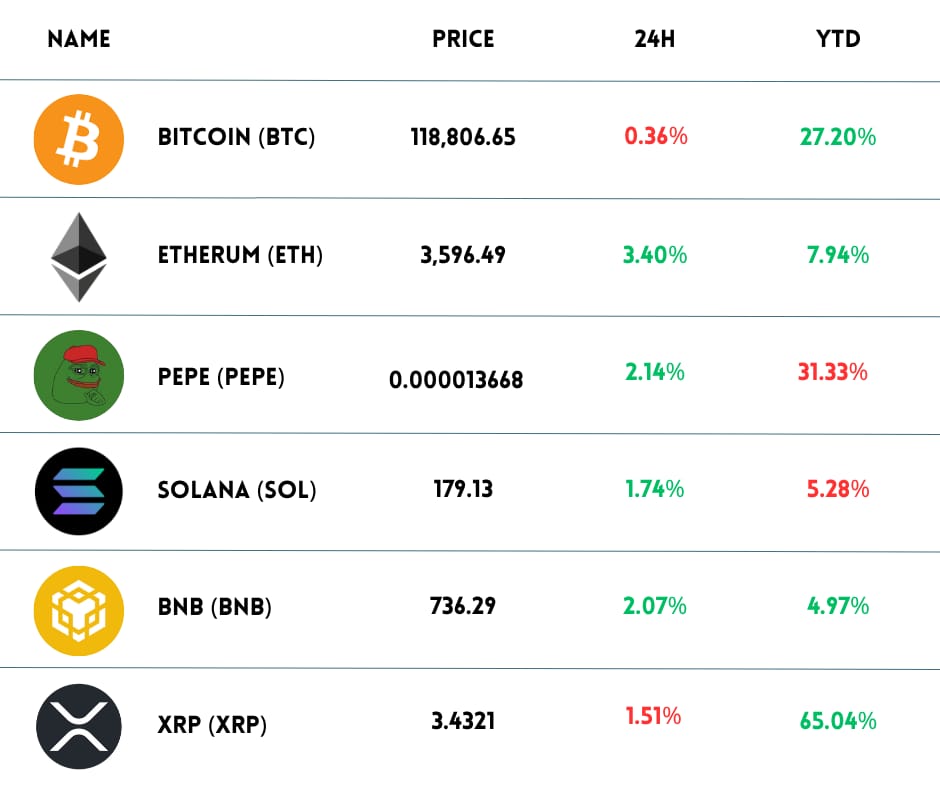

$USDT is Quietly Loading the Next Pump!?.

While CT was memeing over $DOGE.X ( ▲ 11.26% ) pumps, Wall Street quietly poured over $1 billion into ETH. Even Bitcoin mining firms are ditching BTC to build Ethereum treasuries. BTC out. ETH in?

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

👀 The official Trump Meme Token site quietly registered a subdomain called ‘TrumpGame.’ Trump might be working on a crypto-based real estate game – similar to his 1989 board game ‘Trump: The Game.‘ This time, it could be Monopoly + Crypto + Trump NFTs. The $TRUMP.X ( ▲ 2.69% ) token price pumped after the news.

$TRUMP coin could be preparing to launch a gaming project, website domain leak 👇🏻

— LANGERIUS (@langeriuseth)

11:33 AM • Jul 16, 2025

🚀 $XRP.X ( ▲ 5.09% ) just broke past its 2018 ATH of $3.4, reaching $3.6, +20% daily and +38% weekly gain. It’s now the #3 crypto by market cap. It’s only the second time in 7 years XRP has hit a new record. With regulatory wins, new products, and growing institutional trust, this could be just the start!

$Xrp is now the third largest crypto by market cap after $btc and $eth

Xrp near ATH on weekly chart 🍀🚀— Jerry (@jerry_01101011)

7:05 AM • Jul 17, 2025

🔥 BREAKING: the US House officially passed 3 major crypto bills, including: GENIUS Act, CLARITY Act, Anti-CBDC Act. Together, they form a legal triangle that puts the U.S. at the heart of global crypto innovation. Crypto market obviously loves it. $BTC.X ( ▲ 0.58% ) is steady at $120K. $ETH.X ( ▲ 5.23% ) just broke $3,600 for the first time since Feb 2025

🚨IT’S OFFICIAL: HOUSE PASSED ALL 3 CRYPTO BILLS

Clarity Act (294-134)

Genius Act (308-122)

Anti-CBDC Act (219-210)A historic win for crypto in the US — regulatory clarity is coming, and the future is looking bullish. 🔥

— Coin Bureau (@coinbureau)

1:28 AM • Jul 18, 2025

💥 PayPal’s stablecoin, $PYUSD.X ( ▼ 0.18% ) , is now officially live on Arbitrum, alongside Ethereum and Solana. And, $ARB.X ( ▲ 5.53% ) token surged 8–12% within just 24 hours of the news. Oddly, Stellar ($XLM.X ( ▲ 2.57% ) ), which was previously announced as the next PYUSD chain, is missing from the updated terms. Looks like Arbitrum beat Stellar to production.

The ARB trade is nearing its profit target and currently has rallied 89%. This was planned for way ahead of time and executed as planned. Congrats to those who took advantage. CRV, Litecoin, and Bitcoin longs all still open if anyone was wondering.

— Trade Pro (@TradePro16)

5:20 AM • Jul 18, 2025

🚨 Coinbase officially launched full-on super Base App, calling it the gateway for the next billion users into Web3, with a social feed, direct trading, payments & even AI agents. You can tokenize posts using Zora, earn tips, trade from the feed, access mini-apps like games or prediction markets, and send 1-tap USDC payments via NFC!

There are tons of mini apps in the Base app. Here’s 15 to get you started:

@noicedotso, @DIMO_Network, @paragraph_xyz, @tbpn, @FarvilleGarden, @MorphoLabs, @titlesxyz, @fantasy_top_, @RemixGG_, @podsdotmedia, @KresusOfficial, @endaomentdotorg, @virtuals_io, @cooprecsmusic,

— Base app (@baseapp)

11:18 PM • Jul 16, 2025

🥇 ETH is On Fire. What could Fuel ETH Rise Through 2030?

Ethereum is becoming the go-to treasury asset for major public companies. It just broke past $3,600, up 21.2% in the past week alone – a massive leap compared to Bitcoin’s modest 2.96% gain in the same period.

$ETH JUST BROKE $3,600 🚀

BEARS ARE GETTING LIQUIDATED!

— Ash Crypto (@Ashcryptoreal)

1:45 AM • Jul 18, 2025

→ And it’s a strong signal that institutional interest in Ethereum is heating up fast.

💼 Institutions Are Going All-In on Ethereum, $1B ETH Holdings and Counting

New data from Lookonchain shows SharpLink Gaming just bought 32,892 ETH, worth $115M, right after they grabbed 20,279 ETH yesterday.

SharpLink(@SharpLinkGaming) bought another 32,892 $ETH($115M) in the past 3 hours.

In the past 9 days, they’ve accumulated 144,501 $ETH($515M).

— Lookonchain (@lookonchain)

1:16 AM • Jul 18, 2025

→ In just 9 days, SharpLink scooped up 144,501 ETH, totaling $515M in value. Their total assets? Over $1B now, and they’re just getting started. They even filed an amended prospectus with the SEC, planning to issue up to $5B in new shares. The goal? Grow their ETH treasury and fund operations.

But SharpLink isn’t alone. BitMine, backed by Tom Lee, announced it now holds 300,657 ETH, worth over $1B.

Bitmine increased ETH holdings to $1 billion, >300,000 ETH tokens

😍😍😍😍😍Tom Lee @fundstrat, Chairman of $BMNR:

“we surpassed $1 billion in Ethereum holdings, just seven days after closing on the initial $250 million private placement”“We are well on our way to

— Bitmine Immersion Technologies, Inc. (@BitMNR)

2:44 PM • Jul 17, 2025

GameSquare Holdings also completed a $70M public raise as part of a plan to build a $100M Ethereum treasury. They sold 46.66M shares at $1.50 each. With an added 15% option and $9.2M raised last week, they’ve now raised over $90M, according to CEO Justin Kenna.

Even BTC Digital, a Bitcoin mining firm, is switching sides, moving all Bitcoin holdings into Ethereum. They just raised $6M and bought another $1M in ETH.

THIS COMPANY SOLD ALL OF THEIR BTC AND BOUGHT $200M OF ETH

Bit Digital just acquired $192.9M ETH after raising ~$172M from a public offering, and selling their entire holdings of BTC, worth ~$28M.

Bit Digital now holds a total of $254.8 Million of ETH.

— Arkham (@arkham)

6:24 PM • Jul 7, 2025

Why the ETH rush? According to Ray Youssef (CEO of NoOnes), institutions are waking up to Ethereum’s real strategic value. It’s becoming:

-

A store of value

-

A base layer for tokenized assets

-

A powerful DeFi + TradFi bridge

Meanwhile, Jamie Elkaleh (CMO at Bitget Wallet) notes that this isn’t just hype. ETH’s surge is due to a shift in how institutions value crypto.

⚙️ Can Ethereum Hit 10,000 TPS?

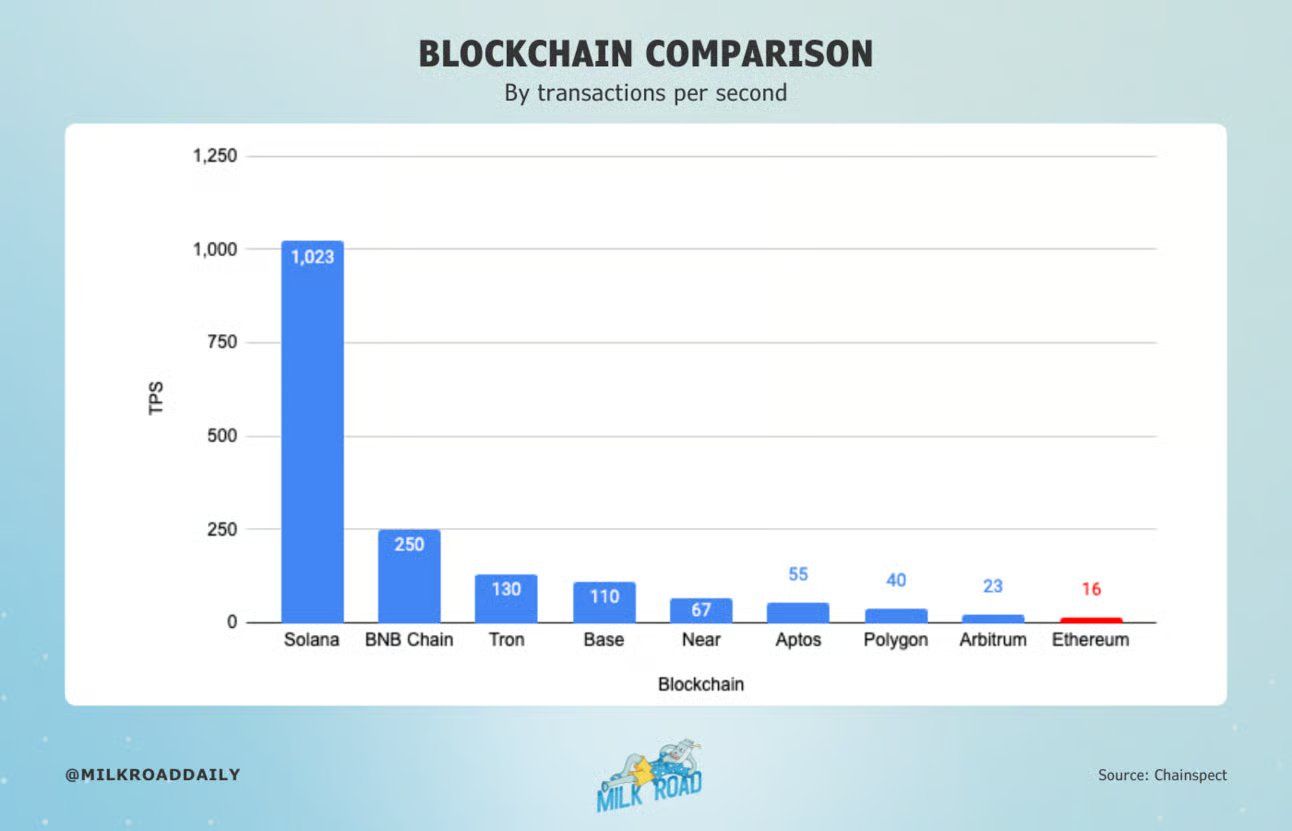

Right now, according to Chainspect, Ethereum handles just 16 TPS (transactions per second) → a super modest number compared to Solana’s 1,023 TPS → Ethereum’s biggest weakness: scalability.

But that could change soon.

Ethereum is entering a new upgrade phase using a powerful tech called ZK Real-Time Proving. This allows ZK proofs to be generated in real time, which means Ethereum can raise its gas limit from 36M → 2B → unlocking around 1,000 TPS by 2027–2028.

So what about 10,000 TPS?

To get there, Ethereum will need help from Layer-2s, especially the upcoming based rollups and native rollups, which are expected to launch in 2026.

These solutions will:

-

Keep Ethereum’s core decentralization and security intact

-

Offload heavy transactions to run in parallel on L2

-

Scale Ethereum without sacrificing its values

If it works, Ethereum might not only catch up but could even surpass today’s high-performance blockchains, all without compromising decentralization, which is the heart of Ethereum’s vision.

📈 Can ZK Tech Actually Push $ETH Price Up?

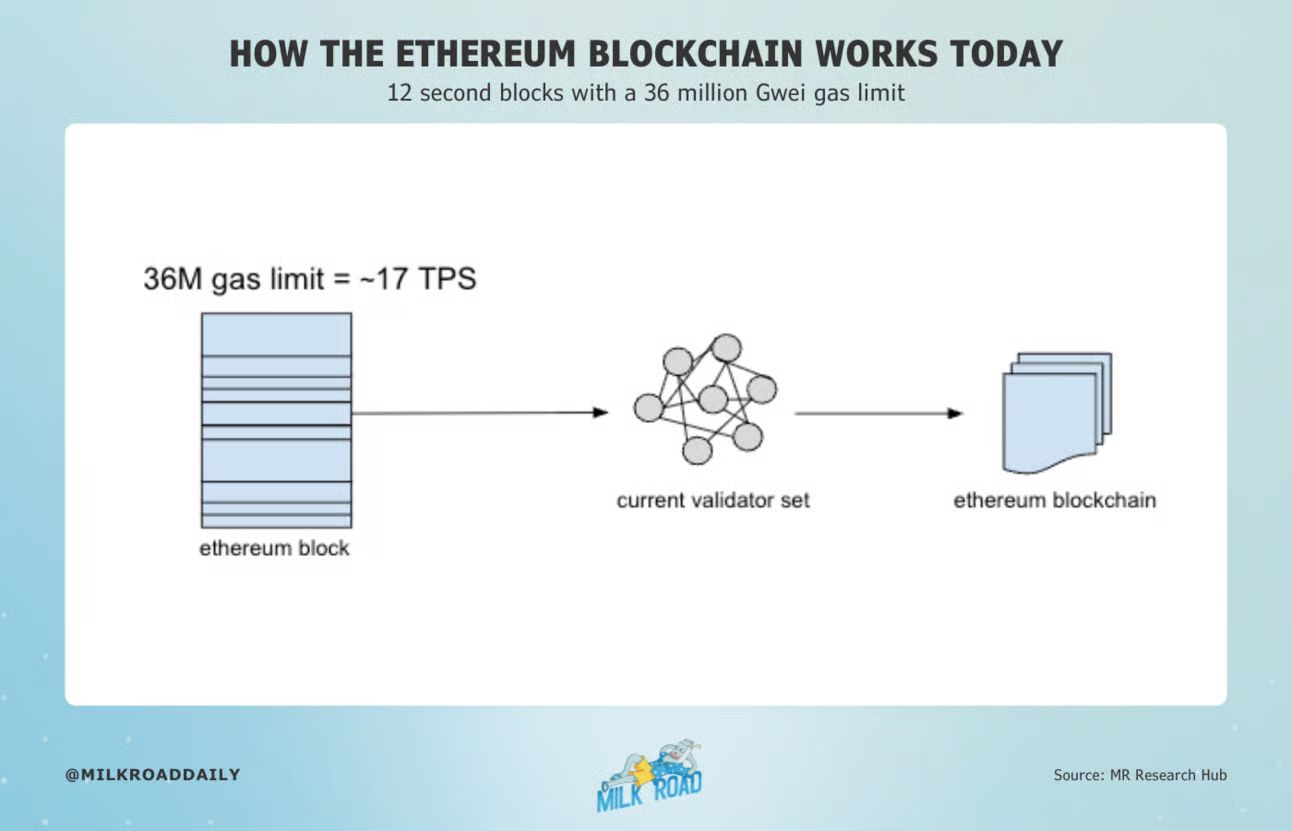

To understand ZK’s impact on Ethereum, we first need to compare how Ethereum works now vs. how it’ll work with ZK Real-Time Proving.

How Ethereum works today

Source: MR Research Hub

-

One block every 12 seconds

-

Each block has a 36 million gas limit

-

An average transaction uses ~180,000 gas

→ Each block fits ~200 transactions

→ That’s about 17 TPS (transactions per second)

Pretty limited, right?

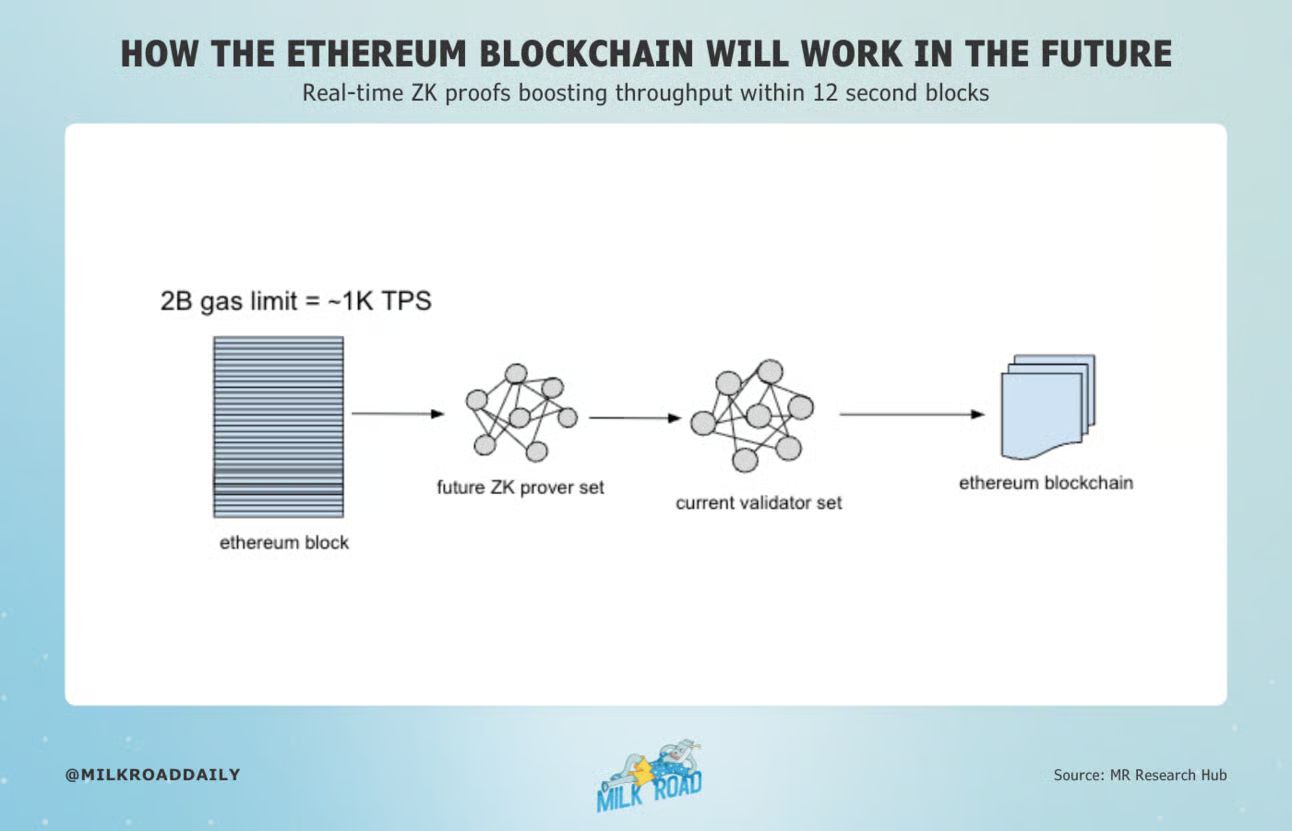

How Ethereum will work with ZK Real-Time Proving. ZK-RTP includes 4 parts:

Source: MR Research Hub

-

Ethereum Block

→ Still 12-second blocks

→ But gas limit jumps from 36M → 2B

→ That means we could hit ~1,000 TPS -

Future ZK Prover Set

→ ZK proofs get generated in real time

→ Boosts speed without overloading the network -

Current Validator Set

→ Validators still secure the network

→ But ZK offloads the heavy lifting -

Ethereum Blockchain

→ Once verified, all data gets recorded on-chain as usual

ZK tech massively improves scalability and makes Ethereum way more attractive to developers and dApps. But… when it comes to ETH price, there’s a catch:

-

Short-term: ZK can build buy pressure from hype, dev interest, and optimism

-

Long-term: It depends on real-world adoption, ZK must prove it’s not just hype but actually gets used

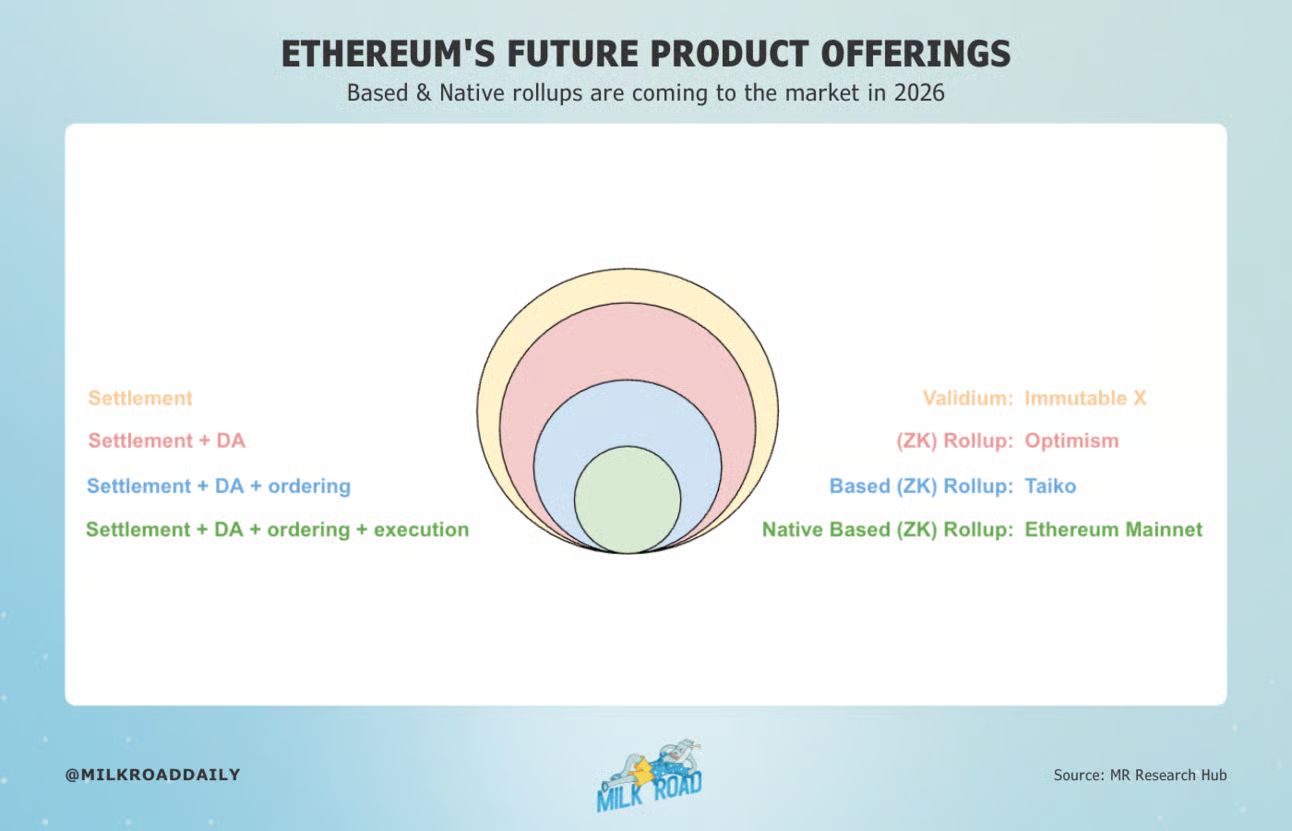

🚀 Is Ethereum About to Explode in 2026?

Right now, thanks to the rise of Layer-2s, most users are doing transactions on L2, not on Ethereum Layer-1. That means Ethereum has become more of a settlement and data layer rather than a place to execute transactions directly.

But in 2026, Ethereum plans to roll out two powerful upgrades:

-

Based Rollups

-

Native Based Rollups

These new tools are designed to scale performance and give users a smoother experience across the board.

So instead of one shared environment like Solana, Ethereum is building multiple customizable zones, giving developers and dApps their own flexible “land” to build on.

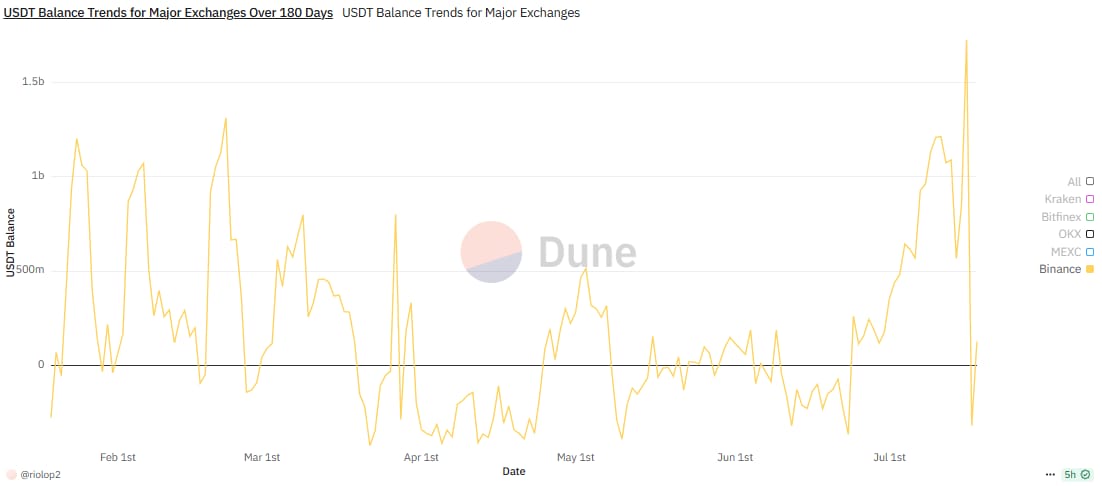

🔁 $USDT Flow Just Quietly Flipped, and Almost No One’s Talking About It…

Since mid-June, something major has changed in how $USDT is moving around. Instead of being scattered across exchanges, the flow is now heavily concentrated in one place, setting up perfectly for the current market pump.

Since 2020 Tether USDt

– Market cap ↑ 34x ($4.7B ➝ $160B)

– On-chain volume ↑ 74x ($14.8B ➝ $1.1T/month)

– Users ↑ 160x (2.8M ➝ 450M)— Paolo Ardoino 🤖 (@paoloardoino)

4:22 PM • Jul 16, 2025

Want to know:

-

How this capital shift actually happened?

-

What this setup tells us about the current price surge?

Then this is the post you need to read:

1️⃣ How Has $USDT Balance on Binance Changed Recently?

Since June 23, the $USDT.X ( ▲ 0.02% ) balance on Binance has jumped by over $1.6B in less than 3 weeks → the strongest surge we’ve seen since the start of 2025.

The last time this kind of sharp increase happened? → Early May, when balance rose +$870M after a long sideways market… and shortly after, $BTC.X ( ▲ 0.58% ) hit a new ATH.

What does this tell us?

When $USDT balances sit low for a while, and then suddenly ramp up, it often means money is flowing back in, getting ready for a market move.

Right now, we’ve hit a new $USDT peak and it’s starting to drop, signaling that the market has already entered a recovery phase.

📊 LATEST: $USDT hits new ATH with supply over $158B.

— Cointelegraph (@Cointelegraph)

5:00 PM • Jun 28, 2025

But here’s the pattern to watch: Since the start of 2025, this is the third time the $USDT balance has approached or hit +1B → Every time it peaks and then reverses, the market tends to face notable corrections right after.

2️⃣ What’s Going On with $USDT Balance on Kraken?

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply