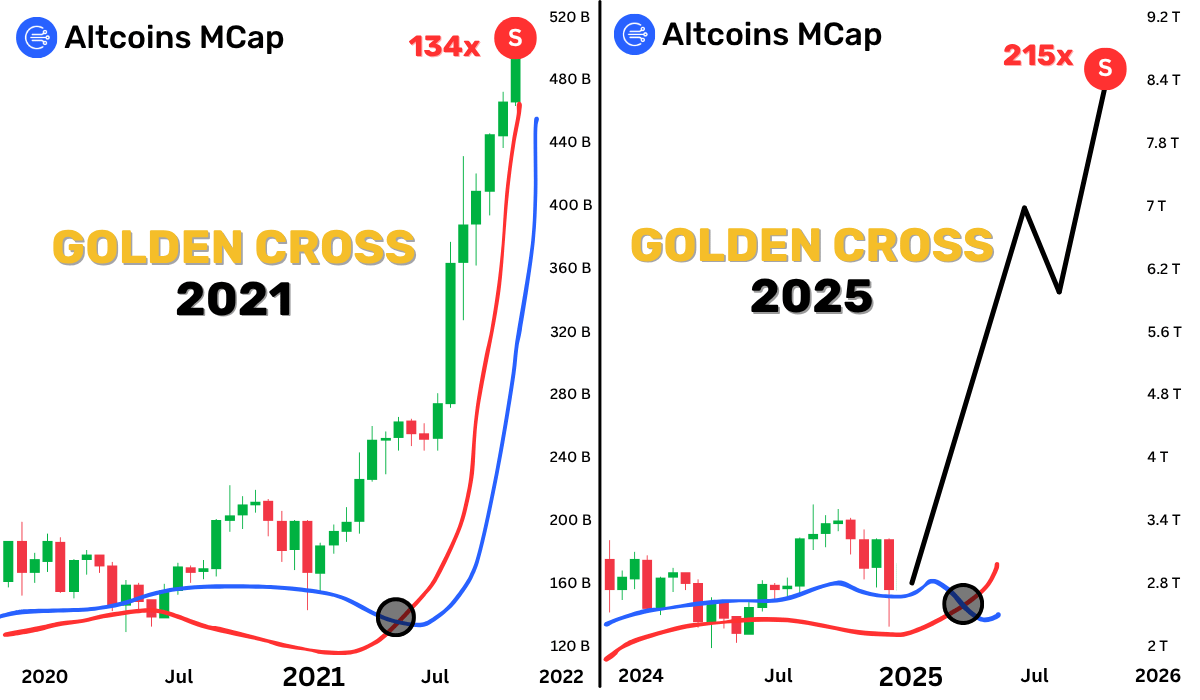

👀 Golden Cross Just Flashed: Is Altcoin Season Finally Here?

The famous “Golden Cross” – a bullish technical signal – just appeared again. Historically, this pattern often marks the beginning of a strong upward trend. But will it play out the same this time?

In today’s post, we’ll break down:

-

What exactly is a Golden Cross — and why does it matter?

-

What has happened in past cycles when this signal appeared?

-

Is this time different, or are we following the same pattern?

-

So… what’s the bottom line for traders and altcoin holders?

1️⃣ Golden Cross Just Hit the Altcoin Market. Here’s Why It Matters

Let’s talk about the Golden Cross, one of the most classic (and powerful) technical indicators in the game.

It’s triggered when the short-term moving average → typically the 50-day or 100-day/week SMA → crosses above the long-term moving average (usually the 200-day/week SMA).

But this isn’t an early signal. It’s more of a confirmation → showing that an uptrend has been sustained long enough to actually shift the market structure.

And guess what?

On the altcoin total market cap chart (excluding BTC), this exact signal just appeared in mid-June 2025:

→ The 100-week SMA (green) crossed above the 200-week SMA (red).

That’s a big deal, it’s the strongest trend reversal signal we’ve seen across the entire altcoin market in nearly 4 years.

Altcoin Season? Maybe not officially yet, but this is the clearest sign we’ve had in a long time that something major could be brewing.

2️⃣ What Does History Say about the Golden Cross?

Let’s let the charts do the talking but here’s the story they tell 👇

In the last two market cycles, every time a Golden Cross appeared on the altcoin market cap chart, it signaled a major shift in capital flow from $BTC.X ( ▲ 0.59% ) into riskier assets.

Investors were ready to take bigger risks in search of higher returns → a classic sign of risk-on behavior.

But here’s the catch… In both 2017 and 2020, this shift happened in very friendly macro environments:

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply