Why ETH Will be 2nd BTC?.

A founder who called ICOs scams just ran the biggest ICO of 2025. And it raised $1.3 billion in total – with zero staking, zero utility, and 48% unlocked on day one. $PUMP.

Here’s what we got for you today:

⭐ 5 Things You Shouldn’t Miss

🔥 CZ just retweeted a post accusing Coinbase of being the “anonymous source” behind a smear campaign targeting Trump, World Liberty Financial, and Binance → To block CZ from returning to the U.S. market. This reminds me of when CZ announced Binance was selling all FTT, the move that kicked off the whole FTX collapse drama…

🚨JUST IN: Evidence is emerging that COINBASE was the “anonymous” source behind the hit job on President Trump’s World Liberty Financial and Binance ‼️

Coinbase learned that a pardon for Binance’s CZ may be on the table and due to their industry high fees and poor customer

— Matt Wallace (@MattWallace888)

3:41 AM • Jul 13, 2025

😮 Trump’s Truth Social announced it’s launching a loyalty token as part of its $9.99/month Patriot Package streaming plan. Paid users will earn gems based on engagement. Gems convert into tokens for use across Truth Social and Truth+. Tokens can be used for rewards and in-platform perks.

Trump’s Truth Social is launching a utility token tied to user engagement.

Meanwhile, Trump Media insiders (including the family) have already made tens of millions from the stock while retail bagholders watched their investments bleed.

Now they want you to earn “gems” and

— cryptothedoggy (@cryptothedoggy)

8:59 AM • Jul 10, 2025

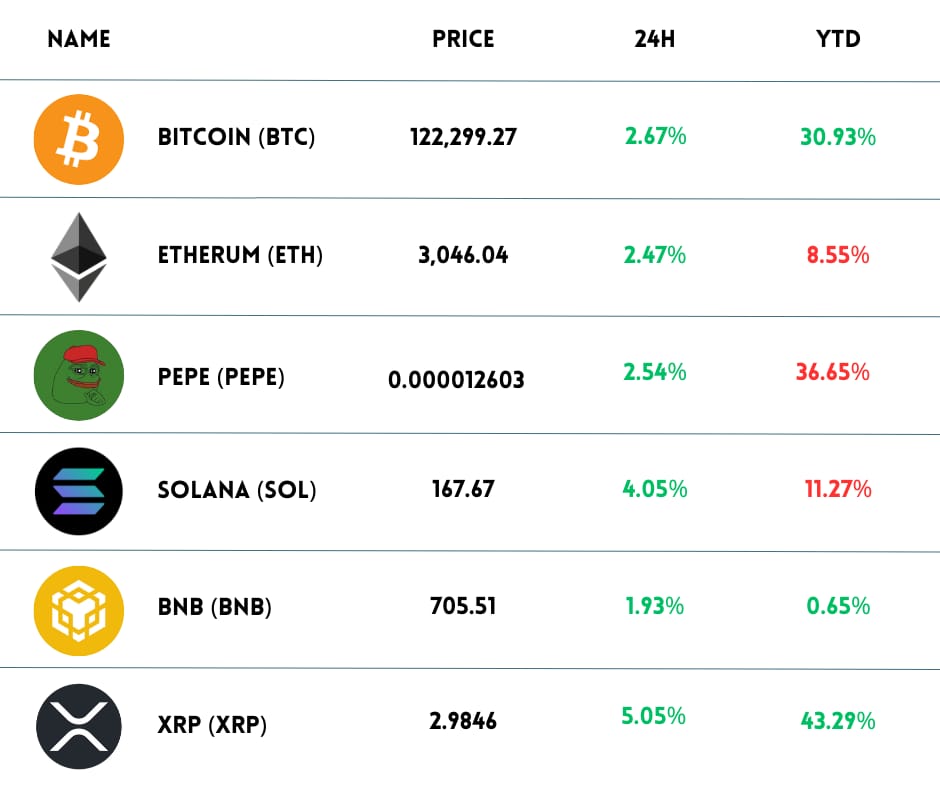

🚀 Bitcoin just smashed a new all-time high $122,000 today. 88% of investors think $BTC.X ( ▲ 3.12% ) will keep climbing this month. 25% believe it’ll hit $130K in July. Matt Hougan (Bitwise CIO) told CNBC that Bitcoin could cross $200,000 this year. The price of Bitcoin is like the debt ceiling. There is ultimately no limit.

JUST IN 🚨:

$BTC going parabolic as it soars to $122,000 for the first time in history 📈📈

Mega Bullish for bitcoin 🔥 🚀

— 𝐊𝐚𝐦𝐫𝐚𝐧 𝐀𝐬𝐠𝐡𝐚𝐫 (@Karman_1s)

7:39 AM • Jul 14, 2025

🐧 Coinbase changed its avatar to a Pudgy Penguin with other major players like OpenSea → A full-blown “penguin wave”. $PENGU.X ( ▼ 2.61% ) token surged over 60% within minutes, daily volume breaking $1B. But just 24 hours later, both Coinbase and OpenSea quietly removed the penguin avatars!? Meanwhile, PENGU keeps winning.

Coinbase

Polkadot

Moonpay

OpenSeaAll have Pudgy Penguin PFPs

Probably nothing..👀

— Quan (@quan_eth)

4:05 PM • Jul 12, 2025

💰 Justin Sun (founder of TRON) plans to buy $100M worth of $TRUMP.X ( ▼ 0.8% ) . He’s already invested $14M+ in TRUMP via HTX wallets and attended a private Trump gala dinner in May. Interestingly, Sun is reportedly gaining favorable treatment from U.S. regulators, including the SEC dropping an investigation into TRON ($TRX.X ( ▲ 0.08% ) )

We are committed to buying $100M of $TRUMP! Together, $TRUMP and #TRON are the future of Crypto.

This move highlights our belief in collaborating across ecosystems to grow the crypto landscape with communities such as @GetTrumpMemes.

$TRUMP on #TRON is the currency of #MAGA!

— H.E. Justin Sun 🍌 (@justinsuntron)

5:51 PM • Jul 9, 2025

🚀 The Craziest ICO of 2025: $500M $PUMP Sells Out in 13 Minutes

On July 12 at 9:00 PM (VN time), Pump.fun – the Solana-based meme token launch platform – kicked off its long-awaited $PUMP ICO. And within just 13 minutes, it was completely sold out.

Users could join using USDT, USDC, SOL, or bbSOL, but needed to complete KYC.

the $PUMP public sale is only one day away!

to participate, make sure to verify yourself using the link in the next tweet or on one of our participating exchange’s sites

for more info 👇🏻

— pump.fun (@pumpdotfun)

2:00 PM • Jul 11, 2025

💸 Here’s what went down:

-

125 billion $PUMP tokens were sold at a fixed price of $0.004 each

-

Total raised: $500 million

-

That’s 12.5% of the total supply – sold out almost instantly

-

Tokens were available to buy on: Bybit, Kraken, KuCoin, Bitget, Gate, and MEXC

-

Supported currencies: USDT, USDC, SOL, and bbSOL

-

KYC was required to participate

With that price, $PUMP’s fully diluted valuation hit $4 billion

the $PUMP public sale has now ended.

we are delighted to reveal that the $PUMP public sale was able to sell out in only 12 minutes.

we would like to thank our entire community for participating!

the $PUMP tokens will now enter the distribution phase 👇🏻

— pump.fun (@pumpdotfun)

2:38 PM • Jul 12, 2025

Originally, Pump.fun announced it would sell 15% of total supply during the ICO… But at launch, the website quietly updated it to 12.5%, locking in a $500M raise at $0.004 per token – pushing $PUMP’s FDV to $4 billion.

Pump ICO allocation changed from 15% to 12.5%

Is this to make room for the airdrop that was previously left out of the tokenomics?

Would put it a 100M airdrop (2.5% @ 4b)

— WenMoon 闻月 💚 (@0xWenMoon)

3:47 PM • Jul 12, 2025

No official explanation was given for the last-minute change. The circulating supply will jump to 55% immediately after the token becomes tradable, all ICO tokens unlock within 48–72 hours, with no vesting at all. That’s highly unusual and way more aggressive than typical project launches.

On-chain data tells the full story:

-

10,145 wallets bought directly from pump.fun

-

Average wallet size: $44,000

-

202 wallets maxed out their allocation at $1M each

Add this to the $700M raised in private sale, and pump.fun has now pulled in a jaw-dropping $1.3 billion from its combined token sales.

Yes, you read that right: A memecoin launchpad on Solana just raised $1.3B in less than a year.

PumpFun ( $PUMP ) just became the 3rd largest ICO in history.

Here’s everything we know from the on-chain numbers:

In 12 minutes,

$448.5M worth of PUMP was sold.

10,145 wallets participated,

out of 23,959 who KYC’d on the website.(a 42.3% buy rate).

Average buy $44K per

— Adam (@Adam_Tehc)

8:08 PM • Jul 12, 2025

This was not just retail FOM, whales showed up early and heavy. Whether $PUMP moons or melts, one thing’s for sure: Crypto liquidity is alive, memes are institutional now, and 2025 isn’t done surprising us yet.

🧩 Here’s what $PUMP will power:

-

Fee sharing

-

Staking rewards

-

Buybacks + incentive payouts. It’s built to fuel a creator-owned economy, not Web2 ad machines.

Token unlock details:

-

All ICO tokens (public + private) will be fully unlocked within 48–72 hours

-

That puts 55% of total supply into circulation almost immediately

-

That’s far more aggressive than most projects, which typically vest over months or years

Multiple exchanges opened PUMP futures early. $PUMP is already trading at $0.055–$0.057 → Nearly +40% above the ICO price ($0.004)

⚠️ Bybit Responds to $PUMP ICO Overload

$PUMP Token Sale: Oversubscription and Allocation Updates

At 2:00 PM UTC on July 12, 2025, the $PUMP public token sale officially launched with extremely high demand, and the sale was heavily oversubscribed within seconds, resulting in some users successfully receiving

— Bybit (@Bybit_Official)

9:10 AM • Jul 13, 2025

Just seconds after the $PUMP public sale went live at 9:00 PM (July 12), the platform was overwhelmed by traffic, and many users failed to receive tokens even after placing orders.

Bybit’s official response:

-

Allocation was done via FCFS (First Come, First Serve)

-

All unsuccessful orders were fully refunded within 10 minutes

-

Users who successfully purchased $PUMP will still receive full allocations as promised

→ To make up for the chaos, Bybit is giving 20 USDT in Spot Fee Vouchers to affected users. If you joined via Bybit, check your Reward Hub to claim your voucher and use it right away.

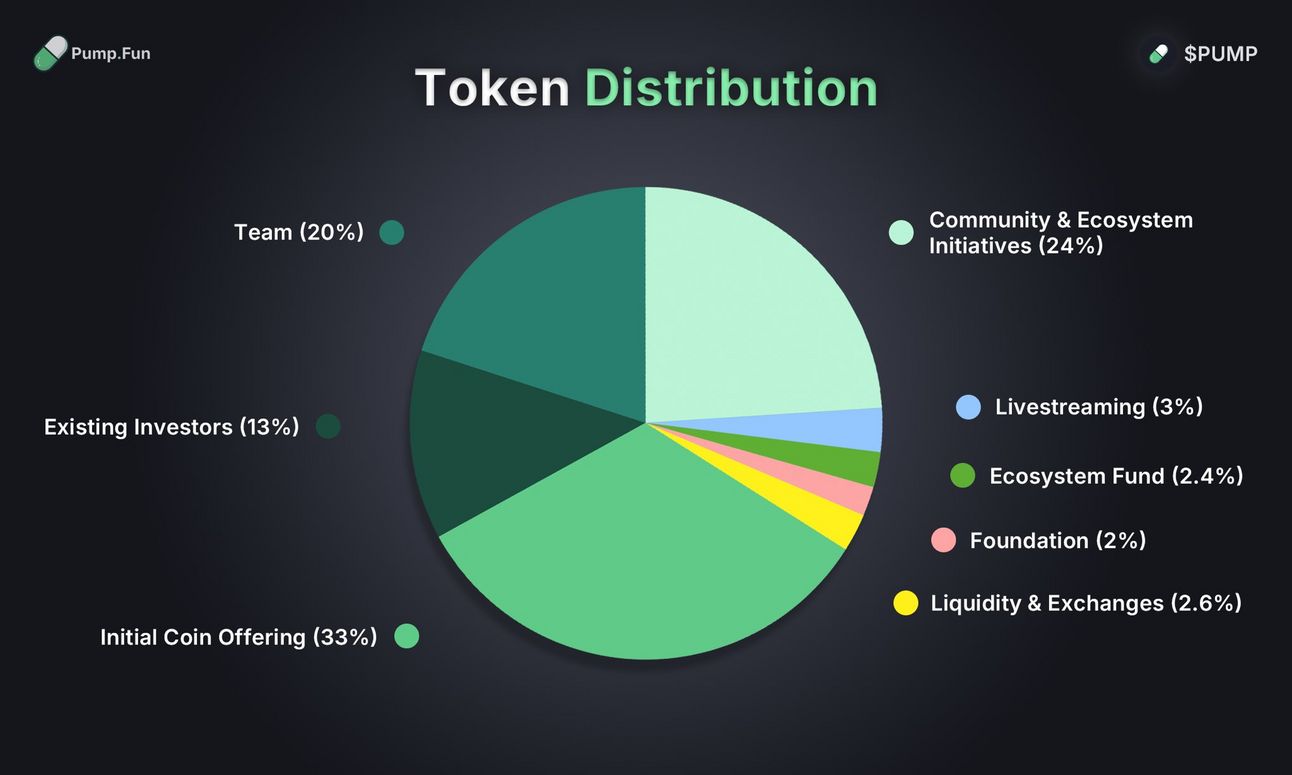

📦 Tokenomics recap (announced July 9):

-

Total supply: 1 trillion $PUMP

-

33% for ICO

→ 18% private sale

→ 15% public sale (later cut to 12.5%) -

24% for community + ecosystem rewards

-

20% for the dev team

-

13% for early backers

-

10% split among:

→ Ecosystem fund (2.4%)

→ Foundation (2%)

→ Livestreaming (3%)

→ Liquidity + exchanges (2.6%)

$PUMP will have a maximum supply of 1,000,000,000,000 and will be distributed as follows:

33% will be sold in the Initial Coin Offering

24% reserved for community and ecosystem initiatives

20% to the team

2.4% to the ecosystem fund

2% for the foundation

13% to existing investors— pump.fun (@pumpdotfun)

2:01 PM • Jul 9, 2025

Let’s break it down: Around 48% of total supply unlocked on day one, putting ~$2B worth of tokens into circulation at a $4B FDV.

Meanwhile, team (20%) and investor (13%) allocations are fully locked until July 2026 → no short-term sell pressure from insiders.

That might sound “safe,” but the large initial unlock + lockup illusion can fuel short-term FOMO while creating a false sense of security.

What about the “community” allocation? 24% sounds generous but only 10–15% of that is actually accessible to retail in the short term.

So what’s happening? Retail buyers are fighting over a tiny slice of supply, which raises speculation levels and amplifies price volatility.

→ In short: You’re holding pure price speculation with zero claim on the hundreds of millions in revenue the platform is already generating.

Binance also listed PUMPUSDT futures two days before the sale even started, adding fuel to the hype and giving the market early access to price action.

To be fair, pump.fun hasn’t ruled out a future airdrop. But for now, it’s clear: they’re playing big, bold, and unapologetically.

💬 Hot Take from MoonRock Capital CEO on $PUMP’s Price Path

Most likely scenario for @pumpdotfun:

1) Despite all the public hate, I believe that behind closed doors, there are a ton of whales already getting antsy, just waiting to ape into $PUMP. That’s why I think the ICO will sell out in under an hour on Saturday. Hype will be real and

— Simon (@sjdedic)

1:01 PM • Jul 11, 2025

Simon, CEO of MoonRock Capital, called it early he predicted the $PUMP ICO would sell out in under an hour. And he’s right. But here’s the real prediction that’s turning heads:

-

Right after next week’s TGE, Simon expects $PUMP to dip, possibly down to a $2.5B–$3B valuation as short-term FOMO buyers rush to take profits.

-

The core team and long-term believers start buying → scooping up tokens from weak hands and redistributing supply to actual holders.

→ And once that flips? He sees a “revenge rally” coming, a shock move that could send $PUMP to a $20B market cap.

Simon says there’s a 70–80% chance this plays out.

👀 ETH is About to Become the Second BTC, Why?

Sounds like hype? Maybe not. If you missed the Bitcoin ETF rally, this could be the one chance you don’t want to sleep on. Here’s what you need to know 👇

1️⃣ Bitcoin’s Rally Started with a Bold Move, Is $ETH.X ( ▲ 3.31% ) Next?

Back in 2020, something big happened: MicroStrategy (aka Strategy) started buying huge amounts of $BTC and loudly backed it in public.

MicroStrategy starts buying Bitcoin in August 2020 at the initiative of Michael Saylor.

Since then:

– Bitcoin is up 448%

– MSTR stock is up 614%

– They hold 193k BTC with a ROI of 100%I believe the technical term for that is “winning”.

— ecoinometrics (@ecoinometrics)

12:07 PM • Feb 29, 2024

That one move triggered a chain reaction:

👉 Media attention exploded

👉 Big companies, financial institutions, even some governments started buying Bitcoin

That wasn’t just noise. Bitcoin’s market cap grew from $200B → $2.2T.

Governments slowly became more open to BTC. And the real turning point? The approval of Bitcoin ETFs in 2021 → From there, institutional money flooded in and BTC soared +960% in just a few years.

Now, Ethereum is walking the same path. ETH’s spot ETF got approved in 2024 → a major milestone. It made it easy for giants like BlackRock and Goldman Sachs to legally invest in ETH.

Before this, many funds avoided ETH due to security classification risk.

Now that ETH is officially labeled a commodity (like BTC), that fear is gone.

Public companies are jumping in too:

-

SharpLink Gaming, BitMine, and BitDigital have each accumulated over 100,000 ETH.

-

Some even took on hundreds of millions in debt to buy more.

There are currently 5 Ethereum treasury companies that own a combined ~240,000 ETH ($600 million). Tom Lee’s BitMine is not listed here yet, but he’s buying $250mil worth of ETH.

There will be many more treasuries coming online over the course of the next year.

Accelerate.

— sassal.eth/acc 🦇🔊 (@sassal0x)

6:13 AM • Jul 6, 2025

SharpLink went all in, not just holding ETH, but treating it as a strategic asset, just like MicroStrategy did with BTC.

2️⃣ Why Do People Call ETH “The Second BTC”?

At first glance, both $BTC and $ETH are similar:

-

High liquidity

-

Widely accepted

-

Now both have spot ETFs, giving institutions easy access

But ETH has one big edge over BTC 👇

Unlock Full Market Insights in This Part with Pro Plan

You’re reading a premium insight. Stay ahead of the crypto curve. Go beyond the headlines with full access to premium insights, in-depth analysis, and actionable investment narratives. FREE for 14 days – no commitment, cancel anytime.

Continue Reading with Pro Access >>

🤡 Meme Of The Day

We read your emails, comments, and poll replies daily

Hit reply and say Hello – we’d love to hear from you!

Like what you’re reading?

And if you’ve got a friend deep in crypto (or just getting started), feel free to forward this to them. They can sign up here.

Cheers,

The Crypto Fire

This newsletter is for informational purposes only and should not be considered investment advice. Traders should conduct thorough research, understand the risks, and carefully evaluate their decisions before investing in cryptocurrency.

Leave a Reply